Sba Form 770 Instructions 1987 2008

What is the Sba Form 770 Instructions 1987

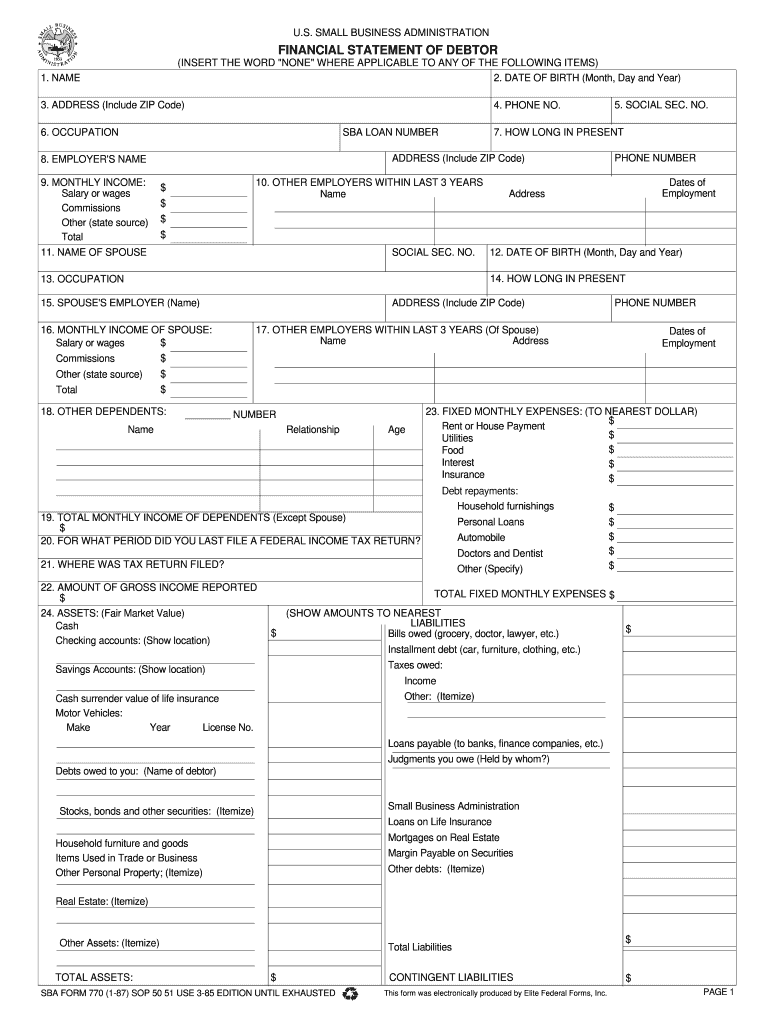

The Sba Form 770 Instructions 1987 is a document provided by the Small Business Administration (SBA) that outlines the process for businesses to apply for certain benefits or assistance programs. This form is specifically designed for businesses seeking to document their eligibility for SBA programs, ensuring compliance with federal regulations. The instructions detail how to fill out the form accurately, the information required, and the purpose of each section, making it essential for applicants to understand the requirements fully.

Steps to complete the Sba Form 770 Instructions 1987

Completing the Sba Form 770 requires careful attention to detail. Here are the key steps involved:

- Gather necessary documentation, including business financial records and identification.

- Review the instructions thoroughly to understand the requirements for each section.

- Fill out the form section by section, ensuring all information is accurate and complete.

- Double-check the form for any errors or omissions before submission.

- Submit the completed form according to the specified submission methods, whether online, by mail, or in person.

Legal use of the Sba Form 770 Instructions 1987

The Sba Form 770 Instructions 1987 is legally binding once completed and submitted. It serves as a formal request for assistance from the SBA and must be filled out truthfully. Misrepresentation or failure to provide accurate information can lead to penalties, including denial of benefits or legal repercussions. Understanding the legal implications of this form is crucial for businesses to ensure compliance with federal laws.

How to obtain the Sba Form 770 Instructions 1987

To obtain the Sba Form 770 Instructions 1987, businesses can visit the official SBA website or contact their local SBA office. The form is typically available for download in PDF format, allowing users to print and complete it manually. Additionally, some local offices may provide physical copies upon request. It is important to ensure that you are using the most current version of the form to avoid any issues during the application process.

Filing Deadlines / Important Dates

Filing deadlines for the Sba Form 770 can vary depending on the specific program or assistance being applied for. It is essential to check the SBA's official guidelines for any program-specific deadlines. Typically, applications should be submitted well in advance of any funding or assistance needs to ensure timely processing. Keeping track of these important dates can help businesses avoid missed opportunities.

Required Documents

When completing the Sba Form 770 Instructions 1987, several documents may be required to support the application. Commonly required documents include:

- Business financial statements, such as profit and loss statements.

- Tax returns for the previous year.

- Proof of business ownership and structure, such as articles of incorporation.

- Identification documents for the business owner(s).

Having these documents prepared and organized can streamline the application process.

Quick guide on how to complete sba form 770 instructions 1987

Complete Sba Form 770 Instructions 1987 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Sba Form 770 Instructions 1987 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The easiest way to edit and eSign Sba Form 770 Instructions 1987 with minimal effort

- Find Sba Form 770 Instructions 1987 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Sba Form 770 Instructions 1987 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sba form 770 instructions 1987

Create this form in 5 minutes!

How to create an eSignature for the sba form 770 instructions 1987

The way to create an electronic signature for a PDF document online

The way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

How to make an eSignature for a PDF file on Android OS

People also ask

-

What are the Sba Form 770 Instructions 1987?

The Sba Form 770 Instructions 1987 provide a comprehensive guide on how to correctly complete the SBA Form 770 for businesses seeking financial assistance through the Small Business Administration. These instructions outline necessary information, specific forms, and eligibility requirements that applicants must meet.

-

Why should I use airSlate SignNow for Sba Form 770 Instructions 1987?

Using airSlate SignNow for your Sba Form 770 Instructions 1987 streamlines the process of filling out and signing your documents electronically. The platform offers a user-friendly interface and ensures your documents are securely stored, making it a cost-effective solution for businesses.

-

Is there a cost associated with using airSlate SignNow for Sba Form 770 Instructions 1987?

Yes, airSlate SignNow offers several pricing plans to accommodate different business needs, providing excellent value for the features it offers in managing your Sba Form 770 Instructions 1987. Each plan includes unlimited templates, integrations, and secure cloud storage.

-

How can airSlate SignNow simplify the completion of Sba Form 770 Instructions 1987 for my team?

airSlate SignNow allows multiple users to collaborate on the Sba Form 770 Instructions 1987 in real-time, making it easy to collect necessary information and signatures quickly. This collaborative feature reduces errors and ensures compliance with all instructions.

-

What integrations does airSlate SignNow offer for managing Sba Form 770 Instructions 1987?

airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Dropbox, and various CRM tools, making it easier to access and manage your Sba Form 770 Instructions 1987. These integrations help streamline your workflow and enhance productivity.

-

Can I track the status of my Sba Form 770 Instructions 1987 using airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Sba Form 770 Instructions 1987. You will receive notifications when the document is viewed, signed, or completed, ensuring you stay informed throughout the process.

-

What are the benefits of eSigning Sba Form 770 Instructions 1987 with airSlate SignNow?

eSigning your Sba Form 770 Instructions 1987 with airSlate SignNow accelerates the signing process while maintaining a high level of security. This method reduces paper usage, saves time, and helps you avoid delays typically associated with traditional signing methods.

Get more for Sba Form 770 Instructions 1987

Find out other Sba Form 770 Instructions 1987

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later