Form 1120 C 2013

What is the Form 1120 C

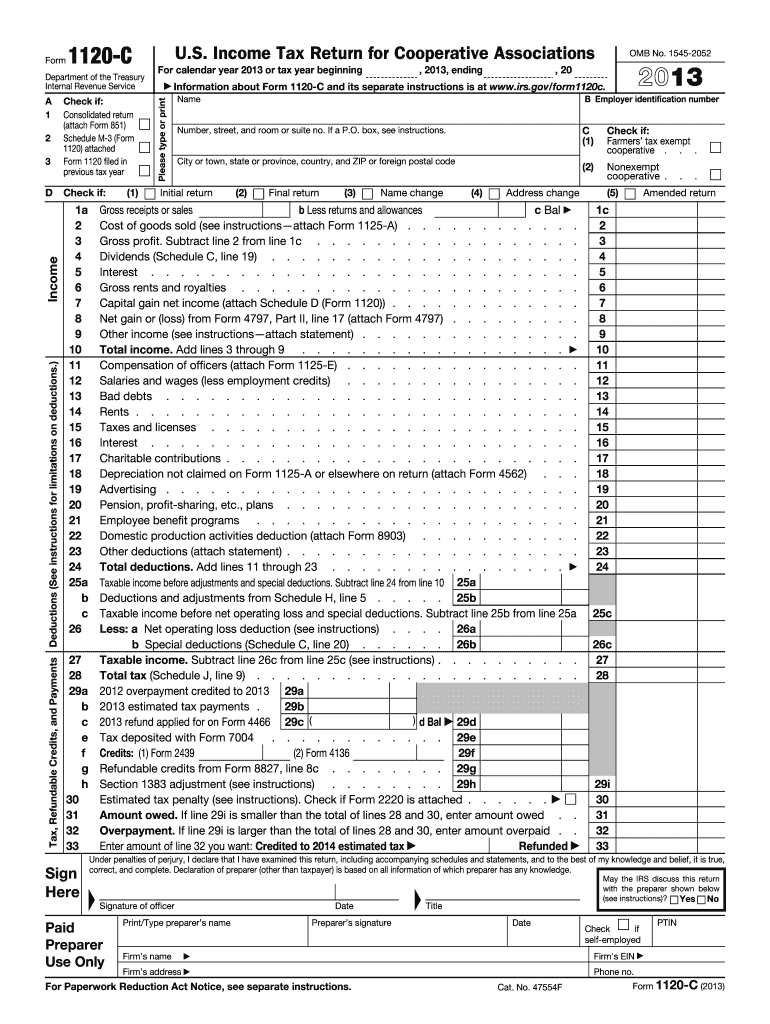

The Form 1120 C is a tax return specifically designed for C corporations in the United States. This form is used to report income, gains, losses, deductions, and credits for a corporation. It is essential for C corporations to file this form annually with the Internal Revenue Service (IRS) to comply with federal tax regulations. The information provided on Form 1120 C helps determine the corporation's tax liability for the year.

How to use the Form 1120 C

Using the Form 1120 C involves several steps, starting with gathering necessary financial information about the corporation. This includes income statements, balance sheets, and details of any deductions or credits the corporation may claim. Once the information is compiled, the corporation can fill out the form accurately, ensuring that all sections are completed. After completing the form, it must be submitted to the IRS by the designated deadline to avoid penalties.

Steps to complete the Form 1120 C

Completing the Form 1120 C requires careful attention to detail. Follow these steps:

- Gather financial documents, including income statements and balance sheets.

- Fill out the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- Report total income in the appropriate sections, including sales and other income sources.

- List allowable deductions, such as salaries, rent, and utilities, to determine taxable income.

- Calculate the corporation's tax liability based on the taxable income reported.

- Sign and date the form, ensuring that it is submitted by the deadline.

Legal use of the Form 1120 C

The Form 1120 C is legally binding when completed and submitted in accordance with IRS regulations. It must be filled out accurately and truthfully to avoid legal repercussions. Misrepresentation or failure to file can lead to penalties, including fines and interest on unpaid taxes. Corporations should ensure compliance with all applicable tax laws and regulations to maintain their legal status and avoid potential audits.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines for the Form 1120 C to avoid penalties. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Corporations can also file for an extension if needed, but they must still pay any taxes owed by the original deadline.

Form Submission Methods (Online / Mail / In-Person)

The Form 1120 C can be submitted to the IRS through various methods. Corporations can file electronically using approved tax software, which often simplifies the process and provides immediate confirmation of submission. Alternatively, the form can be mailed to the appropriate IRS address based on the corporation's location and whether a payment is included. In-person submission is generally not available for tax forms, so electronic filing or mailing are the primary options for compliance.

Quick guide on how to complete 2013 form 1120 c

Complete Form 1120 C with ease on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to acquire the correct form and securely保存 it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without interruptions. Handle Form 1120 C on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-related workflow today.

How to edit and electronically sign Form 1120 C effortlessly

- Obtain Form 1120 C and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with tools specifically designed for that by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or mistakes that require new copies to be printed. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Modify and electronically sign Form 1120 C and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 1120 c

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 1120 c

The way to create an electronic signature for your PDF in the online mode

The way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is Form 1120 C and who needs it?

Form 1120 C is a tax return used specifically by certain corporations taxed under Subchapter C of the Internal Revenue Code. Businesses that operate as C corporations must file this form annually to report their income, deductions, and taxes owed. Ensuring accurate and timely submission of Form 1120 C is crucial to avoid penalties.

-

How can airSlate SignNow assist with Form 1120 C submissions?

airSlate SignNow simplifies the process of signing and sending Form 1120 C by allowing users to eSign documents securely and efficiently. Our platform provides tools to create legally binding signatures, ensuring compliance with IRS requirements. This streamlines the preparation and submission of your tax forms, reducing administrative burdens.

-

Are there any special features for managing Form 1120 C within airSlate SignNow?

Yes, airSlate SignNow offers features specifically designed to handle Form 1120 C, including customizable templates and automated workflows. Users can easily access pre-filled forms, share them with team members for review, and track the signing status in real-time. These features enhance collaboration and minimize errors during tax preparation.

-

What are the pricing options for airSlate SignNow with respect to Form 1120 C?

airSlate SignNow offers competitive pricing plans tailored for businesses needing to manage Form 1120 C effectively. Our plans scale according to your document needs and user base, ensuring you only pay for what you use. Explore our flexible subscription options to find the right fit for your organization.

-

Is airSlate SignNow compliant with IRS regulations for Form 1120 C?

Absolutely! airSlate SignNow is fully compliant with IRS regulations concerning the eSigning and submission of Form 1120 C. Our platform uses secure encryption and digital signature technology to ensure that your signed forms meet all legal requirements, providing peace of mind during the tax filing process.

-

Can I integrate airSlate SignNow with other software for Form 1120 C preparation?

Yes, airSlate SignNow boasts seamless integrations with various accounting and tax software solutions, greatly enhancing the management of Form 1120 C. This allows users to import data directly into airSlate SignNow for signature and submission, creating a more streamlined process. Check our integration options to see how we can fit within your existing tech stack.

-

What benefits does airSlate SignNow offer for eSigning Form 1120 C?

Using airSlate SignNow for eSigning Form 1120 C provides numerous benefits, including increased speed and convenience. Your team can sign documents from anywhere at any time, eliminating the need for physical signatures or delays in mail. This efficiency not only saves time but also helps ensure that you meet your filing deadlines.

Get more for Form 1120 C

- Warranty deed from two individuals to husband and wife iowa form

- Iowa renunciation and disclaimer of property from life insurance or annuity contract iowa form

- Contractors notice to owner individual iowa form

- Quitclaim deed by two individuals to llc iowa form

- Warranty deed from two individuals to llc iowa form

- Contractors notice to owner by corporation or llc iowa form

- Iowa disclaimer 497304899 form

- Notice to owner of dwelling individual iowa form

Find out other Form 1120 C

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online