Further Statement Tax Exemption Form

What is the Further Statement Tax Exemption

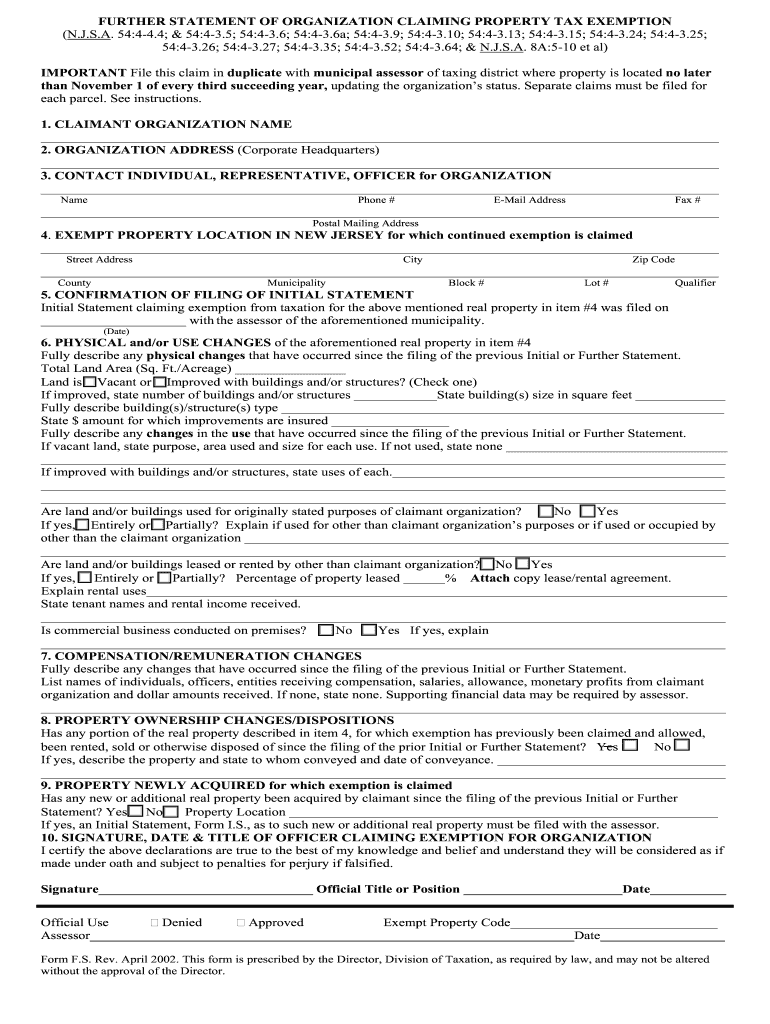

The Further Statement Tax Exemption is a specific tax relief provision available to eligible organizations in New Jersey. This exemption allows qualifying entities to claim relief from property taxes, thereby reducing their financial burden. The exemption is typically applicable to non-profit organizations, educational institutions, and certain other entities that meet the criteria established by the state. Understanding the nuances of this exemption is crucial for organizations seeking to maximize their financial resources.

Steps to complete the Further Statement Tax Exemption

Completing the Further Statement Tax Exemption involves several key steps to ensure compliance and accuracy. First, organizations must gather all necessary documentation, including proof of eligibility and financial records. Next, the appropriate form must be filled out accurately, detailing the organization's information and the basis for the exemption claim. Once completed, the form should be submitted to the relevant local tax authority, either online or via mail. It is essential to keep copies of all submitted documents for future reference and potential audits.

Eligibility Criteria

To qualify for the Further Statement Tax Exemption, organizations must meet specific eligibility criteria set forth by New Jersey law. Generally, this includes being a non-profit entity or an organization dedicated to educational, charitable, or religious purposes. Additionally, the organization must operate primarily for these purposes and not for profit. It is advisable for applicants to review the detailed requirements to ensure compliance before submitting their exemption claims.

Required Documents

When applying for the Further Statement Tax Exemption, organizations must provide several required documents to support their claim. These typically include:

- Proof of the organization's non-profit status, such as IRS determination letters.

- Financial statements demonstrating the organization's operational focus on exempt purposes.

- Completed application forms with accurate and detailed information.

- Any additional documentation requested by the local tax authority.

Ensuring that all required documents are submitted can significantly enhance the chances of a successful exemption claim.

Form Submission Methods

The Further Statement Tax Exemption form can be submitted through various methods, depending on the local tax authority's requirements. Organizations may have the option to submit the form online via a dedicated portal, which often allows for quicker processing. Alternatively, forms can be mailed directly to the appropriate office or submitted in person. It is important to verify the submission method preferred by the local authority to avoid any delays in processing.

Penalties for Non-Compliance

Failing to comply with the regulations surrounding the Further Statement Tax Exemption can result in significant penalties. Organizations that do not meet the eligibility criteria or fail to submit their forms correctly may face fines, loss of exemption status, or other legal repercussions. It is crucial for organizations to adhere to all guidelines and deadlines to maintain compliance and avoid any adverse consequences.

Legal use of the Further Statement Tax Exemption

The legal use of the Further Statement Tax Exemption is governed by state laws and regulations. Organizations must ensure that they fully understand the legal implications of claiming this exemption. This includes adhering to the specific purposes for which the exemption is granted and maintaining accurate records to support their claims. Legal compliance not only protects the organization from penalties but also upholds the integrity of the exemption process.

Quick guide on how to complete further statement tax exemption

Easily Prepare Further Statement Tax Exemption on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the essential tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Further Statement Tax Exemption on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and Electronically Sign Further Statement Tax Exemption

- Obtain Further Statement Tax Exemption and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign feature, which only takes seconds and holds the same legal value as a conventional wet ink signature.

- Review all information and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Further Statement Tax Exemption and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the further statement tax exemption

The way to make an electronic signature for a PDF document online

The way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is a claiming property form?

A claiming property form is a legal document used to assert ownership of property or assets. With airSlate SignNow, you can easily create and manage your claiming property form online, ensuring that your documentation meets all legal requirements.

-

How does airSlate SignNow simplify the claiming property form process?

airSlate SignNow streamlines the claiming property form process by offering a user-friendly platform for document creation and electronic signatures. This allows you to complete and send your claiming property form quickly, eliminating the hassle of traditional paperwork.

-

What features does airSlate SignNow offer for managing claiming property forms?

airSlate SignNow provides features such as customizable templates, real-time collaboration, and secure storage for your claiming property form. These tools are designed to enhance efficiency and ensure that all stakeholders can access the necessary documents seamlessly.

-

Is there a cost associated with using airSlate SignNow for claiming property forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan includes the ability to create, send, and eSign claiming property forms, making it a cost-effective solution for managing legal documents.

-

Can I integrate airSlate SignNow with other applications for claiming property forms?

Absolutely! airSlate SignNow supports integration with a variety of third-party applications such as CRM systems and cloud storage services. This means you can easily automate workflows involving your claiming property form and enhance your overall productivity.

-

What are the security measures in place for claiming property forms on airSlate SignNow?

airSlate SignNow takes document security seriously, implementing features like bank-level encryption, secure user authentication, and audit trails for every claiming property form. This ensures that your sensitive information remains protected throughout the entire signing process.

-

Can multiple parties sign a claiming property form using airSlate SignNow?

Yes, airSlate SignNow allows multiple parties to electronically sign a claiming property form seamlessly. You can easily add co-signers, and the platform notifies all parties when it’s their turn to sign, ensuring a smooth and efficient signing experience.

Get more for Further Statement Tax Exemption

Find out other Further Statement Tax Exemption

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online