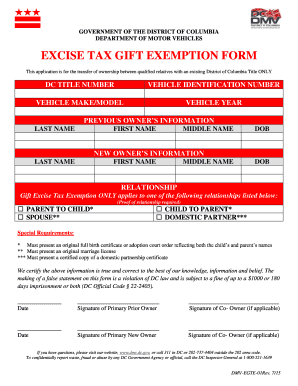

Egte Tax Gift Exemption Form

What is the DC Gift Tax Exemption?

The DC gift tax exemption allows individuals to transfer assets without incurring tax liabilities, provided certain criteria are met. This exemption is particularly relevant for residents of the District of Columbia who wish to give gifts to family members, friends, or charitable organizations. Understanding the specifics of this exemption can help individuals make informed decisions about their financial planning and estate management.

How to Use the DC Gift Tax Exemption

Utilizing the DC gift tax exemption involves understanding the limits and requirements set by the District of Columbia. Individuals can give gifts up to a specified amount each year without triggering tax obligations. It is essential to keep accurate records of all gifts made, as this information may be necessary for tax filings or future estate considerations. Consulting with a tax professional can provide clarity on how to effectively use this exemption to maximize benefits.

Steps to Complete the DC Gift Tax Exemption

To complete the process of claiming the DC gift tax exemption, follow these steps:

- Determine the value of the gift being given.

- Ensure that the gift falls within the annual exemption limit.

- Document the gift transaction, including the date, recipient, and value.

- File any necessary forms with the DC Office of Tax and Revenue if required.

- Maintain records for future reference, especially if the gift exceeds the exemption limit.

Eligibility Criteria for the DC Gift Tax Exemption

Eligibility for the DC gift tax exemption typically includes the following criteria:

- The donor must be a resident of the District of Columbia.

- The recipient must be an individual or a qualifying charitable organization.

- The gift must not exceed the annual exemption limit set by the DC government.

Understanding these criteria ensures that individuals can take full advantage of the exemption without facing unexpected tax implications.

Required Documents for the DC Gift Tax Exemption

When claiming the DC gift tax exemption, certain documents may be required to substantiate the gift. These can include:

- A completed gift tax return form if the gift exceeds the annual limit.

- Documentation showing the value of the gift, such as appraisals or receipts.

- Records of previous gifts made, if applicable.

Having these documents organized can facilitate a smoother process during tax filing or in the event of an audit.

Penalties for Non-Compliance with the DC Gift Tax Exemption

Failure to comply with the regulations surrounding the DC gift tax exemption can result in penalties. These may include:

- Fines for underreporting the value of gifts.

- Interest on unpaid taxes if the gift tax is assessed after the fact.

- Legal repercussions for fraudulent reporting.

Being aware of these penalties emphasizes the importance of adhering to the guidelines when making gifts.

Quick guide on how to complete egte tax gift exemption

Effortlessly Prepare Egte Tax Gift Exemption on Any Device

Digital document management has become favored among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without delays. Handle Egte Tax Gift Exemption on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Efficiently Edit and eSign Egte Tax Gift Exemption with Ease

- Find Egte Tax Gift Exemption and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form navigation, or errors that require the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you select. Edit and eSign Egte Tax Gift Exemption to ensure clear communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the egte tax gift exemption

How to generate an eSignature for your PDF document in the online mode

How to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is a dc gift and how can it be used?

A dc gift typically refers to a digital certificate or document that can serve various purposes, including eSigning and sending important documents. With airSlate SignNow, you can create and manage your dc gifts effortlessly, allowing you to enhance your professional communication and streamline your workflow.

-

How does airSlate SignNow integrate with other tools for dc gifts?

airSlate SignNow offers seamless integrations with numerous applications, making it easy to incorporate dc gifts into your existing workflows. Whether you need to connect with CRM systems or document management platforms, our integration capabilities enhance the versatility of your dc gifts.

-

What are the pricing options for using dc gift features in airSlate SignNow?

airSlate SignNow provides competitive pricing plans that accommodate businesses of all sizes for utilizing dc gift features. Our subscription options are designed to be cost-effective, ensuring you can enjoy the full benefits of eSigning and document management without breaking the bank.

-

What are the benefits of using airSlate SignNow for dc gifts?

Using airSlate SignNow for dc gifts brings signNow advantages, such as increased efficiency and reduced turnaround times for document approvals. Our platform not only simplifies the eSigning process but also provides improved security for your sensitive digital documents.

-

Are there any limitations when sending dc gifts through airSlate SignNow?

While airSlate SignNow provides extensive capabilities for sending dc gifts, there may be some limitations regarding file types and document sizes. However, our robust platform offers support for a wide range of formats to ensure your dc gifts are effective and easily shareable.

-

Can multiple recipients eSign a dc gift simultaneously?

Absolutely! airSlate SignNow allows multiple recipients to eSign a dc gift at the same time, streamlining the process and improving collaboration. This feature ensures that all required parties can quickly approve and finalize documents without delays.

-

Is airSlate SignNow suitable for all industries when using dc gifts?

Yes, airSlate SignNow is versatile and suitable for various industries that require the use of dc gifts. From real estate to healthcare, our eSigning platform adapts to the specific needs of different sectors, making document management efficient and effective for everyone.

Get more for Egte Tax Gift Exemption

Find out other Egte Tax Gift Exemption

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template