Refund Secretary Form

What is the Refund Secretary

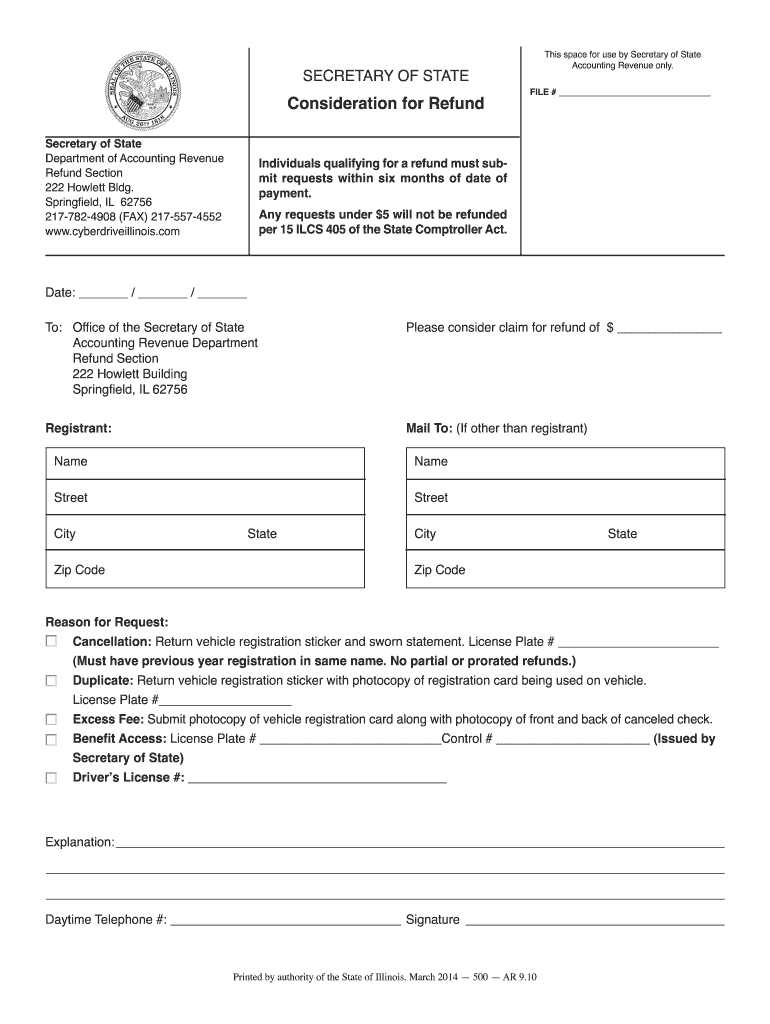

The Refund Secretary is a formal document used primarily in the context of tax and financial transactions. It serves as a means to request a refund for various payments made, ensuring that the process is documented and legally recognized. This form is essential for individuals and businesses seeking to reclaim funds due to overpayment or other qualifying reasons. The Refund Secretary includes specific details such as the taxpayer's information, the reason for the refund, and the amount being requested.

Steps to complete the Refund Secretary

Completing the Refund Secretary requires careful attention to detail to ensure accuracy and compliance with legal standards. Here are the key steps to follow:

- Gather necessary information, including personal identification details and financial records related to the payment.

- Fill out the Refund Secretary form, ensuring all sections are completed, including the reason for the refund.

- Double-check the accuracy of the information provided to avoid delays or rejections.

- Sign and date the form, as required, to validate the request.

- Submit the completed form through the appropriate channels, whether online, by mail, or in person.

Legal use of the Refund Secretary

The Refund Secretary must adhere to specific legal requirements to be considered valid. It is crucial to ensure that the form is filled out correctly and submitted within the designated timeframes. Compliance with state and federal regulations is necessary to avoid complications. The form must be signed by the appropriate parties to confirm authenticity, and it should be stored securely for future reference.

State-specific rules for the Refund Secretary

Each state may have its own regulations regarding the Refund Secretary, affecting how the form is completed and submitted. It is important to be aware of these state-specific rules to ensure compliance. For instance, some states may require additional documentation or have different deadlines for submission. Checking with the relevant state tax authority can provide clarity on these requirements.

Required Documents

When submitting the Refund Secretary, certain documents may be required to support the refund request. Commonly needed documents include:

- Proof of payment, such as receipts or bank statements.

- Identification documents, like a driver's license or Social Security number.

- Any correspondence related to the initial payment or refund request.

Ensuring all required documents are included can facilitate a smoother processing of the refund request.

Form Submission Methods (Online / Mail / In-Person)

The Refund Secretary can typically be submitted through various methods, depending on the jurisdiction and specific requirements. Common submission methods include:

- Online submission through the official state tax website or designated portal.

- Mailing the completed form to the appropriate tax authority.

- In-person submission at local tax offices or designated locations.

Choosing the right submission method can impact the speed and efficiency of processing the refund.

Quick guide on how to complete refund secretary

Complete Refund Secretary effortlessly on any gadget

Online document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to create, alter, and eSign your documents promptly without delays. Handle Refund Secretary on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Refund Secretary effortlessly

- Locate Refund Secretary and click Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes only a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching for forms, or the need to reprint new document copies due to mistakes. airSlate SignNow addresses all your document management requirements in just a few clicks from the device of your choice. Revise and eSign Refund Secretary and ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the refund secretary

How to make an electronic signature for a PDF file in the online mode

How to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is the consideration refund policy at airSlate SignNow?

The consideration refund policy at airSlate SignNow allows customers to request a refund within a specified period if they are not satisfied with the service. This policy ensures that you can try our eSigning solutions risk-free, as we prioritize customer satisfaction. Please check our terms for specific details regarding eligibility and the refund process.

-

How does the consideration refund affect my subscription to airSlate SignNow?

If you qualify for a consideration refund, it will alter your subscription status to reflect the cancellation of your account. Your access to all airSlate SignNow features will cease after the refund process is completed. We encourage users to thoroughly explore the platform before making a long-term commitment.

-

Are there any fees associated with the consideration refund at airSlate SignNow?

There are no hidden fees when you request a consideration refund at airSlate SignNow, as long as you follow the stipulated guidelines in our refund policy. We believe in transparency and want to ensure you are aware of the terms before you initiate a refund. Always review the conditions to understand how fees might apply.

-

What features can I access while considering a refund from airSlate SignNow?

While you assess your options, all features of airSlate SignNow remain fully accessible, allowing you to utilize our eSigning capabilities seamlessly. This full access allows you to thoroughly evaluate the platform’s effectiveness and decide if it meets your business needs. We advocate for informed decisions to enhance your experience with us.

-

How long does the consideration refund process take?

The consideration refund process typically takes a few business days from the time we receive your request at airSlate SignNow. Our team works diligently to process refunds quickly and efficiently. We recommend checking your email for updates or contacting our support team for expedited assistance.

-

Can I integrate other tools with airSlate SignNow during the consideration refund period?

Yes, you can integrate various tools and applications with airSlate SignNow while evaluating the service for a consideration refund. Our platform supports numerous integrations, enhancing your document workflow and eSigning experience. Feel free to leverage these integrations to determine how well airSlate SignNow fits your needs.

-

What benefits does airSlate SignNow offer that may influence my consideration refund?

AirSlate SignNow offers numerous benefits, including an intuitive user interface, robust eSigning features, and the ability to automate document workflows. Understanding these advantages can signNowly inform your decision-making process, potentially impacting your consideration refund choice. We aim to provide value that exceeds your expectations.

Get more for Refund Secretary

- Modello as1 esempio compilazione form

- Influenza consent form flu shots at flushots usu

- Form 3a safety supervisor

- Alberta driver abstract form

- Stable tally sheet oregon form

- Assurant preneed forms

- Official calpia business cards state of california form

- Rules amp regulations little falls arts amp crafts fair form

Find out other Refund Secretary

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online