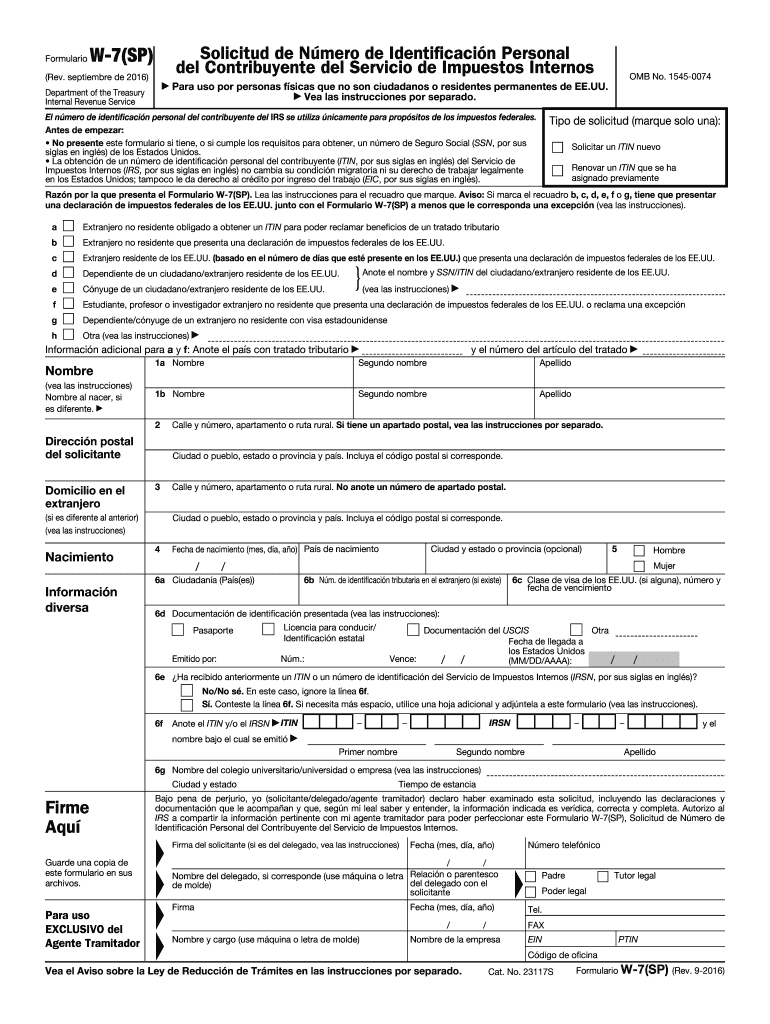

Irs Form

What is the IRS?

The Internal Revenue Service (IRS) is the federal agency responsible for administering and enforcing the United States tax laws. Established in 1862, the IRS plays a crucial role in collecting taxes, processing tax returns, and issuing refunds to taxpayers. It also oversees various tax-related programs and ensures compliance with federal tax regulations.

How to Use the IRS

Utilizing the IRS effectively involves understanding its various functions and services. Taxpayers can access their tax information, file returns, and make payments through the IRS website. The agency provides resources for individuals and businesses, including tax forms, instructions, and guidelines for compliance. Additionally, taxpayers can seek assistance through IRS customer service for questions regarding their tax situations.

Steps to Complete the IRS Form

Completing an IRS form typically involves several key steps:

- Gather necessary documents, such as W-2s, 1099s, and other income statements.

- Choose the appropriate IRS form based on your filing status and income type.

- Fill out the form accurately, ensuring all required fields are completed.

- Review your entries for accuracy and completeness before submission.

- Submit the form electronically or by mail, following the specific instructions provided for your chosen form.

Legal Use of the IRS Form

IRS forms must be completed and submitted in accordance with federal tax laws to be considered legally binding. This includes providing accurate information and adhering to deadlines. Failure to comply with IRS regulations can result in penalties, including fines and interest on unpaid taxes. It is essential to understand the legal implications of the information provided on IRS forms.

Filing Deadlines / Important Dates

Filing deadlines for IRS forms vary depending on the type of form and the taxpayer's situation. Generally, individual tax returns are due on April 15 each year. However, if that date falls on a weekend or holiday, the deadline may be extended. Businesses may have different deadlines based on their structure and fiscal year. Staying informed about these dates is crucial to avoid penalties.

Required Documents

When preparing to file an IRS form, certain documents are typically required. These may include:

- Proof of income, such as W-2 forms or 1099 forms.

- Documentation for deductions and credits, including receipts and statements.

- Previous year’s tax return for reference.

- Identification information, such as Social Security numbers for all dependents.

Penalties for Non-Compliance

Non-compliance with IRS regulations can lead to various penalties. These may include late filing fees, interest on unpaid taxes, and additional fines for inaccuracies or fraudulent claims. Understanding the consequences of non-compliance emphasizes the importance of timely and accurate submissions to the IRS.

Quick guide on how to complete irs 100670627

Complete Irs effortlessly on any device

Digital document handling has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow offers you all the necessary tools to create, edit, and eSign your documents promptly without delays. Manage Irs on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Irs seamlessly

- Obtain Irs and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your delivery method for the form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Disregard concerns about missing or lost files, cumbersome form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign Irs to ensure outstanding communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs 100670627

The best way to create an eSignature for a PDF document online

The best way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is airSlate SignNow and how can it help with IRS documents?

airSlate SignNow is a user-friendly platform that allows businesses to send and eSign documents efficiently. It is particularly useful for managing IRS forms and filings, ensuring compliance and reducing paper trails. With its intuitive interface, you can streamline your document workflows, making it easier to handle IRS-related tasks.

-

How does airSlate SignNow ensure compliance with IRS regulations?

Compliance with IRS regulations is crucial for any business. airSlate SignNow provides advanced security features, including encryption and secure access controls, to ensure that your IRS documents are handled safely. Additionally, the platform keeps a detailed audit trail, giving you peace of mind when dealing with IRS-related paperwork.

-

What pricing plans does airSlate SignNow offer for IRS document management?

airSlate SignNow offers flexible pricing plans tailored to your needs, making it accessible for businesses of all sizes. Each plan includes features designed to streamline IRS document management, with options for monthly or annual billing. You can choose the plan that best fits your volume of IRS transactions and document needs.

-

Can I integrate airSlate SignNow with other tools for IRS management?

Yes, airSlate SignNow seamlessly integrates with various tools and applications to enhance your IRS document management experience. You can connect it with popular software like CRM systems and accounting tools, allowing for a smoother workflow when managing IRS forms. This integration capability ensures that all your business processes remain efficient and organized.

-

What features does airSlate SignNow provide for handling IRS forms?

airSlate SignNow offers a range of features specifically designed to assist with IRS forms, including customizable templates and automated workflows. You can easily create, send, and sign IRS documents while reducing turnaround times across your team. These features help to enhance the overall efficiency of your IRS form handling.

-

Is airSlate SignNow suitable for small businesses dealing with IRS documents?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses dealing with IRS documents. The platform's cost-effective solutions and ease of use make it ideal for small enterprises looking to simplify their IRS-related tasks. You can easily manage your documents without needing extensive resources or training.

-

How can airSlate SignNow improve my team's efficiency in handling IRS paperwork?

airSlate SignNow enhances team efficiency through features like electronic signatures and real-time collaboration. Teams can work together on IRS documents without the delays associated with physical paperwork. This streamlining helps reduce errors and ensures faster processing of IRS forms, improving overall productivity.

Get more for Irs

Find out other Irs

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors