Sales Tax Exemption Form

What is the Sales Tax Exemption Form

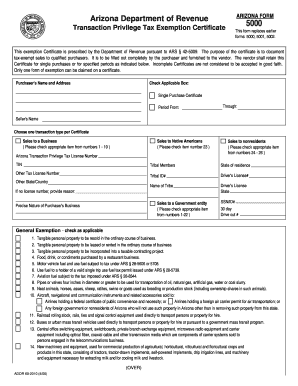

The Arizona tax exempt form, commonly referred to as the sales tax exemption form, allows eligible entities to make purchases without paying sales tax. This form is essential for organizations such as non-profits, government agencies, and certain educational institutions that qualify for tax-exempt status under Arizona law. By presenting this form at the time of purchase, these entities can avoid the additional costs associated with sales tax, thereby maximizing their available resources for their core missions.

How to obtain the Sales Tax Exemption Form

To obtain the Arizona sales tax exemption form, individuals or organizations can visit the Arizona Department of Revenue's official website. The form is typically available for download in a PDF format, which can be printed and filled out. Additionally, some organizations may provide the form directly upon request. It is important to ensure that the correct version of the form is used, as there may be variations based on the specific type of exemption being sought.

Steps to complete the Sales Tax Exemption Form

Completing the Arizona tax exempt form involves several straightforward steps:

- Download the form from the Arizona Department of Revenue website.

- Fill in the required information, including the name of the organization, address, and tax identification number.

- Specify the type of exemption being claimed, ensuring it aligns with the organization's status.

- Sign and date the form to validate the information provided.

- Submit the completed form to the vendor at the time of purchase.

Key elements of the Sales Tax Exemption Form

Several key elements must be included in the Arizona sales tax exemption form to ensure its validity:

- Organization Details: Name, address, and tax identification number of the entity claiming the exemption.

- Type of Exemption: A clear indication of the specific exemption category that applies.

- Signature: An authorized representative must sign the form to confirm its accuracy.

- Date: The date of completion is essential for record-keeping purposes.

Legal use of the Sales Tax Exemption Form

The legal use of the Arizona tax exempt form is governed by state laws that outline who qualifies for tax exemptions. Entities must ensure they meet the eligibility criteria, such as being a registered non-profit or government agency. Misuse of the form, such as using it for ineligible purchases, can lead to penalties, including fines and back taxes owed. Therefore, it is crucial to understand the legal implications and ensure compliance with state regulations when utilizing this form.

Examples of using the Sales Tax Exemption Form

Common scenarios where the Arizona sales tax exemption form is utilized include:

- A non-profit organization purchasing supplies for community service projects.

- A government agency acquiring equipment for public use.

- An educational institution buying materials for classroom instruction.

In each case, presenting the completed form at the point of sale allows these entities to avoid paying sales tax, thereby conserving funds for their respective missions.

Quick guide on how to complete sales tax exemption form

Effortlessly Prepare Sales Tax Exemption Form on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Sales Tax Exemption Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to alter and eSign Sales Tax Exemption Form effortlessly

- Find Sales Tax Exemption Form and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Highlight relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all information and click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your PC.

Say goodbye to missing or lost files, tedious form searching, or mistakes that require you to print new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Sales Tax Exemption Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales tax exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax exempt form and why is it important?

A tax exempt form is a document that allows eligible individuals or organizations to make purchases without paying sales tax. It is essential for maintaining compliance with tax regulations and can signNowly reduce costs for exempt entities. Understanding how to properly use a tax exempt form can help you save money and streamline your purchasing processes.

-

How can airSlate SignNow help with tax exempt forms?

airSlate SignNow provides an efficient way to create, send, and eSign tax exempt forms digitally. Our platform ensures that your documents are secure, legally binding, and easily accessible. By using airSlate SignNow, you can simplify the process of managing tax exempt forms and improve your overall workflow.

-

Is there a cost associated with using airSlate SignNow for tax exempt forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. These plans are designed to be cost-effective, ensuring that you can manage your tax exempt forms without overspending. You can choose the plan that best fits your organization’s size and requirements, allowing for scalable solutions.

-

What features does airSlate SignNow offer for managing tax exempt forms?

airSlate SignNow offers features like customizable templates for tax exempt forms, automated workflows, and secure document storage. Additionally, you can track the status of your tax exempt forms in real-time, making it easier to manage your documents. These features optimize your workflow for a more efficient process.

-

Can I integrate airSlate SignNow with my existing systems for tax exempt forms?

Absolutely! airSlate SignNow is designed to integrate seamlessly with many existing applications and systems. Whether you use CRM software or accounting tools, you can easily incorporate tax exempt form management into your current processes, enhancing efficiency across departments.

-

How does eSigning a tax exempt form work with airSlate SignNow?

eSigning a tax exempt form using airSlate SignNow is straightforward and user-friendly. Simply upload your tax exempt form, add signer fields if necessary, and send it out for signatures. Recipients can eSign from any device, providing a quick and efficient way to have your documents legally executed.

-

What are the benefits of using airSlate SignNow for tax exempt forms?

Using airSlate SignNow for tax exempt forms offers numerous benefits, such as increased efficiency, better document security, and enhanced compliance. With digital signature capabilities and automated workflows, you can save time and reduce errors associated with paper-based processes. Moreover, leveraging our platform supports your business's commitment to sustainability.

Get more for Sales Tax Exemption Form

- 2nd grade spelling words form

- Essay outline template form

- Nemt wv form

- Sbi general health insurance claim form part a

- Clear correct consent form

- Online visa for thailand form

- Family dollar paystub form

- I hereby authorize xome to initiate automatic deposits to my account at the financial institution form

Find out other Sales Tax Exemption Form

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal