Form 886 H DEP SP Rev 5 Irs 2019

What is the Form 886 H DEP SP Rev 5 Irs

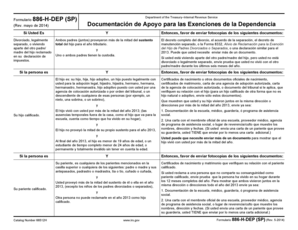

The Form 886 H DEP SP Rev 5 is a specific document used by the Internal Revenue Service (IRS) to determine eligibility for certain tax benefits related to dependents. This form is particularly relevant for taxpayers who need to provide information about their dependents, including their relationship to the taxpayer and other relevant details. It serves as a supporting document to establish claims for tax credits or deductions associated with dependents, ensuring compliance with IRS regulations.

How to use the Form 886 H DEP SP Rev 5 Irs

Using the Form 886 H DEP SP Rev 5 involves a few straightforward steps. First, gather all necessary information about your dependents, such as their names, Social Security numbers, and relationship to you. Next, accurately fill out the form, ensuring that all information is correct to avoid delays or issues with the IRS. Once completed, the form should be submitted along with your tax return or as instructed by the IRS. It is essential to keep a copy of the form for your records.

Steps to complete the Form 886 H DEP SP Rev 5 Irs

Completing the Form 886 H DEP SP Rev 5 requires careful attention to detail. Follow these steps:

- Gather necessary information about your dependents, including their full names and Social Security numbers.

- Ensure you have the correct version of the form, as updates may occur.

- Fill out the form clearly, providing accurate information in each section.

- Review the completed form for any errors or omissions.

- Submit the form along with your tax return or as directed by the IRS.

Legal use of the Form 886 H DEP SP Rev 5 Irs

The legal use of the Form 886 H DEP SP Rev 5 is crucial for taxpayers claiming dependent-related tax benefits. The form must be filled out truthfully and accurately, as any discrepancies can lead to penalties or denial of claims. It is essential to understand that submitting this form constitutes an assertion of eligibility for tax benefits, which the IRS may verify. Therefore, maintaining proper documentation and compliance with IRS guidelines is vital.

Filing Deadlines / Important Dates

Filing deadlines for the Form 886 H DEP SP Rev 5 align with the overall tax return deadlines set by the IRS. Typically, individual tax returns are due on April 15 of each year, unless that date falls on a weekend or holiday, in which case the deadline may extend to the next business day. It is important to be aware of these dates to ensure timely submission and avoid potential penalties.

Required Documents

When completing the Form 886 H DEP SP Rev 5, certain documents may be required to support your claims. These can include:

- Social Security cards for each dependent.

- Proof of relationship, such as birth certificates or adoption papers.

- Any prior year tax returns if applicable.

Having these documents ready can streamline the process and help ensure that your claims are substantiated.

Quick guide on how to complete form 886 h dep sp rev 5 2014 irs

Complete Form 886 H DEP SP Rev 5 Irs effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers a perfect eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without interruptions. Manage Form 886 H DEP SP Rev 5 Irs on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Form 886 H DEP SP Rev 5 Irs without hassle

- Obtain Form 886 H DEP SP Rev 5 Irs and then click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or blackout private information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your edits.

- Select how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Edit and eSign Form 886 H DEP SP Rev 5 Irs and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 886 h dep sp rev 5 2014 irs

The best way to create an electronic signature for your PDF file online

The best way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

The way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is Form 886 H DEP SP Rev 5 Irs?

Form 886 H DEP SP Rev 5 Irs is a tax document used primarily to support dependency claims for tax purposes. It provides essential information to the IRS regarding dependents you may be claiming on your tax return. Completing and submitting this form accurately can help ensure you receive the appropriate tax benefits.

-

How can airSlate SignNow help me with Form 886 H DEP SP Rev 5 Irs?

airSlate SignNow allows users to easily create, send, and eSign Form 886 H DEP SP Rev 5 Irs electronically, streamlining the process. With our platform, you can ensure that all necessary information is included and that the form is sent securely to the relevant parties. This enhances efficiency and mitigates errors in your submissions.

-

What features does airSlate SignNow offer for eSigning documents like Form 886 H DEP SP Rev 5 Irs?

airSlate SignNow offers a variety of features for eSigning documents, including template creation, bulk sending, and real-time tracking of signatures. Users can also customize the signing experience with fields for names, dates, and other necessary entries. These features simplify the eSigning process for Form 886 H DEP SP Rev 5 Irs and ensure compliance with regulations.

-

Is airSlate SignNow suitable for businesses of all sizes for handling Form 886 H DEP SP Rev 5 Irs?

Yes, airSlate SignNow is designed to accommodate businesses of all sizes. Whether you're a small startup or a large enterprise, our solution provides an effective way to manage documents like Form 886 H DEP SP Rev 5 Irs. Our pricing plans are flexible, allowing you to choose a plan that best fits your needs.

-

What is the pricing structure for using airSlate SignNow for documents like Form 886 H DEP SP Rev 5 Irs?

airSlate SignNow offers competitive pricing options based on the features you need. Our plans are cost-effective and include everything required to send and eSign documents, including Form 886 H DEP SP Rev 5 Irs. Additionally, you can try our services through a free trial to see how it meets your requirements.

-

Can I integrate airSlate SignNow with other applications when handling Form 886 H DEP SP Rev 5 Irs?

Absolutely! airSlate SignNow supports integration with various applications that can streamline your workflow for managing Form 886 H DEP SP Rev 5 Irs. This includes popular tools for project management, CRM systems, and cloud storage, allowing you to centralize your document handling efficiently.

-

Are there security measures in place when using airSlate SignNow for Form 886 H DEP SP Rev 5 Irs?

Yes, airSlate SignNow prioritizes your security. We implement advanced encryption and security protocols to protect sensitive information in documents like Form 886 H DEP SP Rev 5 Irs. Our platform is compliant with industry standards, ensuring your documents are handled securely at all times.

Get more for Form 886 H DEP SP Rev 5 Irs

- Health insurance claim form the maritime financial group

- Order of descendants of pirates and privateers form

- Pdf covid 19 vaccine screening and consent form florida

- Income tax refund verip form

- Mediclaim insurance policy claim form paramount health

- Icfp form owners certificate 1 xls

- Townsend fire company craft show form

- Osha forms printable forklift

Find out other Form 886 H DEP SP Rev 5 Irs

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple