T2200 Form 2019-2026

What is the T2200 Form

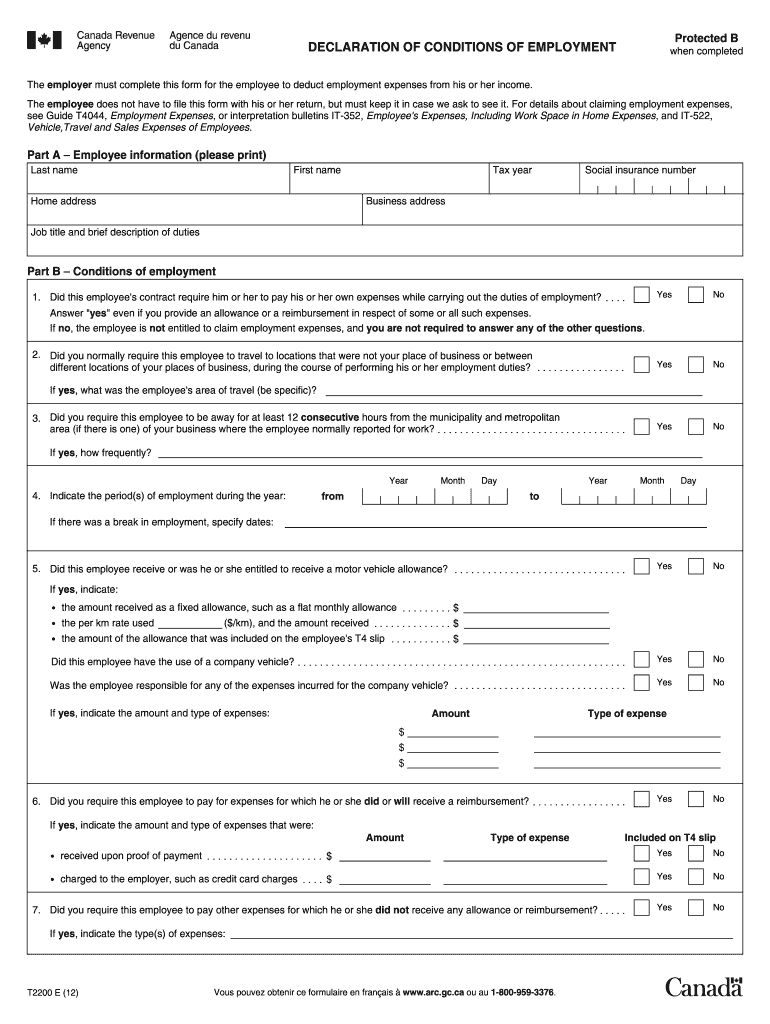

The T2200 form, also known as the Declaration of Conditions of Employment, is a tax document issued by the Canada Revenue Agency (CRA). It is primarily used by employees who incur expenses related to their employment that are not reimbursed by their employer. This form allows individuals to claim these expenses on their income tax return, potentially reducing their taxable income. The T2200 form outlines the specific conditions under which the employee is required to incur these expenses, making it essential for accurate tax reporting.

How to obtain the T2200 Form

To obtain the T2200 form, employees should request it from their employer. The employer is responsible for completing the form and certifying that the employee meets the necessary conditions for claiming expenses. Once the employer fills out and signs the form, it can be provided to the employee for their records. Additionally, the T2200 form can be downloaded from the CRA website, ensuring that employees have access to the most current version.

Steps to complete the T2200 Form

Completing the T2200 form involves several key steps:

- Obtain the form from your employer or download it from the CRA website.

- Provide your personal information, including your name and address.

- Have your employer fill out the sections that detail your employment conditions and the expenses you are eligible to claim.

- Ensure that the form is signed by your employer, confirming the accuracy of the information provided.

- Keep a copy of the completed form for your records when filing your tax return.

Legal use of the T2200 Form

The T2200 form is legally binding when it is completed accurately and signed by the employer. It serves as proof that the employee has incurred specific expenses as part of their job duties. To ensure its legal validity, it is important to adhere to the guidelines set forth by the CRA. This includes maintaining proper documentation of any expenses claimed, as the CRA may request supporting evidence during audits or reviews.

Key elements of the T2200 Form

Several key elements must be included in the T2200 form to ensure it is complete and valid:

- Employee's personal information, including name and address.

- Employer's information, including name and contact details.

- A detailed description of the employment conditions that require the employee to incur expenses.

- Specific types of expenses that the employee is eligible to claim.

- Employer's signature and date to verify the information.

Examples of using the T2200 Form

There are various scenarios in which the T2200 form may be utilized. For instance, a salesperson who uses their personal vehicle for work-related travel may use the T2200 form to claim vehicle expenses. Similarly, an employee who works from home may claim a portion of their home office expenses if their employer certifies that such expenses are necessary for their job. These examples illustrate how the T2200 form can help employees reduce their taxable income by claiming legitimate work-related expenses.

Quick guide on how to complete t2200 2012 form

Effortlessly Prepare T2200 Form on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle T2200 Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The simplest way to modify and eSign T2200 Form with ease

- Locate T2200 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your PC.

Eliminate concerns over lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Modify and eSign T2200 Form and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t2200 2012 form

Create this form in 5 minutes!

How to create an eSignature for the t2200 2012 form

The way to create an electronic signature for your PDF document in the online mode

The way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the t2200 form and why do I need it?

The t2200 form is a Canada Revenue Agency document that certifies your eligibility to claim work-related expenses on your tax return. It is essential for self-employed individuals and employees who incur expenses related to their job. Understanding how to fill out the t2200 form accurately can help maximize your deductions and minimize your tax liability.

-

How can airSlate SignNow help me with the t2200 form?

airSlate SignNow provides an intuitive platform to prepare, send, and eSign your t2200 form efficiently. You can create templates, automate workflows, and gather electronic signatures quickly, ensuring you never miss a deadline for tax claims. Leveraging our eSignature solution simplifies the process, allowing you to focus on your business.

-

Is there a cost associated with using airSlate SignNow for the t2200 form?

Yes, airSlate SignNow offers several pricing plans tailored to meet different business needs. Our cost-effective solution allows companies to handle multiple documents, including the t2200 form, without breaking the bank. By investing in our service, you will benefit from streamlined document management and secure electronic signatures.

-

Can I integrate airSlate SignNow with other tools for managing the t2200 form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRM systems, cloud storage, and productivity tools. This means you can automate the collection and processing of the t2200 form with other software you already use, enhancing your overall workflow efficiency.

-

What features does airSlate SignNow offer for handling forms like the t2200 form?

Our platform includes numerous features designed to simplify document management for forms like the t2200 form. These features include customizable templates, a user-friendly drag-and-drop interface for document creation, automated reminders for signers, and secure storage for all your signed documents. Together, these enhance your efficiency and ensure compliance.

-

Is my data secure when using airSlate SignNow for the t2200 form?

Yes, security is a top priority at airSlate SignNow. We employ advanced encryption protocols and security measures to protect your data when handling sensitive documents like the t2200 form. You can trust that your information is safe and accessible only to authorized users.

-

How can I track the status of my t2200 form when using airSlate SignNow?

With airSlate SignNow, you can easily track the status of your t2200 form throughout the signing process. The platform provides real-time updates when a document is viewed, signed, or completed. This transparency keeps you informed and ensures you can address any delays promptly.

Get more for T2200 Form

- Personal future workbook pdf fourth edition2011 form

- 14 team double elimination bracket 100400740 form

- Registro de prueba de sangre form

- Skill builder interpreting graphs answer key form

- Odhform624

- Red cross referral form

- Contractor detail form biogro biogro co

- Clinically organized relevant exam core back tool form

Find out other T2200 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors