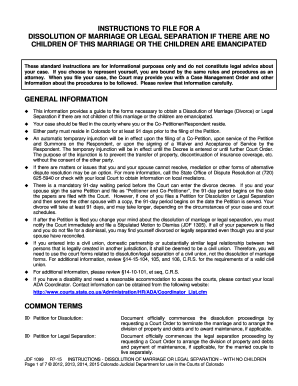

Jdf 1099 Form

What is the JDF 1099?

The JDF 1099 is a specific tax form used in Colorado for reporting various types of income. This form is essential for individuals and businesses that have paid or received certain payments throughout the tax year. The JDF 1099 serves as a record for the Internal Revenue Service (IRS) and helps ensure that all income is accurately reported for tax purposes. It is important to understand the different types of JDF 1099 forms available, as they cater to various income situations, including freelance work, rental income, and other non-employee compensation.

How to Obtain the JDF 1099

Obtaining the JDF 1099 form is straightforward. Individuals or businesses can access the form through the Colorado Department of Revenue website or other official state resources. It is also possible to request a physical copy from the relevant tax authority if needed. For convenience, many tax software programs include the JDF 1099 form, allowing users to fill it out digitally. Ensure that you have the latest version of the form to comply with current regulations.

Steps to Complete the JDF 1099

Completing the JDF 1099 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including the payer's and payee's details, the amount paid, and the nature of the income. Follow these steps:

- Download the JDF 1099 form from a reliable source.

- Fill in the payer's information, including name, address, and taxpayer identification number (TIN).

- Enter the payee's details, ensuring accuracy in names and TINs.

- Specify the amount paid in the appropriate box based on the type of income.

- Review all entries for accuracy before submission.

Legal Use of the JDF 1099

The JDF 1099 is legally recognized as a valid document for reporting income to the IRS. To ensure its legal standing, it must be filled out correctly and submitted by the required deadlines. Compliance with federal and state regulations is crucial. Using a reliable eSignature platform can enhance the legality of the document by providing a secure way to sign and store it electronically. This ensures that the form meets the standards set by the ESIGN Act and other relevant laws.

Filing Deadlines / Important Dates

Filing deadlines for the JDF 1099 are critical for compliance. Generally, the form must be submitted to the IRS by January thirty-first of the year following the tax year in which payments were made. If filing electronically, the deadline may extend to March thirty-first. It is essential to be aware of these dates to avoid penalties and ensure timely processing of the form.

Penalties for Non-Compliance

Failing to file the JDF 1099 on time or submitting incorrect information can lead to significant penalties. The IRS imposes fines based on how late the form is filed, with higher penalties for larger delays. Additionally, incorrect information may trigger audits or further scrutiny from tax authorities. It is advisable to double-check all entries and adhere to filing deadlines to minimize the risk of penalties.

Quick guide on how to complete jdf 1099

Effortlessly Prepare Jdf 1099 on Any Device

The management of documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it on the internet. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without delays. Handle Jdf 1099 on any device using the airSlate SignNow applications for Android or iOS and simplify any document-driven process today.

How to Modify and eSign Jdf 1099 with Ease

- Locate Jdf 1099 and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or conceal sensitive details using tools specifically offered by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and press the Done button to save your revisions.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form retrieval, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Jdf 1099 and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the jdf 1099

The best way to create an eSignature for your PDF document in the online mode

The best way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

The best way to make an eSignature for a PDF file on Android devices

People also ask

-

What is a JDF 1099 form and how can airSlate SignNow help?

The JDF 1099 form is an important tax document used to report income received by non-employees. With airSlate SignNow, you can quickly create, send, and eSign JDF 1099 forms securely, ensuring compliance and efficiency in your tax reporting process.

-

How much does it cost to use airSlate SignNow for JDF 1099 forms?

airSlate SignNow offers competitive pricing plans that cater to various business needs. Depending on your volume of JDF 1099 forms and additional features required, you can select a plan that fits your budget while maximizing the benefits of eSigning.

-

What features does airSlate SignNow provide for managing JDF 1099 forms?

airSlate SignNow provides numerous features for handling JDF 1099 forms, including customizable templates, bulk sending, and automated reminders for signers. These features streamline your workflow and ensure that your forms are completed accurately and timely.

-

Is airSlate SignNow secure for sending sensitive JDF 1099 forms?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance with industry regulations. This ensures that your JDF 1099 forms are transmitted securely and protects sensitive information from unauthorized access.

-

Can I integrate airSlate SignNow with other tools for managing JDF 1099 forms?

Absolutely! airSlate SignNow offers seamless integration with various applications like CRM systems and accounting software. This allows you to efficiently manage the workflow of your JDF 1099 forms alongside the other tools you already use.

-

How does airSlate SignNow enhance collaboration for JDF 1099 forms?

With airSlate SignNow, collaboration on JDF 1099 forms is simplified through real-time status updates and notifications. Team members can easily track who has signed, ensuring that your documents are completed without unnecessary delays.

-

What makes airSlate SignNow a cost-effective solution for JDF 1099 forms?

airSlate SignNow eliminates the need for paper, printing, and postage, making it a cost-effective solution for processing JDF 1099 forms. The user-friendly interface and automation features reduce the time spent on manual tasks, translating to additional savings for your business.

Get more for Jdf 1099

- Consumer credit report alert identity verification certification 01192010 doc form

- Marriage license sd form

- Food acceptance form

- Para propsitos informativos solamente no utilice

- Maryland form 502v use of vehicle for charitable purposes

- Clinical affiliation agreement template form

- Cliff vesting agreement template form

- Clinical laboratory service agreement template form

Find out other Jdf 1099

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form