Irs Form 4030 2016

What is the Irs Form 4030

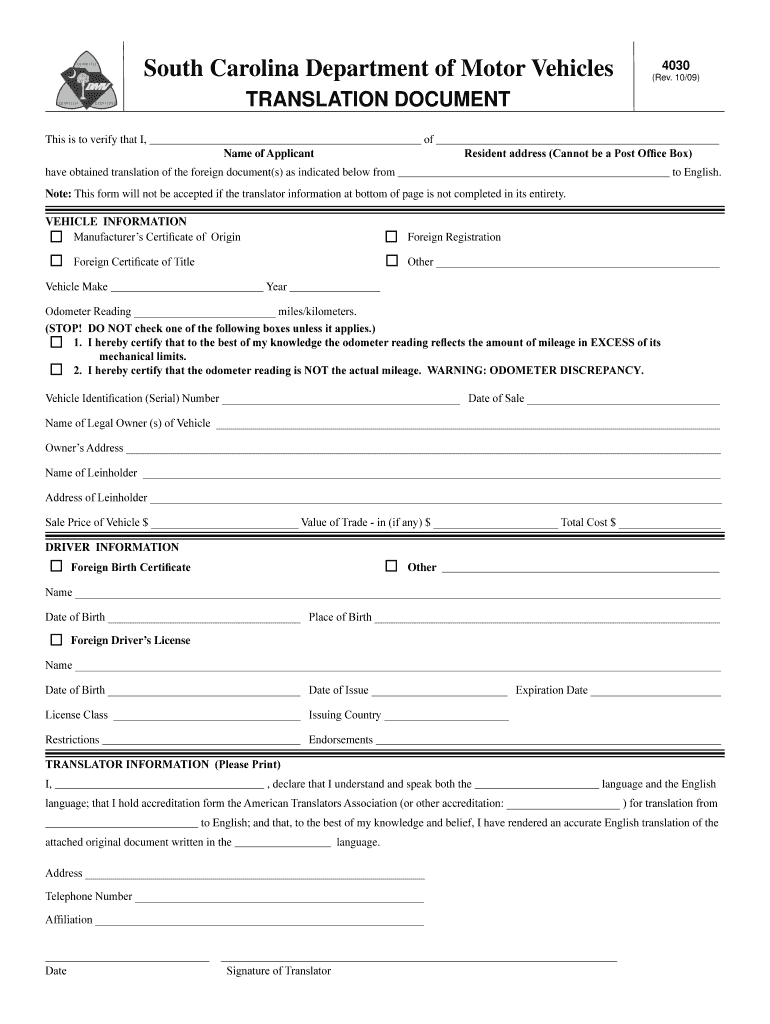

The IRS Form 4030 is a document used by taxpayers to report certain financial information to the Internal Revenue Service. This form is essential for ensuring compliance with federal tax regulations. It is primarily utilized by specific entities and individuals who need to disclose particular financial transactions or statuses to the IRS. Understanding the purpose and requirements of this form is crucial for accurate tax reporting and avoiding penalties.

How to use the Irs Form 4030

Using the IRS Form 4030 involves several steps to ensure that the information provided is accurate and complete. First, gather all necessary financial documents that pertain to the information you need to report. Next, carefully fill out the form, ensuring that each section is completed according to the IRS guidelines. It is important to double-check for any errors or omissions that could lead to complications. Once completed, the form can be submitted electronically or via mail, depending on your preference and the specific instructions provided by the IRS.

Steps to complete the Irs Form 4030

Completing the IRS Form 4030 can be broken down into a few straightforward steps:

- Gather all relevant financial documents and information.

- Download the form from the IRS website or access it through tax software.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any mistakes or missing information.

- Submit the form electronically or print it for mailing, as per IRS instructions.

Legal use of the Irs Form 4030

The legal use of the IRS Form 4030 is governed by specific regulations set forth by the IRS. To be considered valid, the form must be completed accurately and submitted within the designated time frame. Additionally, the information provided must be truthful and reflect the taxpayer's actual financial situation. Failure to comply with these requirements can result in penalties or legal repercussions. Therefore, it is essential to understand the legal implications of submitting this form.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 4030 vary depending on the specific circumstances of the taxpayer. Generally, forms must be submitted by the annual tax filing deadline, which is typically April fifteenth. However, extensions may be available under certain conditions. It is important to stay informed about any changes to deadlines or requirements that the IRS may announce each tax year to avoid late submission penalties.

Examples of using the Irs Form 4030

There are several scenarios in which the IRS Form 4030 may be used. For example, a self-employed individual may need to report income and expenses related to their business activities. Additionally, partnerships may use the form to disclose financial information pertinent to their operations. Understanding these examples can help taxpayers determine whether they need to file this form based on their unique financial situations.

Quick guide on how to complete irs form 4030 2009

Easily Prepare Irs Form 4030 on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to swiftly create, modify, and eSign your documents without any delays. Handle Irs Form 4030 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Edit and eSign Irs Form 4030

- Find Irs Form 4030 and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Mark signNow sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal authority as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Irs Form 4030 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 4030 2009

How to make an electronic signature for a PDF file in the online mode

How to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is IRS Form 4030?

IRS Form 4030 is a form used for various tax purposes, including information related to employee benefits. Understanding its requirements is essential for accurate tax reporting, and using tools like airSlate SignNow can simplify this process.

-

How can airSlate SignNow help me with IRS Form 4030?

airSlate SignNow allows you to easily create, sign, and send IRS Form 4030 electronically. This not only streamlines the signing process but also ensures that your documents are securely stored and easily accessible.

-

Is there a cost associated with using airSlate SignNow for IRS Form 4030?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs. The cost may vary based on features required for managing forms like IRS Form 4030, but we provide a cost-effective solution for document management.

-

What features does airSlate SignNow offer for IRS Form 4030?

For IRS Form 4030, airSlate SignNow provides features such as eSignature, document templates, and cloud storage. These tools enhance productivity and ensure compliance with IRS regulations.

-

Can I integrate airSlate SignNow with other applications for IRS Form 4030?

Yes, airSlate SignNow offers integrations with various applications, allowing you to manage IRS Form 4030 seamlessly. This integration helps in aligning your documents with your existing workflows for greater efficiency.

-

What are the benefits of using airSlate SignNow for IRS Form 4030?

Using airSlate SignNow for IRS Form 4030 provides numerous benefits, including faster processing times and reduced paperwork. It enhances collaboration by allowing multiple signers to access and complete the form easily.

-

Is eSigning IRS Form 4030 legally binding?

Yes, eSigning IRS Form 4030 through airSlate SignNow is legally binding under the ESIGN Act and UETA. This means that your electronically signed documents hold the same legal weight as traditional signatures.

Get more for Irs Form 4030

- Personal financing i application form v6x

- Tematiskt cv form

- Spotify cancellation form

- 14 nbc form no b 16 order of payment form docx puertoprincesa

- Research institute for animal science in biochemis form

- Private duty patient intake form

- Tda loan application code lo15 form

- Air force verbal counseling mfr example form

Find out other Irs Form 4030

- Certify Electronic signature Document Online

- Certify Electronic signature Document Free

- Certify Electronic signature PPT Secure

- How Can I Certify Electronic signature Document

- Validate Electronic signature Word Secure

- Validate Electronic signature PDF Online

- Validate Electronic signature Document Online

- Validate Electronic signature Document Now

- Validate Electronic signature PDF iOS

- How To Validate Electronic signature Document

- How Do I Validate Electronic signature Document

- Validate Electronic signature Document Android

- Validate Electronic signature Form Online

- How To Validate Electronic signature PDF

- E-mail Electronic signature Form Online

- How To E-mail Electronic signature Word

- Install Electronic signature Word Free

- Can I Install Electronic signature Word

- Can I Install Electronic signature PDF

- How Can I Install Electronic signature Document