W 3pr Form 2012

What is the W-3PR Form

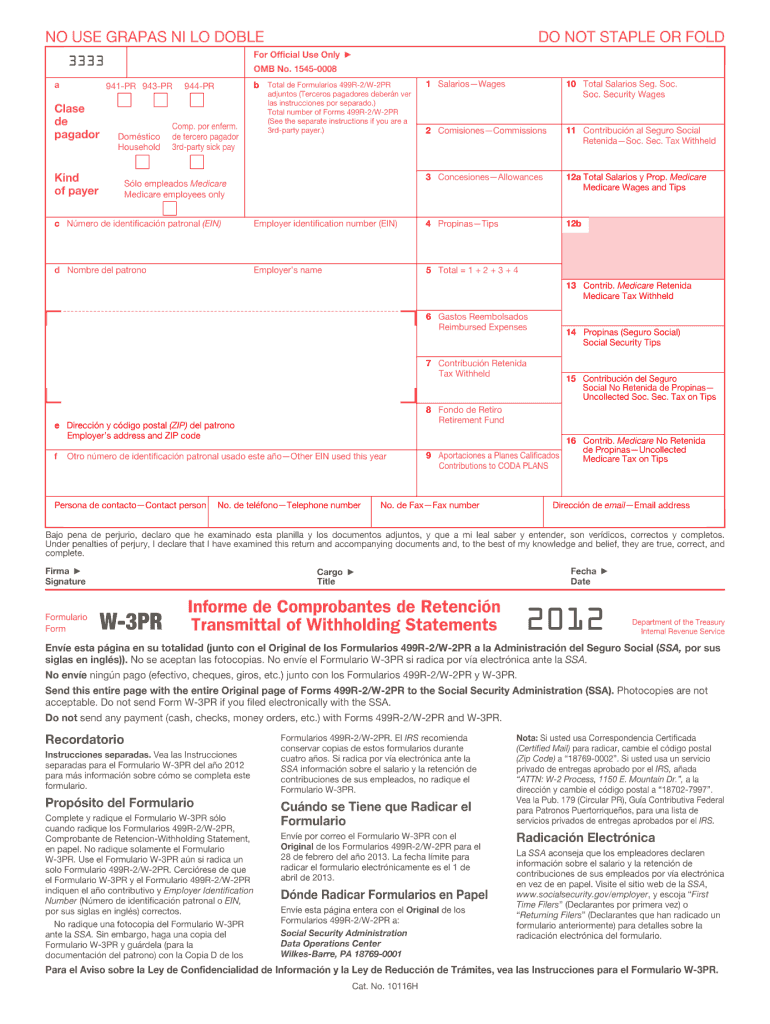

The W-3PR Form is a summary of the wages and tax information reported on the W-2 forms for employees in Puerto Rico. This form is essential for employers who need to report their employees' earnings and tax withholdings to the Internal Revenue Service (IRS). It consolidates the data from multiple W-2 forms into one document and is submitted along with the W-2 forms. The W-3PR is specifically designed for employers in Puerto Rico and must be filed annually to ensure compliance with federal tax regulations.

How to Use the W-3PR Form

Utilizing the W-3PR Form involves several steps to ensure accurate reporting of employee wages. Employers must first gather all W-2 forms issued to employees in Puerto Rico. The total amounts from these forms are then transferred to the W-3PR, summarizing the total wages paid and taxes withheld. It is crucial to ensure that all information is accurate, as discrepancies can lead to penalties or delays in processing. Once completed, the W-3PR must be submitted to the IRS along with the corresponding W-2 forms.

Steps to Complete the W-3PR Form

Completing the W-3PR Form involves a systematic approach to ensure accuracy:

- Gather all W-2 forms issued to employees for the tax year.

- Calculate the total wages paid to employees as reported on the W-2 forms.

- Sum the total federal income tax withheld from all employees.

- Fill in the W-3PR Form with the summarized information, ensuring all fields are completed accurately.

- Review the form for any errors before submission.

- Submit the W-3PR along with the W-2 forms to the IRS by the designated deadline.

Legal Use of the W-3PR Form

The W-3PR Form is legally required for employers in Puerto Rico to report employee earnings and tax information to the IRS. Failure to file this form can result in penalties and interest on unpaid taxes. It is essential for employers to understand the legal implications of submitting accurate information, as incorrect filings can lead to audits or additional scrutiny from tax authorities. Compliance with federal tax laws is crucial for maintaining good standing and avoiding legal issues.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the W-3PR Form. Typically, the form must be submitted to the IRS by the end of January following the tax year. This timeline ensures that employees receive their W-2 forms in a timely manner and that the IRS has the necessary information for processing tax returns. Employers should mark their calendars and prepare the necessary documentation well in advance to avoid any last-minute complications.

Who Issues the Form

The W-3PR Form is issued by the Internal Revenue Service (IRS). It is part of the reporting requirements for employers who have employees in Puerto Rico. The IRS provides the necessary forms and guidelines for completion, ensuring that employers understand their obligations regarding wage reporting and tax withholding. Employers can access the W-3PR Form and related instructions directly from the IRS website or through authorized tax professionals.

Quick guide on how to complete w 3pr 2012 form

Effortlessly Prepare W 3pr Form on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly and without delays. Manage W 3pr Form on any platform using the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

How to Modify and eSign W 3pr Form with Ease

- Obtain W 3pr Form and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or conceal sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in a few clicks from your chosen device. Modify and eSign W 3pr Form while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w 3pr 2012 form

Create this form in 5 minutes!

How to create an eSignature for the w 3pr 2012 form

The way to create an electronic signature for your PDF file online

The way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The way to make an eSignature for a PDF document on Android devices

Get more for W 3pr Form

- Quitclaim deed by two individuals to corporation iowa form

- Warranty deed from two individuals to corporation iowa form

- Ia corporation llc form

- Demand to record satisfaction individual iowa form

- Quitclaim deed from individual to corporation iowa form

- Warranty deed from individual to corporation iowa form

- Demand to record satisfaction by corporation or llc iowa form

- Acknowledgment of satisfaction for individual iowa form

Find out other W 3pr Form

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast