Rnmfoc39 Form 2017-2026

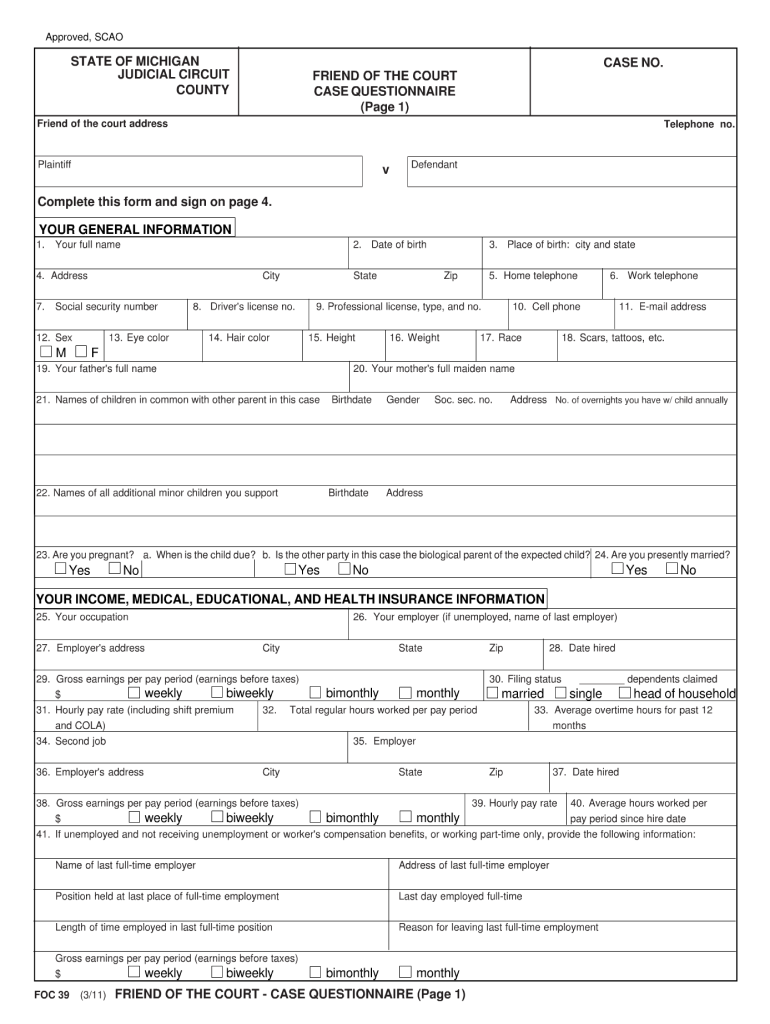

What is the Rnmfoc39 Form

The Rnmfoc39 form is a crucial document used in the context of annuities, specifically for reporting payments made by an annuities payer on a bimonthly basis. This form serves to provide detailed information regarding the distribution of annuity payments, ensuring that all parties involved have a clear understanding of the financial transactions. It is essential for both the payer and the recipient to accurately complete this form to maintain compliance with tax regulations and to facilitate proper record-keeping.

How to use the Rnmfoc39 Form

Using the Rnmfoc39 form involves several steps to ensure accurate reporting of bimonthly annuity payments. First, gather all necessary information, including the payer's details, recipient's information, and the specifics of the annuity payments. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once filled, the form must be submitted to the appropriate tax authority or financial institution as required. It is advisable to keep a copy of the completed form for personal records.

Steps to complete the Rnmfoc39 Form

Completing the Rnmfoc39 form involves a systematic approach:

- Begin by entering the payer's name and address in the designated fields.

- Provide the recipient's name and contact information accurately.

- Detail the amount of each bimonthly payment, including the total for the reporting period.

- Include any relevant identification numbers, such as Social Security numbers or tax identification numbers.

- Review the form for accuracy before submission, ensuring all required fields are filled.

Legal use of the Rnmfoc39 Form

The Rnmfoc39 form is legally binding when completed correctly and submitted in accordance with applicable laws. It is important to adhere to IRS regulations regarding the reporting of annuity payments to avoid potential penalties. Proper use of this form not only ensures compliance but also protects the rights of both the payer and the recipient. In legal contexts, this form can serve as evidence of payment and may be required in disputes or audits.

Key elements of the Rnmfoc39 Form

Key elements of the Rnmfoc39 form include:

- Payer's name and address

- Recipient's name and contact information

- Payment amounts and frequency

- Tax identification numbers for both parties

- Date of each payment

These elements are vital for ensuring that the form is complete and can be processed without issues.

Form Submission Methods (Online / Mail / In-Person)

The Rnmfoc39 form can be submitted through various methods, depending on the requirements of the payer or the financial institution involved. Common submission methods include:

- Online submission through a secure portal provided by the financial institution.

- Mailing the completed form to the appropriate address specified by the payer.

- In-person submission at designated locations, if applicable.

Choosing the right submission method is important for ensuring timely processing and compliance with reporting deadlines.

Quick guide on how to complete rnmfoc39 2011 form

Effortlessly Prepare Rnmfoc39 Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed papers, enabling you to access the correct format and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Handle Rnmfoc39 Form on any platform using airSlate SignNow apps for Android or iOS and enhance your document-related processes today.

The Most Efficient Method to Alter and Electronically Sign Rnmfoc39 Form with Ease

- Obtain Rnmfoc39 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Rnmfoc39 Form while ensuring exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rnmfoc39 2011 form

Create this form in 5 minutes!

How to create an eSignature for the rnmfoc39 2011 form

The best way to create an eSignature for a PDF file in the online mode

The best way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What are annuities payer bimonthly and how do they work?

Annuities payer bimonthly refers to a payment schedule where annuity payments are made every two months. This approach allows individuals to receive their earnings more frequently compared to traditional monthly payments. Understanding this structure can help in managing cash flow more effectively, particularly for those relying on these payments for regular expenses.

-

What are the benefits of opting for annuities payer bimonthly?

Choosing annuities payer bimonthly can provide a smoother cash flow as it allows for more regular access to funds. This payment frequency can be particularly advantageous for budgeting, enabling better financial planning. Additionally, receiving funds sooner can help in addressing immediate financial needs without waiting for a full month.

-

How can I calculate my payments for annuities payer bimonthly?

To calculate payments for annuities payer bimonthly, you'll need to determine the total amount of your annuity and the interest rate offered. Divide your total annuity amount by the number of payment periods, which in this case would be six for a year. This will give you the amount received every two months.

-

Are there any fees associated with setting up annuities payer bimonthly?

Setting up annuities payer bimonthly may involve administrative or transaction fees, depending on your provider. It's essential to review the terms and conditions of your annuity contract, as these fees can vary signNowly. Transparency in costs will ensure that you are aware of any deductions from your payments.

-

What types of investments usually support annuities payer bimonthly?

Many financial institutions offer annuities that can be structured to pay out bimonthly. Common investments that support this include fixed annuities, variable annuities, and indexed annuities. Each type has its own set of risks and benefits, so understanding them can help you choose the right option for your financial needs.

-

Can I change my payment frequency from monthly to annuities payer bimonthly?

In most cases, you can request a change to your payment frequency, including switching from monthly to annuities payer bimonthly. However, this change may depend on the terms set by your annuity provider. It is crucial to contact your provider directly to discuss your options and any potential implications.

-

What factors should I consider before choosing annuities payer bimonthly?

Before choosing annuities payer bimonthly, consider your financial goals, cash flow needs, and any associated fees. Additionally, assess your provider’s reputation and the overall terms of the annuity contract. Consulting with a financial advisor can also help to ensure that this payment schedule aligns with your financial strategy.

Get more for Rnmfoc39 Form

- Emergency contact form save the children savethechildren

- Lefs follow up and discharge visit body mechanix physical therapy form

- Hamipatra in marathi format pdf

- Intel letterhead form

- Utah tc 40 individual income tax return form

- Warning any misrepresentation made in the personal data sheet and the work experience sheet shall cause the filing of form

- International data transfer agreement template form

- Offer and acceptance contract template form

Find out other Rnmfoc39 Form

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online