Prerequisite for Osha 500 2012-2026

What is the prerequisite for OSHA 500?

The prerequisite for OSHA 500 is a requirement for individuals who wish to become authorized trainers for the OSHA Outreach Training Program. This program focuses on safety and health hazards in the workplace. To qualify for the OSHA 500 course, participants must have completed the OSHA 30-hour General Industry or Construction course. Additionally, they should have a minimum of five years of safety experience in the field, which can include roles such as safety manager, safety consultant, or safety engineer.

How to obtain the prerequisite for OSHA 500

To obtain the prerequisite for OSHA 500, individuals must first complete the OSHA 30-hour course relevant to their industry. This course can be taken online or in-person through various authorized training providers. After completing the OSHA 30-hour course, participants should gather evidence of their safety experience, such as resumes, job descriptions, or letters of recommendation from employers. This documentation may be required when enrolling in the OSHA 500 course.

Steps to complete the prerequisite for OSHA 500

Completing the prerequisite for OSHA 500 involves several key steps:

- Enroll in and complete the OSHA 30-hour General Industry or Construction course.

- Document your relevant safety experience, ensuring it meets the five-year requirement.

- Gather necessary documentation, including certificates and proof of experience.

- Register for the OSHA 500 course through an authorized provider.

Legal use of the prerequisite for OSHA 500

The legal use of the prerequisite for OSHA 500 is essential for maintaining compliance with OSHA regulations. Individuals who complete the OSHA 500 course are authorized to teach the OSHA Outreach Training Program. This authorization allows them to issue completion cards to participants, which are recognized by employers and regulatory agencies. It is important to ensure that all documentation and training materials adhere to OSHA standards to avoid potential legal issues.

Eligibility criteria for OSHA 500

Eligibility for the OSHA 500 course requires individuals to meet specific criteria. Participants must have completed the OSHA 30-hour course within the last six months. They should also possess a minimum of five years of safety experience, which can be verified through documentation. Additionally, it is recommended that candidates have a strong understanding of OSHA standards and regulations to effectively teach the material.

Examples of using the prerequisite for OSHA 500

Individuals who have completed the prerequisite for OSHA 500 can leverage their training in various ways. For instance, they may conduct safety training sessions for employees in their organization, ensuring compliance with OSHA standards. They can also offer their services as independent trainers, providing OSHA outreach training to other companies. Furthermore, these trainers can contribute to the development of safety programs and policies within their organizations, enhancing overall workplace safety.

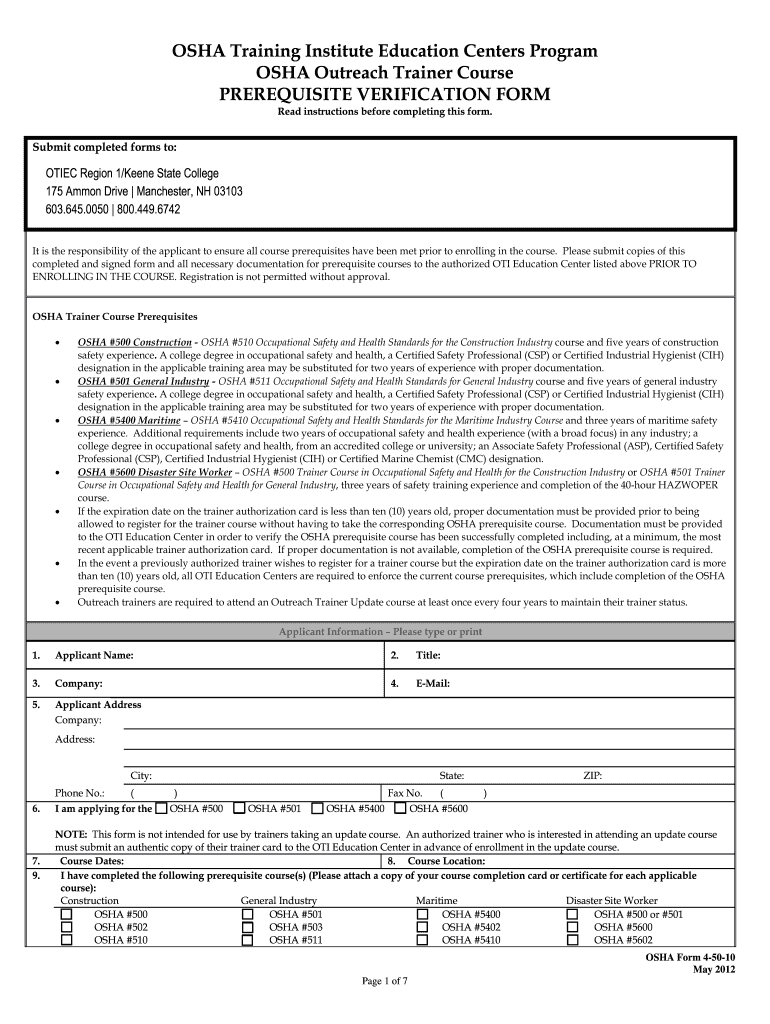

Quick guide on how to complete osha form 4 50 10

Discover how to navigate the Prerequisite For Osha 500 completion with this straightforward guide

Electronic filing and signNowing forms is becoming increasingly favored and is the preferred choice for a diverse range of clients. It provides numerous benefits over traditional printed documents, such as convenience, time savings, enhanced precision, and security.

With applications like airSlate SignNow, you can find, modify, sign, and enhance and transmit your Prerequisite For Osha 500 without getting bogged down in endless printing and scanning. Follow this brief guide to begin and complete your form.

Follow these steps to obtain and complete Prerequisite For Osha 500

- Begin by clicking the Get Form button to access your document in our editor.

- Observe the green label on the left indicating required fields so you don’t miss them.

- Utilize our advanced features to comment, revise, sign, secure, and enhance your document.

- Secure your file or convert it into a fillable form using the tools in the right panel.

- Review the document carefully for any mistakes or inconsistencies.

- Click DONE to complete your edits.

- Rename your form or keep it unchanged.

- Select the preferred storage service for saving your document, send it via USPS, or click the Download Now button to save your document.

If Prerequisite For Osha 500 isn’t what you need, feel free to explore our extensive library of pre-prepared forms that you can fill out with ease. Discover our solution today!

Create this form in 5 minutes or less

FAQs

-

How do I fill out a W-4 form?

The main thing you need to put on your W-4 besides your name, address and social security number is whether you are married or single and the number of exemptions you wish to take to lower the amount of money with held for taxes from your paycheck. The number of exemptions refers to how many people you support, i. e. children. Say you are single and have 3 children, you can put down 4 exemptions, 1 for your self and 1 for each child. This means you will have more pay to take home because you aren’t having it with held from your paycheck. If you are single and have no children, you can either take 1 or 0 exemptions. If you make decent money, take 0 deductions, if you are barely making it you could probably take 1 exemption. Just realize that if you take exemptions, and not enough money is taken out of your check to pay your taxes, you will be liable for it come April 15th.If you are married and have no children and you make decent money, take 0 deductions. If you have children, only one spouse should take them as exemptions and it should be the one who makes the most money. For example, say your spouse is the major bread winner and you have 2 children, your spouse could take 4 exemptions (one for each member of the family) and then you would take 0 exemptions.Usually, it’s best to err on the side of caution and take the smaller amount of deductions so that you won’t owe a lot of money come tax time. If you’ve had too much with held it will come back to you as a refund.

-

How do I fill up the ITR 4 form?

Guidance to File ITR 4Below are mentioned few common guidelines to consider while filing your ITR 4 form:If any schedule is not relevant/applicable to you, just strike it out and write —NA— across itIf any item/particular is not applicable/relevant to you, just write NA against itIndicate nil figures by writing “Nil” across it.Kindly, put a “-” sign prior to any negative figure.All figures shall be rounded off to the nearest one rupee except figures for total income/loss and tax payable. Those shall be rounded off to the nearest multiple of ten.If you are an Employer individual, then you must mark Government if you are a Central/State Government employee. You should tick PSU if you are working in a public sector company of the Central/State Government.Sequence to fill ITR 4 formThe easiest way to fill out your ITR-4 Form is to follow this order:Part AAll the schedulesPart BVerificationModes to file ITR 4 FormYou can submit your ITR-4 Form either online or offline. It is compulsory to file ITR in India electronically (either through Mode 3 or Mode 4) for the following assesses:Those whose earning exceeds Rs. 5 lakhs per yearThose possessing any assets outside the boundary of India (including financial interest in any entity) or signing authority in any account outside India.Those claiming relief under Section 90/90A/91 to whom Schedule FSI and Schedule TR applyOffline:By furnishing a return in a tangible l paper formBy furnishing a bar-coded returnThe Income Tax Department will issue you an acknowledgment as a form of response/reply at the time of submission of your tangible paper return.Online/Electronically:By furnishing the return electronically using digital signature certificate.By sending the data electronically and then submitting the confirmation of the return in Return Form ITR-VIf you submit your ITR-4 Form by electronic means under digital signature, the acknowledgment/response will be sent to your registered email id. You can even download it manually from the official income tax website. For this, you are first required to sign it and send it to the Income Tax Department’s CPC office in Bangalore within 120 days of e-filing.Keep in mind that ITR-4 is an annexure-less form. It means you don’t have to attach any documents when you send it.TaxRaahi is your income tax return filing online companion. Get complete assistance and tax saving tips from experts.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

What is the time period to fill out form 10?

Well its a huge mission if you’re going to use a printer forget about it :)I’ve tried all the products and a lot of them you struggle with the mouse cursor to find the space to complete. So I think people can sometimes just get annoyed and use a printer.But the best is Paperjet. Go Paperless which uses field detection and makes the form fillable online immediately.No doubt the easiest and quickest way imho.

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

Create this form in 5 minutes!

How to create an eSignature for the osha form 4 50 10

How to create an electronic signature for the Osha Form 4 50 10 in the online mode

How to make an electronic signature for your Osha Form 4 50 10 in Chrome

How to make an electronic signature for putting it on the Osha Form 4 50 10 in Gmail

How to make an eSignature for the Osha Form 4 50 10 from your smartphone

How to create an eSignature for the Osha Form 4 50 10 on iOS devices

How to make an eSignature for the Osha Form 4 50 10 on Android OS

People also ask

-

What is the prerequisite for OSHA 500 training?

The prerequisite for OSHA 500 training is that participants must have completed the OSHA 30-hour General Industry or Construction course. This foundational knowledge is essential for understanding workplace safety standards and regulations. Ensuring you meet this prerequisite for OSHA 500 will help you maximize the benefits of the training.

-

How much does the OSHA 500 training cost?

The cost of OSHA 500 training can vary depending on the provider and location. Typically, you can expect to pay between $600 to $1,200. It's important to check with your chosen training provider for specific pricing details and any available discounts related to the prerequisite for OSHA 500.

-

What are the benefits of completing OSHA 500 training?

Completing OSHA 500 training equips you with essential skills to train others in workplace safety standards. This course enhances your understanding of OSHA regulations and helps improve safety culture in your organization. Meeting the prerequisite for OSHA 500 ensures you are prepared to take on this crucial role effectively.

-

How long is OSHA 500 training?

OSHA 500 training typically spans 5 days, during which participants engage in intensive learning. This duration allows for a thorough understanding of OSHA standards, safety protocols, and effective training methods. Meeting the prerequisite for OSHA 500 is crucial, as it sets the stage for this more advanced training.

-

Are there any online options for OSHA 500 training?

Yes, many providers offer OSHA 500 training online, making it convenient for busy professionals. Online courses often allow for flexibility in scheduling and pacing, which can be beneficial for those who need to meet the prerequisite for OSHA 500 but have time constraints. Be sure to verify that the provider is accredited.

-

What topics are covered in OSHA 500 training?

OSHA 500 training covers a range of topics including OSHA regulations, hazard recognition, and safety program development. Participants learn how to effectively communicate safety standards to others, addressing the prerequisite for OSHA 500. This comprehensive curriculum prepares you to ensure compliance and enhance workplace safety.

-

Can I receive a certification after completing OSHA 500 training?

Yes, upon successful completion of OSHA 500 training, participants receive a certification that is recognized nationwide. This certification demonstrates your ability to train others in OSHA safety standards, which is vital for organizations aiming to foster a safe working environment. Remember, fulfilling the prerequisite for OSHA 500 is necessary to qualify for this certification.

Get more for Prerequisite For Osha 500

- Aampampampps confidential and faculty form is to be be used for

- Mission vision ampamp values florida state college at jacksonville form

- Family education rights and privacy act ferpaschool form

- Troy university access your trojanpass profile form

- Satisfactory academic progress us department of education form

- Ps vendor setup form 2doc

- Declaration of major form university college

- Graduate certificate in government contracting troy university form

Find out other Prerequisite For Osha 500

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online