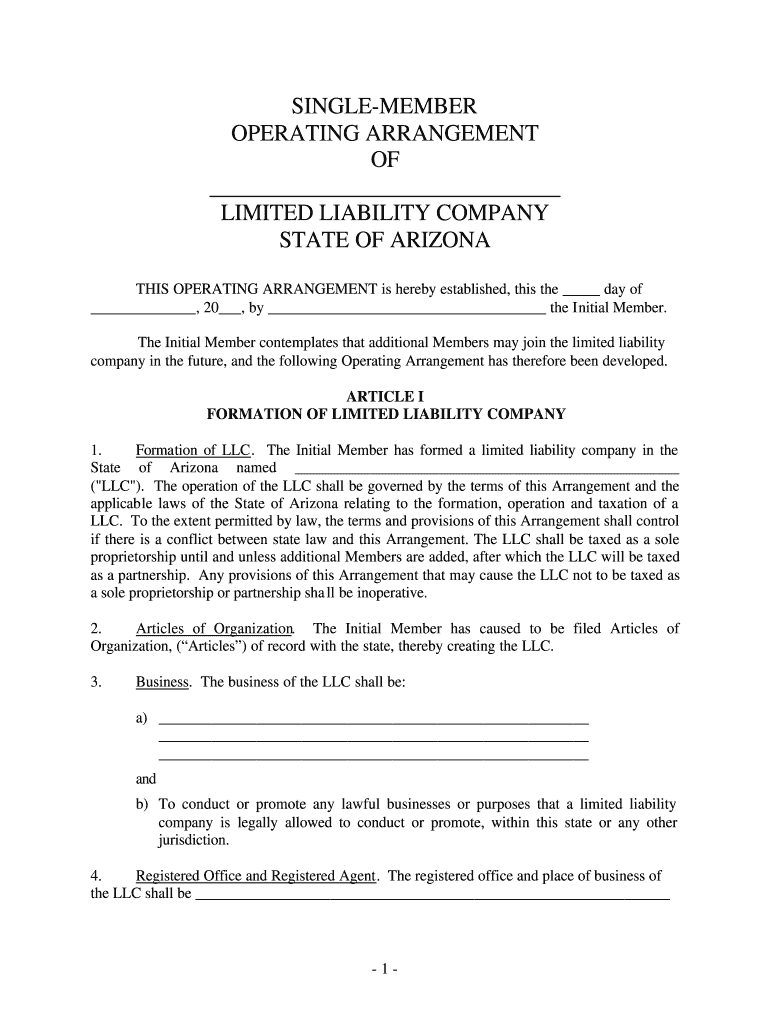

Llc Operating Agreement Arizona Form

What is the LLC Operating Agreement in Arizona

An LLC operating agreement in Arizona is a crucial document that outlines the management structure and operating procedures of a limited liability company (LLC). This agreement serves as an internal guideline for the members of the LLC, detailing their rights, responsibilities, and the operational framework of the business. While Arizona does not legally require an operating agreement for LLCs, having one is highly recommended to clarify the roles of each member and prevent potential disputes. The operating agreement can also specify how profits and losses are distributed, how decisions are made, and the process for adding or removing members.

Key Elements of the LLC Operating Agreement in Arizona

When creating an LLC operating agreement in Arizona, several key elements should be included to ensure clarity and effectiveness. These elements typically encompass:

- Member Information: Names and addresses of all LLC members.

- Management Structure: Details on whether the LLC is member-managed or manager-managed.

- Voting Rights: Specifications on how voting will occur and the weight of each member's vote.

- Profit Distribution: Guidelines on how profits and losses will be allocated among members.

- Amendment Procedures: Processes for making changes to the operating agreement in the future.

Steps to Complete the LLC Operating Agreement in Arizona

Completing an LLC operating agreement in Arizona involves several straightforward steps. First, gather all members to discuss and agree on the terms that will govern the LLC. Next, draft the agreement, ensuring it includes all key elements relevant to your specific business needs. Once the draft is complete, review the document thoroughly to ensure all members understand and agree to the terms. After finalizing the agreement, each member should sign the document to make it legally binding. It is advisable to keep the signed agreement in a safe place, as it may be required for various business operations or legal matters.

Legal Use of the LLC Operating Agreement in Arizona

The LLC operating agreement holds significant legal weight in Arizona. Although not required by law, it can be used to establish the LLC's legitimacy and operational guidelines in disputes or legal matters. Courts often refer to the operating agreement to determine the intentions of the members and the agreed-upon procedures for the LLC. Furthermore, a well-drafted operating agreement can protect members from personal liability, as it reinforces the separation between personal and business assets.

How to Use the LLC Operating Agreement in Arizona

Using the LLC operating agreement in Arizona involves adhering to the guidelines set forth in the document throughout the LLC's operation. Members should refer to the agreement when making decisions, particularly regarding profit distribution, voting, and management changes. It is also essential to update the operating agreement as the business evolves, ensuring it reflects any changes in membership or operational procedures. Regularly reviewing the agreement can help maintain clarity and prevent misunderstandings among members.

Obtaining the LLC Operating Agreement in Arizona

To obtain an LLC operating agreement in Arizona, you can either draft one from scratch or use a template to guide you. Many online resources provide customizable templates that can be tailored to fit your specific business needs. It is important to ensure that the template complies with Arizona laws and includes all necessary elements. If you prefer professional assistance, consulting with a legal expert can help ensure that your operating agreement is comprehensive and legally sound.

Quick guide on how to complete llc operating agreement arizona form

Complete Llc Operating Agreement Arizona seamlessly on any device

Online document management has become widespread among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Llc Operating Agreement Arizona on any platform using airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Llc Operating Agreement Arizona effortlessly

- Locate Llc Operating Agreement Arizona and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Llc Operating Agreement Arizona and ensure excellent communication at any stage of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I get help to modify an operating agreement for a newly formed LLC without hiring a lawyer?

Legally, you can't. A person cannot cannot offer legal services without an active law license, and such issues are far too complex for unintelligent forms based sites (not run by actual attorneys, just legally classified "form assistants") like Legal Zoom, etc; they can only act as a "filing service" to file base docs, and that is only q% of the overall process, if that; it does not suffice, and they mislead people.The other parts of legal entities are very complex and subtle and become exponentially more so with more members. The exception is a CPA, who can do very limited company formation work, but who generally don't really know what they're doing with formation, other than the tax specific aspects, and are never used for ongoing matters or as the lead people for company exit stages. The best option is always a corporate attorney (senior if possible) with a strong enjoyment of the tax law area of the work, or a combo team (e.g corporate lawyer and tax lawyer in the same firm, or a bit quite as common but still good, a corporate attorney and a CPA (some firms actually offer this in house).Normally however you get what you pay for, and if you invest in a good business attorney up front you will never have to even ask such a question because all contingencies would have been handled during setup. If you did that yourself, it's likely things weren't done correctly at the corporate governance level and half the decisions are null and void anyway, falling back to state law defaults (which are intended for large and/or public companies), leaving many unintended consequences. You may need a commercial litigation attorney/firn at this stage depending on size.

-

We registered an LLC in Arizona for our startup. Can we use a template for the operating(?) agreement?

If your business is likely to fail, there's not much point in spending money on a properly vetted operating agreement. If your business is likely to succeed, or you're confident it's a worthwhile endeavor, then I fail to understand; (a) why you would not have a professional operating agreement in place, and (b) why you would not address critical issues not found in a template.If the company is successful and one of you needs to liquidate (due to, let's say, serious illness or unexpected expenses), how are your provisions drafted for doing so? Are there "drag-along" as well as "tag-along" rights? Will differences of opinion involving legal matters be resolved through binding arbitration or by the filing of a complaint sounding in tort by the aggrieved party?The above is just a small fraction of things to be considered... which a "one size fits all" template cannot address. However, realistically, the majority of business startups fail. Sadly, businesses that start off with a "template" and then succeed tend to never address the operating agreement until there's a disagreement... at which point, it becomes a costly mistake.I suggest you govern yourself accordingly. If you're serious about success, take the steps necessary to ensure a strong foundation.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

How does an LLC adopt a new operating agreement?

Good question as an administrative task like this can have drastic effects if it’s not completed properly. Operating agreements often include language addressing how the LLC may alter or revoke the agreement. If not, the rule for adopting a new operating agreement is governed by the default rule in your state. The default rule for the State of Washington is approval by all members, which is easy for your single member LLC.I agree with Dana and and Stephen that you should clearly note in your new operating agreement that this one replaces the former. I also agree with the Anonymous post that recommends seeking counsel on the tax implications that your amendment may have.We’ve helped countless startups with making changes like this at LawTrades. Our platform connects bootstrapping entrepreneurs to a vast network of experienced and affordable startups attorneys. Also, feel free to message me if you have any other questions regarding your operating agreement!

-

What tax form do I need to fill out to convert from single member LLC to multi-member LLC?

When you add a member to your previously single member LLC (which you can do structurally by amending your operating agreement and filing an amended report, if required, with your secretary of state), you cease to be a 'disregarded entity' under the applicable Treasury Regulations.Going forward, you will either be a (a) partnership, by default, and will have to file a partnership income tax return on Form 1065, or (b) a corporation, if you so elect, and will have to file a Form 1120 if you are a C corporation or Form 1120S if you elect to be taxed as an S corporation.There can be other tax issues as well, and these need to be addressed with a business CPA.

Create this form in 5 minutes!

How to create an eSignature for the llc operating agreement arizona form

How to make an eSignature for your Llc Operating Agreement Arizona Form online

How to make an electronic signature for your Llc Operating Agreement Arizona Form in Google Chrome

How to generate an electronic signature for signing the Llc Operating Agreement Arizona Form in Gmail

How to make an electronic signature for the Llc Operating Agreement Arizona Form from your mobile device

How to create an electronic signature for the Llc Operating Agreement Arizona Form on iOS devices

How to generate an eSignature for the Llc Operating Agreement Arizona Form on Android

People also ask

-

What is an operating agreement LLC Arizona template?

An operating agreement LLC Arizona template is a customized legal document that outlines the ownership and management structure of an LLC in Arizona. This template ensures that all members understand their roles, responsibilities, and the operational procedures of the business. Using a template streamlines the process of establishing clear guidelines and can help prevent disputes among members.

-

How can I create an operating agreement LLC Arizona template using airSlate SignNow?

You can create an operating agreement LLC Arizona template by accessing our user-friendly document builder on the airSlate SignNow platform. Simply input your business details, and the template will generate a comprehensive operating agreement tailored to Arizona's laws. This process is efficient and makes it easy for anyone to draft their agreement without legal jargon.

-

Is there a cost for using the operating agreement LLC Arizona template from airSlate SignNow?

Yes, airSlate SignNow offers competitive pricing for accessing the operating agreement LLC Arizona template. We provide various subscription plans that cater to different business needs, ensuring you get a cost-effective solution. Additional features like eSigning and document tracking can also be bundled for a comprehensive package.

-

What are the benefits of using an operating agreement LLC Arizona template?

Using an operating agreement LLC Arizona template provides clear guidelines for operations, which can enhance business efficiency. This document protects the interests of all members and helps avoid potential legal disputes. By having a well-defined agreement, your LLC can operate smoothly and in compliance with Arizona regulations.

-

Can I customize the operating agreement LLC Arizona template?

Absolutely! The operating agreement LLC Arizona template provided by airSlate SignNow is fully customizable to meet your specific needs. You can easily modify sections to reflect your LLC's unique policies, member roles, and decision-making processes. This flexibility ensures that your agreement aligns perfectly with your business objectives.

-

Does the operating agreement LLC Arizona template support electronic signatures?

Yes, the operating agreement LLC Arizona template on airSlate SignNow supports electronic signatures. This feature allows all members to sign the document securely and conveniently from anywhere, ensuring timely completion. Electronic signatures are legally binding in Arizona, making this a valid option for your LLC agreement.

-

What integrations are available with the airSlate SignNow platform for the operating agreement LLC Arizona template?

airSlate SignNow offers several integrations with popular tools and platforms, enhancing the functionality of the operating agreement LLC Arizona template. You can connect with CRM systems, cloud storage services, and other business applications to streamline your document management. These integrations make it easier to share, track, and manage your documents efficiently.

Get more for Llc Operating Agreement Arizona

- Chapter 3 medical legal and ethical issues flashcards form

- Tactical apta form

- Patient information form responsible party insurance

- Newborn form

- Patient testimonial harlan chiropractic amp acupuncture form

- Gwinnett medical financial aid form

- Rb nutrition intake formdoc

- Individual pathology materials request form

Find out other Llc Operating Agreement Arizona

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT