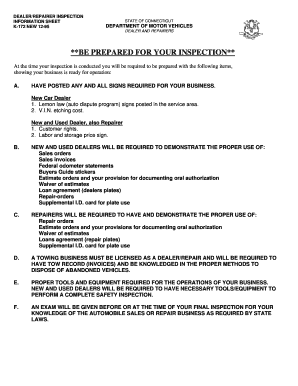

BE PREPARED for YOUR INSPECTION CT Gov Ct 1995

Understanding the Connecticut K-172 Form

The Connecticut K-172 form is a tax document used by businesses in Connecticut to report their income and calculate their tax liabilities. This form is particularly relevant for partnerships, limited liability companies (LLCs), and other pass-through entities. It allows these entities to report their income to the state while ensuring compliance with state tax regulations. Understanding the specifics of the K-172 form is essential for accurate tax reporting and avoiding potential penalties.

Steps to Complete the Connecticut K-172 Form

Completing the Connecticut K-172 form involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Complete the identification section, providing details about the business entity, such as name, address, and tax identification number.

- Report total income, including all sources of revenue generated during the tax year.

- Detail allowable deductions, ensuring compliance with state tax laws to minimize taxable income.

- Calculate the total tax liability based on the reported income and deductions.

- Review the form for accuracy and completeness before submission.

Required Documents for the Connecticut K-172 Form

To successfully complete the Connecticut K-172 form, several documents are typically required:

- Financial statements for the tax year, including profit and loss statements.

- Records of all income sources, such as sales receipts and invoices.

- Documentation of expenses that qualify for deductions, including receipts and invoices.

- Previous year’s tax return, if applicable, for reference.

Filing Deadlines for the Connecticut K-172 Form

Timely filing of the Connecticut K-172 form is crucial to avoid penalties. The form is typically due on the fifteenth day of the fourth month following the end of the tax year. For most businesses operating on a calendar year, this means the form must be filed by April 15. It is advisable to check for any specific extensions or changes in deadlines that may apply.

Legal Use of the Connecticut K-172 Form

The Connecticut K-172 form serves a legal purpose in tax compliance. Properly completing and submitting this form ensures that the business entity meets its state tax obligations. Failure to file the form can result in penalties, interest on unpaid taxes, and potential legal action from the state. Therefore, understanding the legal implications of this form is essential for all business owners in Connecticut.

Who Issues the Connecticut K-172 Form

The Connecticut K-172 form is issued by the Connecticut Department of Revenue Services (DRS). This state agency is responsible for administering tax laws and ensuring compliance among businesses operating within Connecticut. The DRS provides guidelines and resources to assist businesses in understanding their tax responsibilities and completing the K-172 form accurately.

Quick guide on how to complete be prepared for your inspection ctgov ct

Complete BE PREPARED FOR YOUR INSPECTION CT gov Ct effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents efficiently without delays. Manage BE PREPARED FOR YOUR INSPECTION CT gov Ct on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign BE PREPARED FOR YOUR INSPECTION CT gov Ct effortlessly

- Locate BE PREPARED FOR YOUR INSPECTION CT gov Ct and click Get Form to initiate the process.

- Utilize the tools provided to complete your document.

- Highlight relevant sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign BE PREPARED FOR YOUR INSPECTION CT gov Ct while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct be prepared for your inspection ctgov ct

Create this form in 5 minutes!

How to create an eSignature for the be prepared for your inspection ctgov ct

The best way to make an electronic signature for a PDF document online

The best way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the Connecticut K 172 form?

The Connecticut K 172 form is a tax form used by businesses and individuals to report income and calculate tax liabilities in the state of Connecticut. Understanding how to fill out the Connecticut K 172 form correctly is crucial for compliance and to avoid penalties.

-

How can airSlate SignNow assist with the Connecticut K 172 form?

airSlate SignNow provides a seamless solution for electronically signing and sending the Connecticut K 172 form. Our platform allows users to easily upload, share, and get documents signed, ensuring a quick and efficient filing process.

-

Is there a cost associated with using airSlate SignNow for the Connecticut K 172 form?

Yes, there are various pricing plans available for airSlate SignNow that cater to different business needs. Whether you need basic eSignature capabilities or advanced features for the Connecticut K 172 form, our plans are designed to be cost-effective and provide great value.

-

What features does airSlate SignNow offer for the Connecticut K 172 form?

airSlate SignNow offers features such as customizable templates, automatic reminders, and audit trails, all designed to simplify the process of completing the Connecticut K 172 form. These tools enhance efficiency and accuracy, making compliance easier.

-

Can I integrate airSlate SignNow with other systems when using the Connecticut K 172 form?

Absolutely! airSlate SignNow allows for seamless integration with various applications, enabling you to streamline your workflows when dealing with the Connecticut K 172 form. This ensures that you can manage documents efficiently across your favorite software solutions.

-

What are the benefits of using airSlate SignNow for the Connecticut K 172 form?

Using airSlate SignNow for the Connecticut K 172 form offers benefits such as time-saving document processing and enhanced security with electronic signatures. Additionally, you can access your signed documents from anywhere, making it easier to stay organized and compliant.

-

Is airSlate SignNow user-friendly for completing the Connecticut K 172 form?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete and sign the Connecticut K 172 form. Our intuitive interface allows users, regardless of their technical skills, to navigate the process effortlessly.

Get more for BE PREPARED FOR YOUR INSPECTION CT gov Ct

Find out other BE PREPARED FOR YOUR INSPECTION CT gov Ct

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors