Irs Form 1026 2012

What is the Irs Form 1026

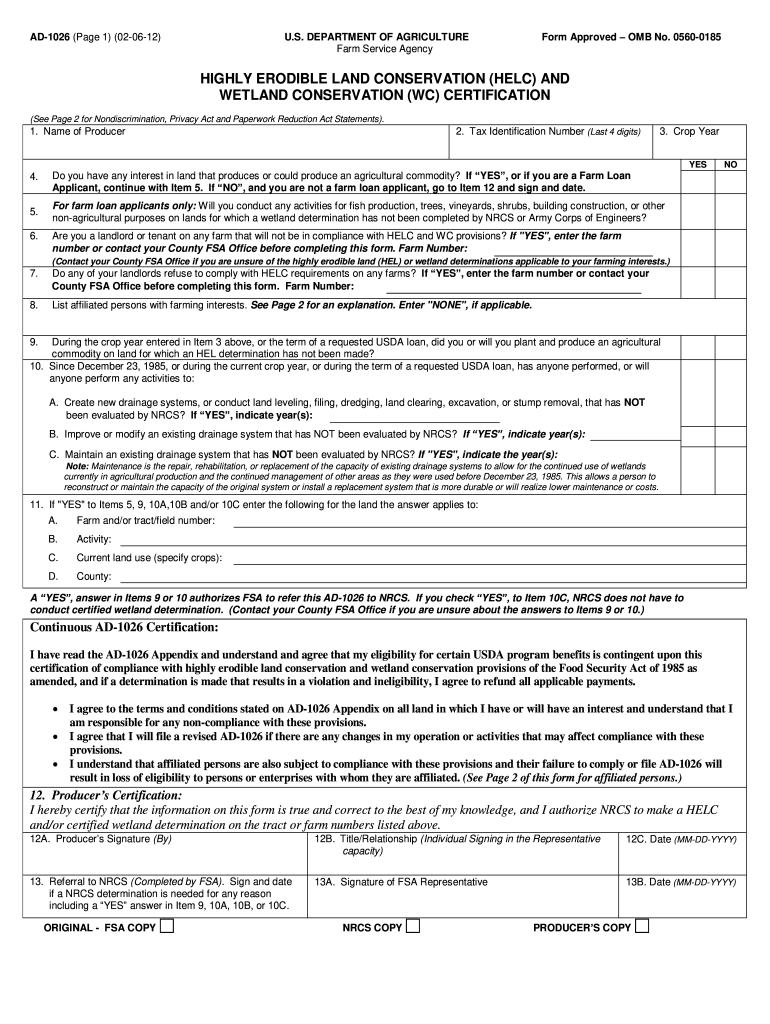

The Irs Form 1026 is a tax form used by individuals and businesses to report specific financial information to the Internal Revenue Service (IRS). This form is essential for compliance with federal tax regulations and helps the IRS assess tax liabilities accurately. Understanding the purpose and requirements of Form 1026 is crucial for anyone who needs to file it, as it ensures that the information provided is complete and accurate.

How to use the Irs Form 1026

Using the Irs Form 1026 involves several steps to ensure proper completion and submission. First, gather all necessary financial documents and information relevant to the form. This may include income statements, expense records, and other financial data. Next, fill out the form carefully, ensuring that all sections are completed accurately. After filling out the form, review it for any errors or omissions before submitting it to the IRS. It is important to keep a copy for your records.

Steps to complete the Irs Form 1026

Completing the Irs Form 1026 requires a systematic approach to ensure accuracy. Follow these steps:

- Gather all necessary financial documents, including income and expense records.

- Read the instructions provided with the form to understand each section.

- Fill out the form, ensuring all required fields are completed.

- Double-check your entries for accuracy and completeness.

- Sign and date the form where indicated.

- Submit the form to the IRS by the specified deadline.

Legal use of the Irs Form 1026

The legal use of the Irs Form 1026 is governed by IRS regulations, which require accurate reporting of financial information. Failure to comply with these regulations can result in penalties and legal repercussions. It is important to ensure that the form is completed honestly and accurately to avoid any issues with the IRS. Additionally, using a reliable electronic signature solution can enhance the legitimacy of the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Irs Form 1026 vary depending on the specific circumstances of the taxpayer. Generally, the form must be submitted by the tax filing deadline, which is typically April fifteenth for individuals. However, businesses may have different deadlines based on their fiscal year. It is crucial to stay informed about these dates to avoid late filing penalties.

Required Documents

To complete the Irs Form 1026, several documents may be required. These typically include:

- Income statements, such as W-2s or 1099s.

- Expense documentation, including receipts and invoices.

- Previous tax returns, if applicable.

- Any additional forms that may be relevant to your specific tax situation.

Form Submission Methods (Online / Mail / In-Person)

The Irs Form 1026 can be submitted through various methods. Taxpayers have the option to file online using approved e-filing software, which can streamline the process and reduce errors. Alternatively, the form can be mailed to the appropriate IRS address, or in certain cases, submitted in person at a local IRS office. Choosing the right submission method can depend on personal preference and specific circumstances.

Quick guide on how to complete irs form 1026 2012

Effortlessly Prepare Irs Form 1026 on Any Device

Digital document management has become increasingly popular among enterprises and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents quickly and without hindrances. Manage Irs Form 1026 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Method to Edit and eSign Irs Form 1026 Effortlessly

- Obtain Irs Form 1026 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight key sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), or sharing link, or download it to your computer.

Eliminate worries about lost or mishandled files, tedious form searches, or errors that require printing additional document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Irs Form 1026 and ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 1026 2012

Create this form in 5 minutes!

How to create an eSignature for the irs form 1026 2012

The best way to generate an eSignature for your PDF file in the online mode

The best way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is Irs Form 1026 and why is it important?

Irs Form 1026 is a crucial document used for various tax purposes, including reporting certain types of income and deductions. Understanding this form helps businesses and individuals comply with tax regulations and avoid potential penalties. Utilizing airSlate SignNow streamlines the process of sending and eSigning Irs Form 1026, ensuring you stay organized and compliant.

-

How does airSlate SignNow assist with filing Irs Form 1026?

AirSlate SignNow simplifies the process of filing Irs Form 1026 by allowing users to easily prepare, send, and eSign the document electronically. Our platform ensures that all signatures are legally binding and that the submission is tracked for your convenience. This digital approach enhances both efficiency and accuracy in your tax reporting.

-

What are the pricing options for airSlate SignNow related to Irs Form 1026?

AirSlate SignNow offers competitive pricing plans tailored for businesses of all sizes, making it cost-effective for handling Irs Form 1026 and other documents. Our plans provide various features, including unlimited eSigning and access to templates, to help ease your workflow. You can choose the plan that best suits your needs and budget.

-

Are there any integrations available for managing Irs Form 1026?

Yes, airSlate SignNow integrates seamlessly with various platforms such as Google Drive, Dropbox, and CRM systems, enhancing your ability to manage Irs Form 1026 and other documents. These integrations enable you to streamline your workflow and ensure all relevant data is centralized. This allows for efficient document management across different tools.

-

What features does airSlate SignNow offer for eSigning Irs Form 1026?

AirSlate SignNow provides a variety of features for eSigning Irs Form 1026, including customizable templates, bulk sending, and advanced security protocols. These features ensure that your documents are signed quickly and safely, giving you peace of mind about compliance. The user-friendly interface makes it easy to manage all aspects of the signing process.

-

Can airSlate SignNow help with the rejection of Irs Form 1026?

If your Irs Form 1026 is rejected, airSlate SignNow can assist you in quickly updating and resending the document. Our platform allows for easy modifications and re-eSigning, ensuring you can promptly address any issues with the form. This saves you time and helps you maintain compliance with IRS requirements.

-

What are the main benefits of using airSlate SignNow for Irs Form 1026?

Using airSlate SignNow for Irs Form 1026 offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced document security. With our eSigning capabilities, you can complete your tax documentation from anywhere, eliminating the need for physical paperwork. Our platform also helps keep your documents organized and easily accessible.

Get more for Irs Form 1026

- Idbi bank signature verification form

- Permission latter for enter the boarder form

- Baycare home draw request form

- Duffys myrtledale promissory note form

- Components of a wave exit ticket quiz form

- Ending a child support assessment form cs1671

- Bfmcb neurosurgery referral bformb flinders medical centre flinders sa gov

- Complete your policy details form

Find out other Irs Form 1026

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed