St 125 2018

What is the St 125?

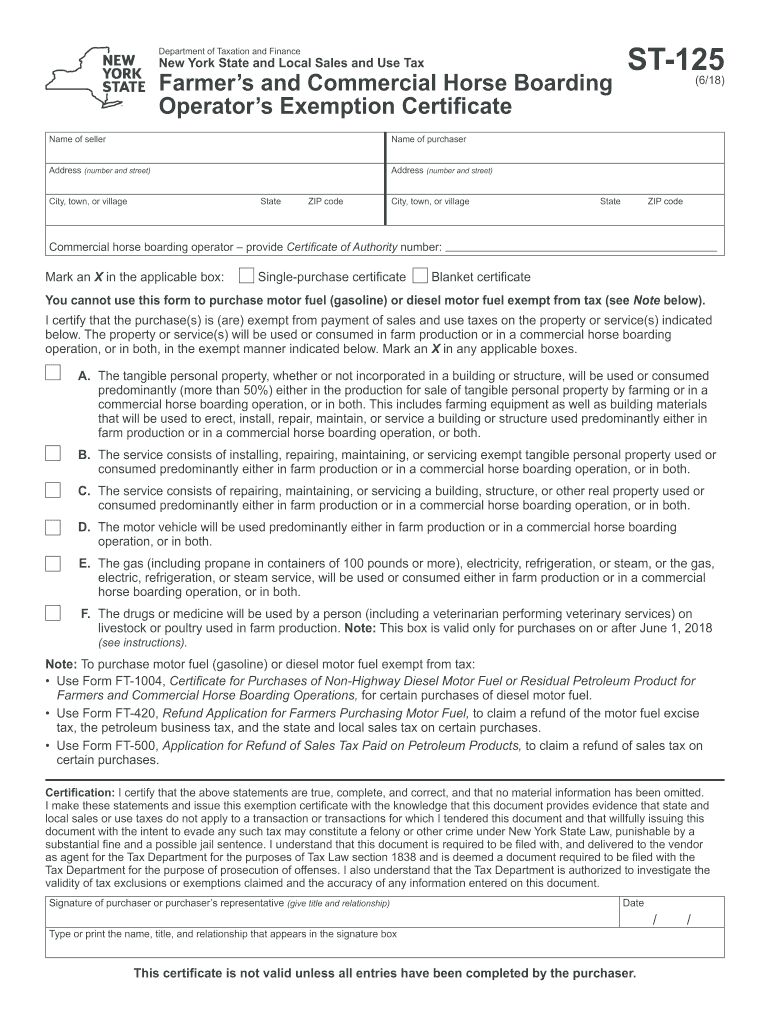

The St 125 form, also known as the New York State Tax Exempt Form, is a crucial document for farmers and agricultural businesses in New York. It allows eligible entities to claim tax exemptions on certain purchases related to agricultural production. This form is particularly important for those involved in farming activities, as it helps reduce the overall cost of operating a farm by exempting specific purchases from sales tax. Understanding the St 125 is essential for compliance with state tax regulations and for maximizing tax savings.

How to use the St 125

Using the St 125 form involves a straightforward process. First, ensure that your business qualifies for tax-exempt status under New York State law. Once eligibility is confirmed, complete the form by providing the necessary information, including the name and address of the purchaser, the nature of the business, and a description of the items being purchased. After filling out the form, present it to the vendor at the time of purchase. This ensures that the vendor does not charge sales tax on the exempt items.

Steps to complete the St 125

Completing the St 125 form requires careful attention to detail. Here are the key steps:

- Gather necessary information, including your business name, address, and tax identification number.

- Identify the specific items you are purchasing that qualify for tax exemption.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

- Provide the completed form to the vendor at the time of purchase to claim the exemption.

Legal use of the St 125

The legal use of the St 125 form is governed by New York State tax laws. To ensure compliance, it is important to use the form only for eligible purchases related to agricultural production. Misuse of the form, such as claiming exemptions for ineligible items, can lead to penalties and fines. Therefore, it is essential to understand the legal implications and requirements associated with the St 125 to maintain compliance and avoid potential legal issues.

Eligibility Criteria

To qualify for using the St 125 form, businesses must meet specific eligibility criteria set forth by New York State. Generally, eligible entities include farmers, agricultural cooperatives, and other businesses engaged in agricultural production. The purchases must be directly related to farming activities, such as seeds, fertilizers, and equipment. It is advisable to review the criteria carefully to ensure that your business qualifies before submitting the form.

Required Documents

When completing the St 125 form, certain documents may be required to support your claim for tax exemption. These documents typically include:

- Proof of business registration, such as a business license or tax identification number.

- Documentation of agricultural activities, which may include receipts or invoices for purchases related to farming.

- Any additional forms or certifications that may be necessary to establish eligibility for tax exemption.

Form Submission Methods

The St 125 form can be submitted in various ways, depending on the vendor's preferences. Typically, the form is presented in person at the time of purchase. However, some vendors may allow for electronic submission or faxing of the form. It is important to confirm with the vendor about their preferred method of receiving the St 125 to ensure that the tax exemption is honored.

Quick guide on how to complete st 125

Complete St 125 effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents promptly without delays. Manage St 125 on any device with airSlate SignNow's Android or iOS applications and streamline any document-based procedure today.

The simplest way to modify and eSign St 125 with ease

- Locate St 125 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark essential sections of the documents or conceal sensitive information with tools provided by airSlate SignNow specifically for that use.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to preserve your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form finding, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign St 125 while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st 125

Create this form in 5 minutes!

How to create an eSignature for the st 125

How to make an eSignature for a PDF document in the online mode

How to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the NYS ST-125 form and why is it important?

The NYS ST-125 form is a crucial document for tax exemption in New York State. It is used by customers to claim tax-exempt status when purchasing specific goods or services. Understanding how to complete this form correctly can save businesses money and ensure compliance.

-

How can airSlate SignNow help with the NYS ST-125 process?

airSlate SignNow streamlines the process of sending and eSigning the NYS ST-125 form. It allows users to quickly prepare, sign, and share the document electronically, saving time and reducing paperwork. With airSlate SignNow, businesses can efficiently manage their tax exemption documentation.

-

Is there a cost associated with using airSlate SignNow for NYS ST-125?

Yes, airSlate SignNow offers a range of pricing plans tailored to different business needs. These plans provide access to features that enhance the eSigning process for documents like the NYS ST-125. Businesses can choose a plan that fits their budget while benefiting from a cost-effective solution.

-

What features does airSlate SignNow offer for managing the NYS ST-125 form?

airSlate SignNow includes features like template creation, automated workflows, and secure cloud storage, specifically for documents like the NYS ST-125. These functionalities enhance user control and streamline the signing process. Users can easily track the status of their documents in real time.

-

Can I integrate airSlate SignNow with other applications for NYS ST-125 management?

Absolutely! airSlate SignNow integrates seamlessly with various applications like CRM systems and cloud storage services. This integration allows for a more efficient workflow in managing the NYS ST-125 form and other important documents, making the process smoother for your business.

-

Is it safe to use airSlate SignNow for sensitive documents like NYS ST-125?

Yes, airSlate SignNow prioritizes the security of your documents, including the NYS ST-125. It offers advanced encryption and authentication features to protect sensitive information. Users can confidently send and sign documents without worrying about data bsignNowes.

-

How does airSlate SignNow improve efficiency for businesses handling the NYS ST-125?

By utilizing airSlate SignNow, businesses can signNowly enhance their efficiency when dealing with the NYS ST-125 form. This platform reduces the time spent on manual paperwork and follows up on signatures, allowing employees to focus on core tasks. ESigning eliminates delays and accelerates transaction times.

Get more for St 125

Find out other St 125

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form