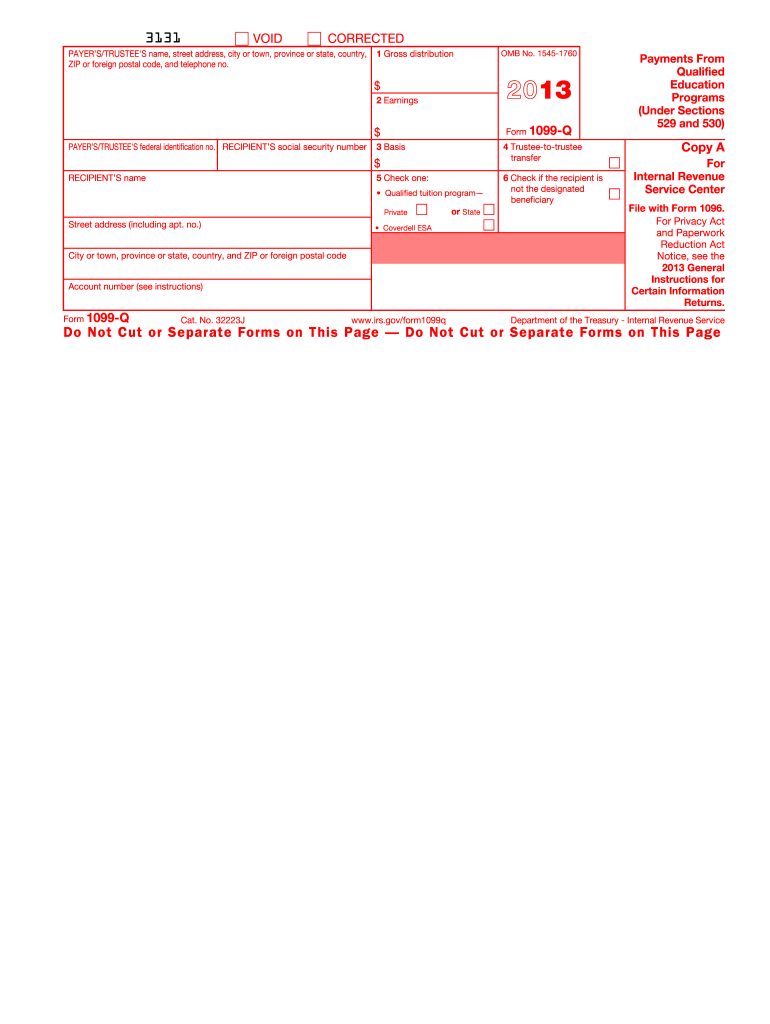

PAYERSTRUSTEE'S Federal Identification No 2013

What is the PAYERSTRUSTEE'S Federal Identification No

The PAYERSTRUSTEE'S Federal Identification No is a unique identifier assigned by the Internal Revenue Service (IRS) to specific entities for tax purposes. This number is essential for organizations that need to report income, payroll, or other tax-related information. It serves as a means of identifying the payer or trustee in financial transactions and is crucial for compliance with federal tax regulations.

How to obtain the PAYERSTRUSTEE'S Federal Identification No

To obtain the PAYERSTRUSTEE'S Federal Identification No, entities must complete Form SS-4, the Application for Employer Identification Number (EIN). This form can be submitted online, by mail, or by fax. When applying, you will need to provide specific information about your organization, including its legal structure, the reason for applying, and the responsible party's details. Once the application is processed, the IRS will issue the identification number.

Steps to complete the PAYERSTRUSTEE'S Federal Identification No

Completing the PAYERSTRUSTEE'S Federal Identification No involves several key steps:

- Gather necessary information about your organization, including its legal name, address, and structure.

- Fill out Form SS-4 accurately, ensuring all required fields are completed.

- Submit the form through your chosen method: online, by mail, or by fax.

- Receive your Federal Identification No from the IRS, which will be sent to you upon approval.

Legal use of the PAYERSTRUSTEE'S Federal Identification No

The PAYERSTRUSTEE'S Federal Identification No is legally binding and must be used in various tax-related documents and transactions. It is essential for filing tax returns, reporting income, and complying with federal regulations. Misuse or failure to obtain this identification number can lead to penalties and complications with tax authorities.

Examples of using the PAYERSTRUSTEE'S Federal Identification No

Entities use the PAYERSTRUSTEE'S Federal Identification No in several scenarios, including:

- Filing annual tax returns, such as Form 990 for non-profit organizations.

- Reporting payroll taxes for employees, ensuring compliance with federal tax laws.

- Opening bank accounts or applying for loans, where the identification number serves as proof of legitimacy.

Required Documents

When applying for the PAYERSTRUSTEE'S Federal Identification No, you may need to provide various documents, including:

- Proof of your organization’s legal structure, such as articles of incorporation or partnership agreements.

- Identification for the responsible party, such as a driver's license or Social Security number.

- Any relevant business licenses or permits, depending on your entity type and location.

Quick guide on how to complete payerstrustees federal identification no

Prepare PAYERSTRUSTEE'S Federal Identification No easily on any device

Digital document management has become popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage PAYERSTRUSTEE'S Federal Identification No on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

The simplest way to modify and electronically sign PAYERSTRUSTEE'S Federal Identification No without hassle

- Locate PAYERSTRUSTEE'S Federal Identification No and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or mask sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and bears the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to preserve your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

No more lost or misplaced documents, tedious form hunting, or errors requiring new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign PAYERSTRUSTEE'S Federal Identification No and maintain effective communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct payerstrustees federal identification no

Create this form in 5 minutes!

How to create an eSignature for the payerstrustees federal identification no

The way to create an electronic signature for your PDF file in the online mode

The way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is a PAYERSTRUSTEE'S Federal Identification No.?

A PAYERSTRUSTEE'S Federal Identification No. is a unique number assigned by the IRS to identify organizations for tax purposes. This identification number is essential for businesses and individuals to ensure proper tax filing and compliance. When using airSlate SignNow, you'll need this number to streamline your eSigning processes.

-

How does airSlate SignNow help manage the PAYERSTRUSTEE'S Federal Identification No.?

airSlate SignNow provides a secure and efficient platform where you can easily manage and include the PAYERSTRUSTEE'S Federal Identification No. in your documents. Our solution allows for seamless integrations where this number is automatically added, ensuring accuracy and compliance. This reduces the hassle of manual entry and potential errors.

-

What pricing options does airSlate SignNow offer for users requiring a PAYERSTRUSTEE'S Federal Identification No.?

airSlate SignNow offers flexible pricing plans tailored to the needs of businesses of all sizes that may require the PAYERSTRUSTEE'S Federal Identification No. within their documents. You can choose from individual plans to robust enterprise solutions that cater to extensive eSigning needs. Our competitive pricing ensures that you get great value while managing important identifiers like the PAYERSTRUSTEE'S Federal Identification No.

-

What features does airSlate SignNow provide for signing documents with a PAYERSTRUSTEE'S Federal Identification No.?

With airSlate SignNow, you can harness features such as customizable templates, automated reminders, and advanced tracking for documents that include the PAYERSTRUSTEE'S Federal Identification No. Our platform ensures that your documents are always secure, legally binding, and easily accessible from anywhere. These features enhance efficiency while handling crucial information.

-

Are there any benefits of using airSlate SignNow for documents requiring a PAYERSTRUSTEE'S Federal Identification No.?

Yes, using airSlate SignNow offers numerous benefits for documents that require a PAYERSTRUSTEE'S Federal Identification No. You'll experience faster turnaround times, reduced paper usage, and enhanced security. Plus, the user-friendly interface allows for quick learning and adoption across your team, improving workflow efficiency.

-

How does airSlate SignNow integrate with other systems when using a PAYERSTRUSTEE'S Federal Identification No.?

airSlate SignNow integrates seamlessly with various applications and systems, ensuring that PAYERSTRUSTEE'S Federal Identification No. can easily flow through your workflow. Connect with CRM systems, cloud storage, and accounting software to handle your documents efficiently. This integration capability enhances usability and allows for easy access to all necessary identifiers.

-

Is airSlate SignNow compliant with regulations related to the PAYERSTRUSTEE'S Federal Identification No.?

Absolutely, airSlate SignNow is designed to comply with the regulatory requirements surrounding the use of the PAYERSTRUSTEE'S Federal Identification No. Our platform adheres to the highest standards of security and legal compliance, ensuring that your documents are protected and valid. Trust airSlate SignNow to keep your sensitive information secure.

Get more for PAYERSTRUSTEE'S Federal Identification No

- Amendment to lease or rental agreement district of columbia form

- Warning notice due to complaint from neighbors district of columbia form

- Lease subordination agreement district of columbia form

- Apartment rules and regulations district of columbia form

- Dc cancellation form

- Amendment of residential lease district of columbia form

- Agreement for payment of unpaid rent district of columbia form

- Commercial lease assignment from tenant to new tenant district of columbia form

Find out other PAYERSTRUSTEE'S Federal Identification No

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF