Application Self Accrual Authority 2016-2026

What is the Application Self Accrual Authority

The Application Self Accrual Authority is a regulatory framework that allows businesses to manage their tax obligations more efficiently by self-reporting certain tax liabilities. This authority is particularly relevant for entities that need to maintain compliance with state tax regulations while optimizing their financial operations. By utilizing this authority, businesses can streamline their tax reporting processes and ensure they meet all necessary legal requirements.

How to Use the Application Self Accrual Authority

Using the Application Self Accrual Authority involves a series of steps designed to ensure compliance and accuracy in tax reporting. Businesses must first familiarize themselves with the specific requirements set forth by their state. This includes understanding the types of taxes that can be self-accrued, as well as any applicable deadlines. Once the necessary information is gathered, businesses can complete the required forms, ensuring that all data is accurate and submitted in a timely manner.

Steps to Complete the Application Self Accrual Authority

Completing the Application Self Accrual Authority requires careful attention to detail. Here are the essential steps:

- Gather all relevant financial documents and records.

- Review state-specific guidelines regarding self-accrual.

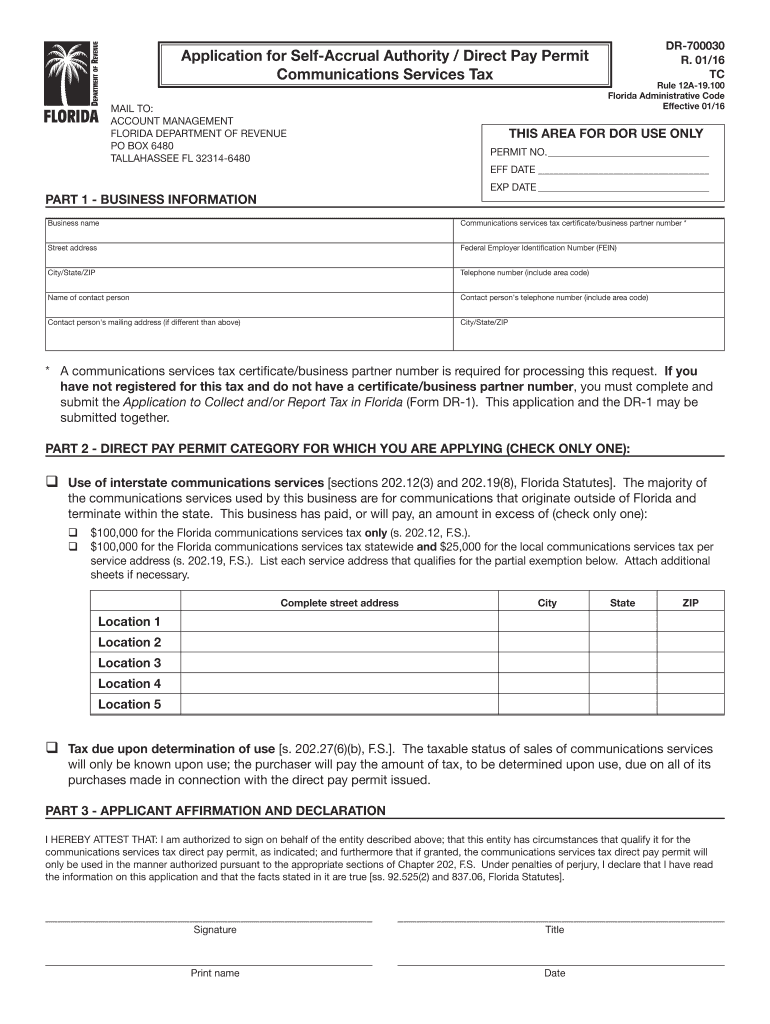

- Fill out the appropriate forms, such as the DR-700030 form for Florida.

- Double-check all entries for accuracy.

- Submit the completed forms by the specified deadlines.

Legal Use of the Application Self Accrual Authority

The legal use of the Application Self Accrual Authority is governed by various state laws and regulations. It is essential for businesses to ensure that they are compliant with these laws to avoid potential penalties. Proper use of this authority not only aids in accurate tax reporting but also protects businesses from legal repercussions that may arise from non-compliance.

Required Documents

To successfully utilize the Application Self Accrual Authority, businesses must prepare several key documents. These typically include:

- Financial statements that reflect the business's tax obligations.

- Completed forms, such as the DR-700030 form.

- Any additional documentation required by state authorities, such as proof of previous tax payments.

Eligibility Criteria

Eligibility for the Application Self Accrual Authority varies by state but generally includes criteria such as business type, size, and tax history. Businesses must demonstrate a consistent track record of compliance with tax regulations to qualify for self-accrual. It is advisable to review state-specific requirements to ensure eligibility before applying.

Quick guide on how to complete application self accrual authority

Complete Application Self Accrual Authority effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents quickly without any hold-ups. Manage Application Self Accrual Authority on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Application Self Accrual Authority with ease

- Obtain Application Self Accrual Authority and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form navigation, or errors requiring the printing of new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Modify and eSign Application Self Accrual Authority to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application self accrual authority

Create this form in 5 minutes!

How to create an eSignature for the application self accrual authority

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is self accrual in the context of airSlate SignNow?

Self accrual in airSlate SignNow refers to the ability for users to manage their financial records independently without relying on external services. This feature ensures that businesses can accurately track transactions and manage cash flow efficiently. By implementing self accrual, users can streamline their document processes while maintaining full control over their accruals.

-

How does self accrual benefit my business?

Utilizing self accrual within airSlate SignNow allows businesses to improve their financial accuracy and reporting efficiency. With the ability to track accruals directly, companies can reduce errors associated with manual entry and enhance overall compliance. This leads to better financial decision-making and increased business agility.

-

Is airSlate SignNow's self accrual feature easy to use?

Yes, the self accrual feature in airSlate SignNow is designed to be user-friendly, even for those without a financial background. The intuitive interface guides users through the process of setting up and managing accruals seamlessly. Our goal is to make financial management accessible for all users.

-

What integrations are available with airSlate SignNow for self accrual?

airSlate SignNow offers various integrations with accounting and financial software, facilitating seamless data transfer for self accrual. Popular integrations include QuickBooks, Xero, and other major platforms that enhance financial workflows. This ensures users can synchronize their documents and financial records without hassle.

-

What pricing plans does airSlate SignNow offer for self accrual?

airSlate SignNow provides various pricing plans that accommodate different business needs, including features for self accrual. Whether you're a small business or a large enterprise, our plans are designed to offer flexibility and cost-effectiveness. To find the right plan for you, please visit our pricing page.

-

Can I customize self accrual settings in airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize their self accrual settings according to their unique business requirements. You can adjust parameters to match your specific accrual methods and reporting needs, ensuring the tool aligns perfectly with your financial processes.

-

Is there customer support available for self accrual users?

Yes, airSlate SignNow provides comprehensive customer support for all users, including those utilizing self accrual features. Our support team is available through various channels to assist with any questions or issues you may encounter. We're committed to helping you maximize your use of our self accrual functionality.

Get more for Application Self Accrual Authority

Find out other Application Self Accrual Authority

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure