Db791 Form

What is the Db791?

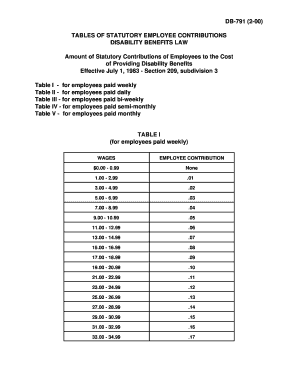

The Db791 form, also known as the tables contributions form, is a crucial document used in New York State for reporting employee contributions to various statutory programs. This form is specifically designed for employers to accurately report their employees' contributions to the New York State disability benefits and paid family leave programs. Understanding the Db791 is essential for compliance with state regulations and ensuring that all contributions are properly documented.

How to Use the Db791

Using the Db791 involves several key steps to ensure accurate completion. Employers must gather all necessary employee information, including names, Social Security numbers, and contribution amounts. Once all data is collected, the employer can fill out the form, ensuring that all fields are completed accurately. After completing the form, it should be reviewed for any errors before submission. Employers can submit the Db791 electronically or via mail, depending on their preference and compliance requirements.

Steps to Complete the Db791

Completing the Db791 form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Collect employee information, including full names and Social Security numbers.

- Determine the contribution amounts for each employee based on their earnings.

- Fill out the Db791 form, ensuring all required fields are completed.

- Review the form for accuracy, checking for any missing or incorrect information.

- Submit the completed form electronically or by mail, following state guidelines.

Legal Use of the Db791

The Db791 form serves a legal purpose in documenting employee contributions to state-mandated programs. Compliance with the submission of this form is essential for employers to avoid penalties and ensure that employees receive the benefits they are entitled to. The legal framework surrounding the Db791 is governed by New York State laws, which mandate accurate reporting and timely submission of contributions.

Required Documents

To complete the Db791 form, employers need specific documents to ensure all information is accurate and compliant. Required documents include:

- Employee payroll records showing earnings and contributions.

- Previous Db791 forms, if applicable, for reference.

- Any correspondence from the New York State Department of Labor regarding contribution requirements.

Form Submission Methods

Employers have several options for submitting the Db791 form. The primary methods include:

- Online Submission: Employers can submit the form electronically through the New York State Department of Labor's online portal.

- Mail Submission: The form can be printed and mailed to the appropriate state office.

- In-Person Submission: Employers may also choose to submit the form in person at designated state offices, although this method is less common.

Quick guide on how to complete db791

Effortlessly Prepare Db791 on Any Device

The management of online documents has become increasingly favored among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and eSign your documents without delays. Handle Db791 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Db791 with Ease

- Locate Db791 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or disordered documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Alter and eSign Db791 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the db791

The best way to create an electronic signature for your PDF in the online mode

The best way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What are tables contributions in airSlate SignNow?

Tables contributions in airSlate SignNow refer to the structured data that can be used to effectively manage and track various document interactions. This feature simplifies collaboration by allowing multiple contributors to engage with the document in a seamless manner, making processes more efficient.

-

How does airSlate SignNow handle tables contributions for team collaboration?

airSlate SignNow offers robust features that facilitate tables contributions, enabling teams to collaborate on documents in real time. Users can assign roles, track changes, and streamline approvals, ensuring that all contributions are organized and easy to manage within the platform.

-

What pricing plans include tables contributions in airSlate SignNow?

The tables contributions feature is available in all pricing plans offered by airSlate SignNow, ensuring that users of any budget can access this valuable tool. Each plan comes with a range of features designed to enhance document management and team collaboration.

-

Can I integrate tables contributions with other software?

Yes, airSlate SignNow allows for integrations with various software tools, which can enhance your workflow when working with tables contributions. Whether you're using CRM platforms, project management tools, or cloud storage services, integrating these applications can streamline your document processes.

-

What are the benefits of using tables contributions in business workflows?

Using tables contributions in airSlate SignNow can signNowly improve the efficiency of business workflows. It allows for clear visibility over document edits and contributions, reduces the chances of errors, and enhances team collaboration, ultimately leading to faster decision-making.

-

Is there a limit to the number of tables contributions I can manage?

AirSlate SignNow does not impose strict limits on the number of tables contributions you can manage, allowing businesses to scale as needed. This flexibility ensures that you can handle large volumes of documents and contributions without compromising on efficiency.

-

How secure are tables contributions in airSlate SignNow?

Security is a top priority at airSlate SignNow. Tables contributions are protected through robust encryption protocols and compliance with industry standards, ensuring that your data remains safe and secure throughout the collaboration process.

Get more for Db791

Find out other Db791

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe