Irs Publication 1 Form

What is the IRS Publication 1?

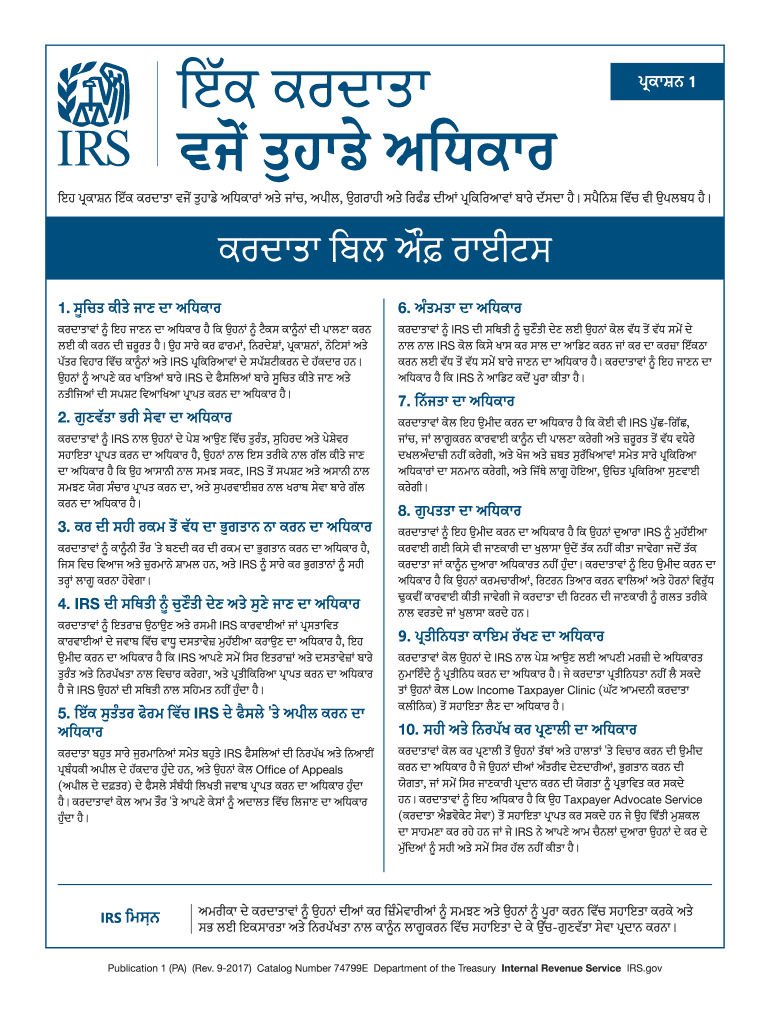

The IRS Publication 1, also known as the taxpayer rights publication, outlines the fundamental rights of taxpayers when dealing with the Internal Revenue Service (IRS). This document serves as a guide to help individuals understand their rights throughout the tax process, ensuring they are treated fairly and with respect. It covers various aspects, including the right to privacy, the right to appeal, and the right to representation. Understanding these rights is crucial for taxpayers to navigate their obligations and interactions with the IRS effectively.

How to use the IRS Publication 1

Using the IRS Publication 1 involves familiarizing yourself with the rights it outlines and applying them during interactions with the IRS. Taxpayers should read through the publication to understand their entitlements, such as the right to be informed about the tax process and the right to challenge the IRS's decisions. When faced with tax issues, refer to this publication to ensure that your rights are upheld. It can also serve as a resource when preparing for audits or disputes, helping you advocate for yourself effectively.

Steps to complete the IRS Publication 1

Completing the IRS Publication 1 involves several steps to ensure you fully grasp your rights as a taxpayer. Start by obtaining a copy of the publication from the IRS website or through other official channels. Next, read through the document carefully, taking notes on key points that pertain to your situation. If you have specific questions or concerns, consider consulting a tax professional for further clarification. Finally, keep the publication handy for reference during any dealings with the IRS.

Legal use of the IRS Publication 1

The IRS Publication 1 is legally recognized as a resource that informs taxpayers of their rights. It is essential for taxpayers to understand that while the publication outlines their rights, it does not serve as a legal document or a substitute for professional legal advice. Taxpayers can use the information contained within the publication to protect themselves during audits, disputes, and other interactions with the IRS. Familiarity with these rights can empower taxpayers to seek fair treatment and ensure compliance with tax laws.

Key elements of the IRS Publication 1

Key elements of the IRS Publication 1 include the following rights:

- The right to be informed: Taxpayers have the right to receive clear and accurate information about their tax obligations.

- The right to privacy: Taxpayers can expect that their personal information will be kept confidential.

- The right to appeal: Taxpayers have the right to contest IRS decisions and seek a fair resolution.

- The right to representation: Taxpayers may have someone represent them in dealings with the IRS.

How to obtain the IRS Publication 1

Obtaining the IRS Publication 1 is straightforward. Taxpayers can download a copy directly from the IRS website, where it is available in PDF format. Additionally, copies may be requested by calling the IRS directly or visiting a local IRS office. It is advisable for taxpayers to keep a current copy of the publication for reference, especially during tax season or when facing IRS inquiries.

Quick guide on how to complete irs publication 1 520274509

Prepare Irs Publication 1 seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, enabling you to access the right format and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without any hold-ups. Manage Irs Publication 1 on any platform using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign Irs Publication 1 effortlessly

- Find Irs Publication 1 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight noteworthy sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Irs Publication 1 to ensure clear communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs publication 1 520274509

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the IRS rights taxpayer form and why is it important?

The IRS rights taxpayer form outlines the rights that taxpayers have when dealing with the Internal Revenue Service. Understanding this form is crucial for ensuring you are treated fairly during audits or disputes, thereby protecting your interests as a taxpayer.

-

How can airSlate SignNow assist with completing the IRS rights taxpayer form?

airSlate SignNow streamlines the process of completing the IRS rights taxpayer form by providing easy-to-use templates and electronic signing capabilities. This ensures your form is filled out accurately and submitted on time, reducing the chances of errors.

-

What are the costs associated with using airSlate SignNow for document signing?

airSlate SignNow offers a range of pricing plans designed to fit various business needs and budgets. With its cost-effective solution, you can easily manage the signing of important documents, including the IRS rights taxpayer form, without breaking the bank.

-

Are there any specific features that enhance the completion of the IRS rights taxpayer form?

Yes, airSlate SignNow includes features like customizable templates, automated workflows, and secure document storage. These features simplify the preparation and submission of the IRS rights taxpayer form, making compliance easier for users.

-

Can I integrate airSlate SignNow with other software for managing my IRS rights taxpayer form?

Absolutely! airSlate SignNow offers seamless integrations with various business tools, allowing you to manage your IRS rights taxpayer form alongside other essential documents. This enhances workflow efficiency and keeps all your important information in one place.

-

Is airSlate SignNow secure for submitting sensitive IRS rights taxpayer forms?

Yes, airSlate SignNow takes security seriously, implementing advanced encryption and compliance measures to protect your data. You can confidently submit your IRS rights taxpayer form, knowing that your information is safe and secure.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the IRS rights taxpayer form, offers numerous benefits, such as time savings, improved accuracy, and easy access. The platform ensures that you can handle your documents efficiently, helping you focus on other important aspects of your business.

Get more for Irs Publication 1

Find out other Irs Publication 1

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter