Mgh W2 Form

What is the MGH W-2?

The MGH W-2 is a tax form used by employees of Massachusetts General Hospital (MGH) to report their annual wages and the taxes withheld from their paychecks. This form is essential for employees to accurately file their federal and state income tax returns. The MGH W-2 includes important information such as the employee's total earnings, Social Security wages, Medicare wages, and the amounts withheld for federal and state taxes. Understanding the details on this form is crucial for ensuring compliance with tax regulations.

How to Obtain the MGH W-2

Employees can obtain their MGH W-2 through the MGH PeopleSoft portal. To access the form, employees must log in using their credentials. Once logged in, they can navigate to the payroll section to view and download their W-2 forms. For those who may have difficulty accessing the portal, MGH provides support through their payroll department, which can assist in retrieving the necessary documents. It is important to ensure that personal information is up to date in the system to avoid any issues with receiving the form.

Steps to Complete the MGH W-2

Completing the MGH W-2 involves several key steps. First, employees should verify that all personal information, such as name and Social Security number, is accurate on the form. Next, they should review the earnings and tax withholdings to ensure they match their pay stubs. If discrepancies are found, employees should contact the payroll department for corrections. Once verified, the MGH W-2 can be used to fill out federal and state tax returns, ensuring that all reported income and withholdings are correctly reflected.

Legal Use of the MGH W-2

The MGH W-2 is legally binding and must be used in accordance with IRS guidelines. Employees are required to report the information from this form when filing their taxes. The accuracy of the W-2 is crucial, as any errors can lead to complications with tax filings, including potential audits or penalties. It is important for employees to retain copies of their W-2 forms for their records, as they may be needed for future reference or in case of discrepancies with the IRS.

Filing Deadlines / Important Dates

Employees should be aware of the filing deadlines associated with the MGH W-2. Typically, employers must provide W-2 forms to employees by January 31 of each year. Employees must use the information on their W-2 to file their federal and state tax returns by April 15. Being aware of these deadlines helps ensure that employees avoid late fees and penalties associated with late tax filings.

Who Issues the Form

The MGH W-2 is issued by the payroll department of Massachusetts General Hospital. This department is responsible for calculating employee wages, withholding taxes, and ensuring that W-2 forms are generated accurately and distributed in a timely manner. Employees can reach out to the payroll department for any questions or concerns regarding their W-2 forms or payroll-related issues.

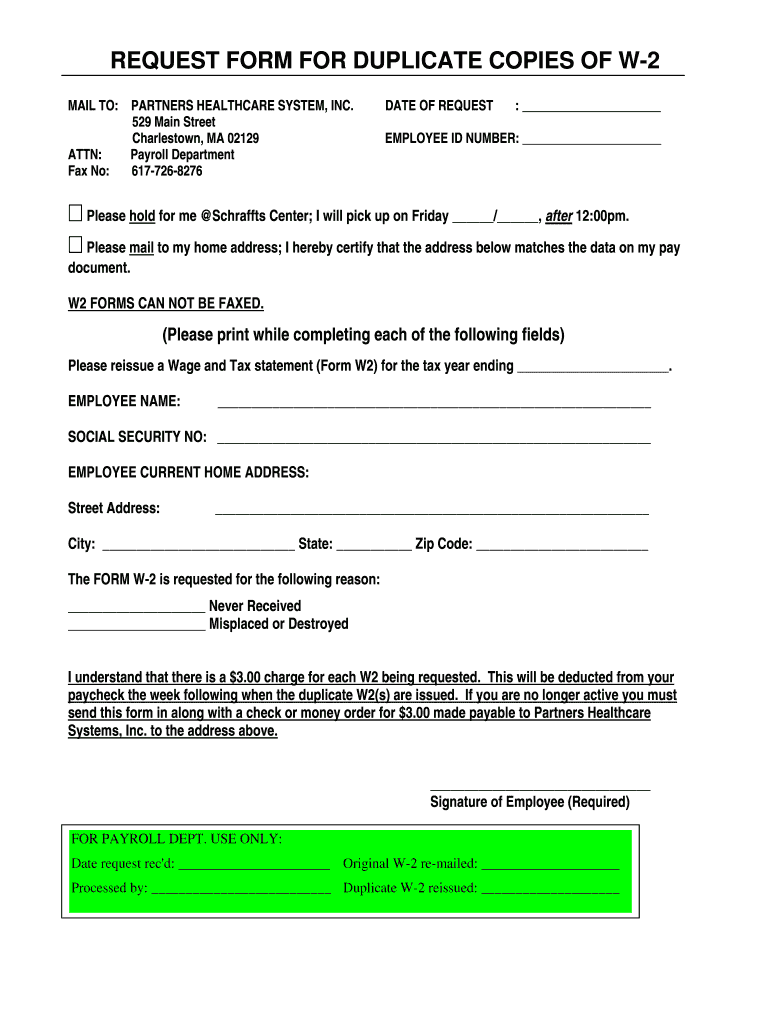

Quick guide on how to complete w 2 mgh form

Discover how to effortlessly complete the Mgh W2 process with this easy guide

Filing electronically and signNowing documents online is becoming more popular and is the preferred choice for various clients. It offers many advantages over conventional printed documents, such as convenience, time savings, enhanced accuracy, and security.

With resources like airSlate SignNow, you can find, edit, sign, and enhance your Mgh W2 without being hindered by endless printing and scanning. Follow this brief guide to begin and finalize your form.

Adhere to these steps to obtain and complete Mgh W2

- Begin by clicking the Get Form button to access your document in our editor.

- Observe the green indicator on the left that highlights required fields so you won’t miss them.

- Utilize our professional tools to annotate, edit, sign, secure, and enhance your document.

- Protect your file or convert it into an interactive form using the appropriate tab tools.

- Review the document and check for any errors or inconsistencies.

- Click on DONE to complete editing.

- Rename your document or keep it as is.

- Select the storage option where you want to save your document, send it via USPS, or click the Download Now button to retrieve your document.

If Mgh W2 isn’t what you were searching for, you can explore our vast collection of pre-imported templates that can be completed with ease. Visit our platform now!

Create this form in 5 minutes or less

FAQs

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How do you fill out a W-2 form?

In general, the W-2 form is divided into two parts each with numerous fields to be completed carefully by an employer. The section on the left contains both the employer's and employee`s names and contact information as well social security number and identification number.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

-

How do I fill out an NDA 2 application form?

visit Welcome to UPSC | UPSCclick on apply online option their and select the ndaII option.Its in 2 parts, Fill part 1 and theirafter 2nd as guided on the website their.

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

-

If I have to fill out Form WH-4852, should I also send in my original W-2 and file it?

The purpose of Form 4852 is to substitute for the original W-2 if for some reason you didn't receive one and couldn't get one from an employer. If you have the original W-2, you don't file Form 4852.

-

How do I fill out a W-4 form?

The main thing you need to put on your W-4 besides your name, address and social security number is whether you are married or single and the number of exemptions you wish to take to lower the amount of money with held for taxes from your paycheck. The number of exemptions refers to how many people you support, i. e. children. Say you are single and have 3 children, you can put down 4 exemptions, 1 for your self and 1 for each child. This means you will have more pay to take home because you aren’t having it with held from your paycheck. If you are single and have no children, you can either take 1 or 0 exemptions. If you make decent money, take 0 deductions, if you are barely making it you could probably take 1 exemption. Just realize that if you take exemptions, and not enough money is taken out of your check to pay your taxes, you will be liable for it come April 15th.If you are married and have no children and you make decent money, take 0 deductions. If you have children, only one spouse should take them as exemptions and it should be the one who makes the most money. For example, say your spouse is the major bread winner and you have 2 children, your spouse could take 4 exemptions (one for each member of the family) and then you would take 0 exemptions.Usually, it’s best to err on the side of caution and take the smaller amount of deductions so that you won’t owe a lot of money come tax time. If you’ve had too much with held it will come back to you as a refund.

Create this form in 5 minutes!

How to create an eSignature for the w 2 mgh form

How to make an eSignature for the W 2 Mgh Form in the online mode

How to make an eSignature for your W 2 Mgh Form in Google Chrome

How to make an electronic signature for putting it on the W 2 Mgh Form in Gmail

How to make an eSignature for the W 2 Mgh Form from your mobile device

How to make an electronic signature for the W 2 Mgh Form on iOS devices

How to generate an eSignature for the W 2 Mgh Form on Android devices

People also ask

-

What is an Mgh W2 and how does it relate to airSlate SignNow?

An Mgh W2 is a tax form that reports an employee's annual wages and the amount of taxes withheld. With airSlate SignNow, you can easily create, send, and eSign your Mgh W2 forms securely, ensuring compliance and efficiency in your payroll processes.

-

How can airSlate SignNow streamline the process of handling Mgh W2 forms?

airSlate SignNow streamlines the handling of Mgh W2 forms by providing a user-friendly platform for electronic signatures and document management. This eliminates the need for physical paperwork, reduces processing time, and enhances the accuracy of your tax documents.

-

Is there a pricing plan for businesses using airSlate SignNow for Mgh W2 forms?

Yes, airSlate SignNow offers flexible pricing plans tailored for businesses of all sizes looking to manage Mgh W2 forms effectively. The plans include features like unlimited eSigning, document templates, and integrations, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing Mgh W2 forms?

airSlate SignNow includes several features for managing Mgh W2 forms, such as customizable templates, secure eSigning, and automated workflows. These features help simplify the process of sending and receiving tax documents, making it easier for you to stay organized.

-

Can I integrate airSlate SignNow with other software for Mgh W2 management?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage Mgh W2 forms efficiently. Whether you use accounting software or HR platforms, you can easily connect to streamline your workflow.

-

What are the benefits of using airSlate SignNow for Mgh W2 forms?

Using airSlate SignNow for Mgh W2 forms provides numerous benefits, including faster turnaround times, reduced paper usage, and enhanced security. Additionally, the platform's ease of use allows employees to complete their forms quickly, boosting overall productivity.

-

Is airSlate SignNow secure for handling sensitive Mgh W2 information?

Yes, airSlate SignNow prioritizes the security of your Mgh W2 information. The platform uses advanced encryption and complies with industry standards to ensure that your sensitive data is protected during transmission and storage.

Get more for Mgh W2

Find out other Mgh W2

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast