Employer Credits Form

What is the Employer Credits

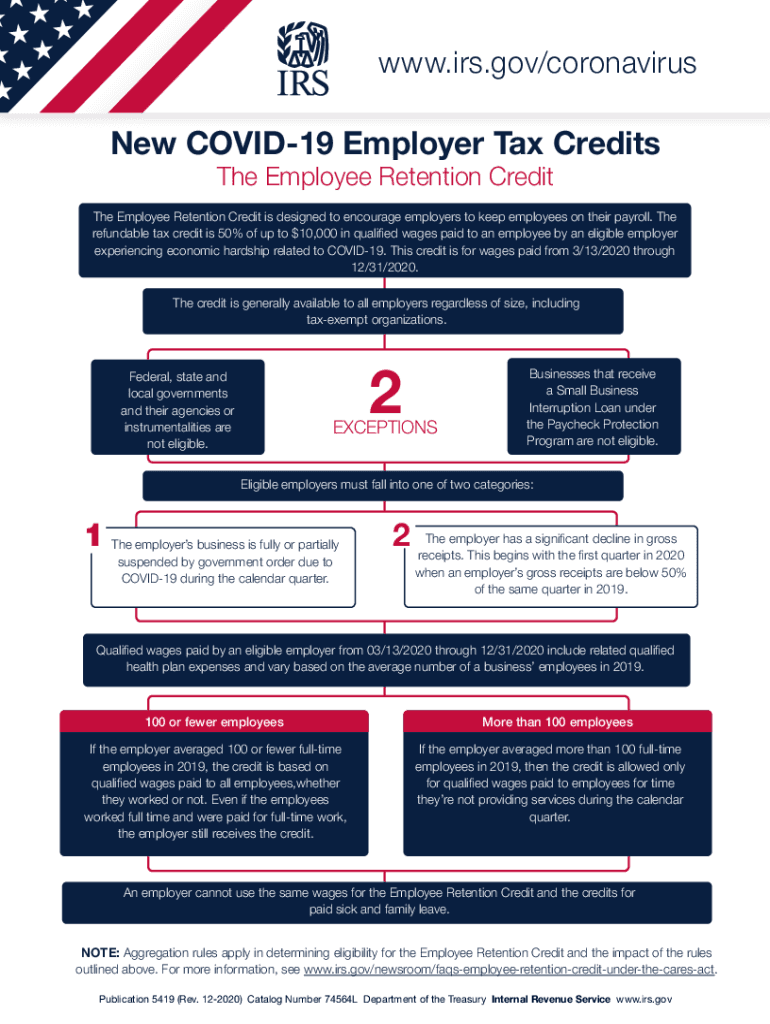

The IRS employer credits refer to various tax incentives designed to support businesses in the United States. These credits can help reduce the overall tax burden for employers, making it easier for them to retain employees and invest in their growth. The credits often apply to specific situations, such as hiring certain groups of workers or providing health insurance to employees. Understanding these credits is crucial for businesses looking to maximize their tax benefits and ensure compliance with IRS regulations.

How to obtain the Employer Credits

To obtain IRS employer credits, businesses must first determine their eligibility based on the specific criteria set forth by the IRS. This may involve assessing the types of employees hired, the nature of the business, and compliance with relevant laws. Once eligibility is established, businesses can claim the credits on their tax returns. It is essential to keep accurate records and documentation to support the claims made. Consulting with a tax professional can also provide guidance on the best practices for claiming these credits.

Steps to complete the Employer Credits

Completing the process for IRS employer credits involves several key steps:

- Identify the specific employer credit applicable to your business.

- Review the eligibility criteria to ensure compliance.

- Gather necessary documentation, such as employee records and payroll information.

- Fill out the appropriate IRS forms, such as the 5419 tax form, accurately reflecting the credits claimed.

- Submit the completed forms with your business tax return by the designated deadlines.

Legal use of the Employer Credits

Utilizing IRS employer credits legally requires adherence to specific guidelines outlined by the IRS. Businesses must ensure that they meet all eligibility requirements and follow the correct procedures for claiming the credits. Misuse of these credits can lead to penalties and potential audits. It is vital to maintain thorough documentation and be prepared to provide evidence of compliance if requested by the IRS.

Eligibility Criteria

Eligibility for IRS employer credits varies depending on the specific credit being claimed. Generally, businesses must meet certain conditions, such as:

- Employing qualified individuals, which may include veterans or individuals from disadvantaged backgrounds.

- Providing health insurance coverage to employees.

- Meeting specific revenue or operational criteria set by the IRS.

Each credit may have unique requirements, so it is important to review the details for each one carefully.

Required Documents

When applying for IRS employer credits, businesses must prepare several key documents to support their claims. These may include:

- Employee payroll records to verify employment status and wages.

- Documentation of health insurance coverage provided to employees.

- Completed IRS forms, such as the 5419 tax form, with accurate information.

- Any additional records that demonstrate compliance with eligibility criteria.

Having these documents organized and readily available can streamline the process of claiming employer credits.

Quick guide on how to complete 2020 employer credits

Complete Employer Credits effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly and without delays. Manage Employer Credits on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Employer Credits with ease

- Locate Employer Credits and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and eSign Employer Credits and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 employer credits

How to generate an electronic signature for a PDF document in the online mode

How to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the 5419 feature in airSlate SignNow?

The 5419 feature in airSlate SignNow refers to our robust electronic signature functionalities designed to streamline the signing process. This feature allows users to create, send, and sign documents quickly and securely, enhancing productivity. It simplifies transactions for businesses of all sizes, whether they are sending contracts or agreements.

-

How much does it cost to use airSlate SignNow with the 5419 features?

airSlate SignNow offers competitive pricing for its plans, including access to the 5419 features. Depending on the subscription level, costs can vary to accommodate businesses of different sizes and needs. You can visit our pricing page for detailed information on the various plans available.

-

What are the key benefits of using airSlate SignNow 5419 for my business?

Using airSlate SignNow's 5419 features provides numerous benefits, including increased efficiency and reduced turnaround time for document signing. This cost-effective solution allows businesses to manage their paperwork more effectively, leading to improved customer experience and satisfaction. Additionally, enhanced security measures ensure that your documents are safe throughout the signing process.

-

Can I integrate airSlate SignNow 5419 with other software?

Yes, airSlate SignNow 5419 offers seamless integrations with various popular software applications. This includes CRM systems, cloud storage solutions, and productivity tools, allowing for a more streamlined workflow. Integration capabilities enable businesses to leverage their existing tools while enhancing the signing process.

-

Is training available to help me utilize the 5419 features in airSlate SignNow?

Absolutely! airSlate SignNow provides extensive training resources for users to effectively utilize the 5419 features. Our support team offers tutorials, webinars, and documentation to help businesses maximize their use of our electronic signature solutions. This ensures that your team can confidently navigate the platform.

-

What types of documents can I send using airSlate SignNow 5419?

With airSlate SignNow 5419, you can send a variety of documents, including contracts, non-disclosure agreements, and client onboarding forms. Our platform supports multiple file formats, making it easy to work with your existing documents. This versatility helps businesses adapt their signing processes to fit their specific needs.

-

How secure is the 5419 feature in airSlate SignNow?

The 5419 feature in airSlate SignNow prioritizes security and compliance. We utilize industry-leading encryption and secure cloud storage to protect your documents and data throughout the signing process. Additionally, we comply with regulations such as GDPR and eIDAS to provide assurance in the safety and legality of your signed documents.

Get more for Employer Credits

- Nsa health screening form

- Neutrasal prescription form 456764583

- W4 fillable form

- Construction site visitor waiver form

- Cuna mutual life insurance change beneficiary form

- 576 d los angeles county assessor assessor lacounty form

- Fillable online assessor lacounty vessel property statement form

- Employees withholding exemption certificaterevised form

Find out other Employer Credits

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple