Tcd on Tax Form

What is the TCD on Tax Form?

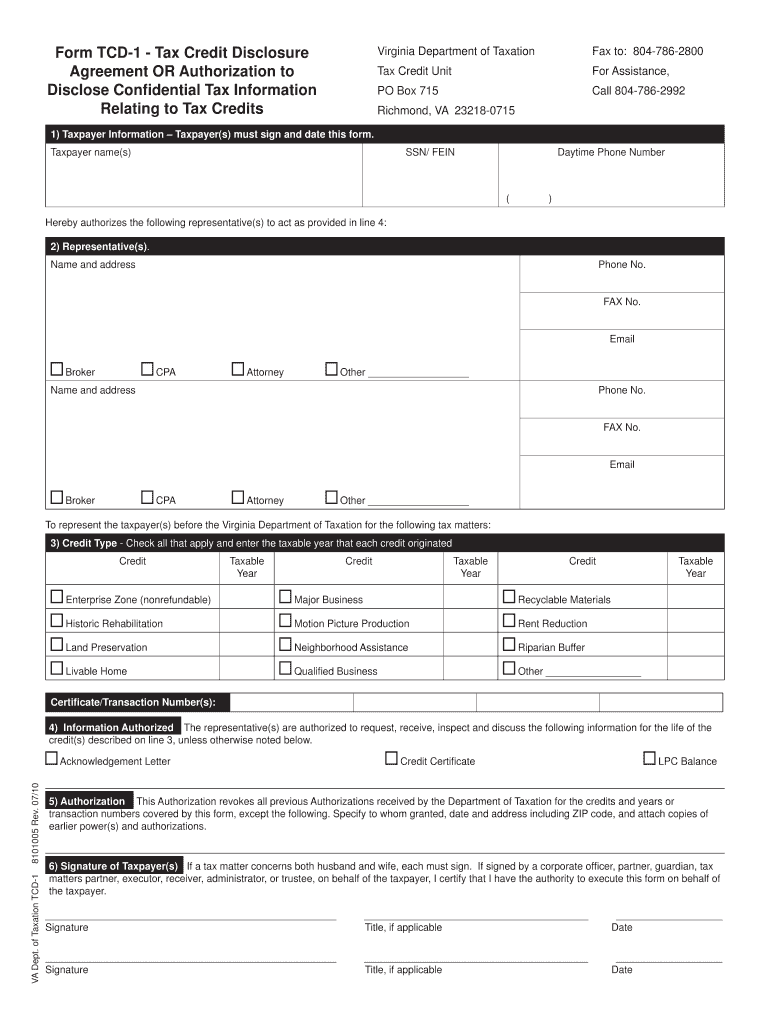

The TCD, or Tax Compliance Document, is a crucial form used in various tax-related processes in the United States. It serves to ensure that taxpayers meet specific compliance requirements set forth by the Internal Revenue Service (IRS). This document may be required for individuals and businesses alike, depending on their tax obligations and circumstances. Understanding the TCD is essential for accurate tax reporting and avoiding potential penalties.

How to Use the TCD on Tax Form

Using the TCD on tax form involves several key steps. First, you must identify the specific requirements applicable to your situation. This may include gathering necessary financial information and documentation. Next, you will fill out the form accurately, ensuring all fields are completed as per IRS guidelines. Once completed, the form can be submitted electronically or via mail, depending on your preference and the requirements of the IRS.

Steps to Complete the TCD on Tax Form

Completing the TCD on tax form requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather all necessary documents, including income statements and previous tax returns.

- Review the instructions provided with the TCD to understand the requirements.

- Fill out the form, ensuring all information is correct and complete.

- Double-check your entries for any errors or omissions.

- Submit the form according to the specified method, either online or by mail.

Legal Use of the TCD on Tax Form

The legal use of the TCD on tax form is governed by IRS regulations. For the form to be considered valid, it must be completed accurately and submitted within the designated timeframes. Failure to comply with these regulations may result in penalties or delays in processing your tax return. It is essential to keep a copy of the submitted form for your records, as it may be needed for future reference or audits.

IRS Guidelines for the TCD on Tax Form

The IRS provides specific guidelines for completing and submitting the TCD on tax form. These guidelines include detailed instructions on what information is required, how to report income, and how to claim deductions or credits. Adhering to these guidelines is crucial for ensuring that your tax return is processed smoothly and accurately. It is advisable to consult the IRS website or a tax professional if you have questions about the guidelines.

Filing Deadlines for the TCD on Tax Form

Filing deadlines for the TCD on tax form are critical to avoid penalties. Typically, individual taxpayers must file their tax returns by April 15 of each year. However, businesses may have different deadlines based on their fiscal year. It is important to stay informed about these deadlines and plan accordingly to ensure timely submission of your tax documents.

Required Documents for the TCD on Tax Form

When preparing to complete the TCD on tax form, certain documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents ready will facilitate a smoother completion process and help ensure that all necessary information is included in your submission.

Quick guide on how to complete tcd on tax form

Complete Tcd On Tax Form effortlessly on any device

Online document management has become widely adopted by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Tcd On Tax Form on any platform using the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

The easiest way to modify and electronically sign Tcd On Tax Form without hassle

- Find Tcd On Tax Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about misplaced or lost documents, frustrating form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Tcd On Tax Form and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

What tax form do I have to fill out for the money I made on Quora?

For 2018, there is only form 1040. Your income is too low to file. Quora will issue you a 1099 Misc only if you made over $600

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

What is a W-10 tax form? Who has to fill one out?

Here is all the information regarding the W-10 tax form from the IRS. But, it is a request to get your Child’s Dependent Care Tax Information. If you are taking care of someone’s child for them you will need to fill it out. Again you are supposed to pay taxes on all Earned Income. But, a lot of people don’t and work under the table. I don’t know many drug dealers getting ready to report their earnings this year. I actually used that scenario in college. You can’t right off bribes as an expense.. Sorry off topic..About Form W10 | Internal Revenue Service

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

If I publish on Smashwords and tick on the option to take a 30 percent tax, do I still need to fill out the tax form?

If you want to get any of that tax money back in your pocket, you will have to fill out the forms.Are you a US citizen? If not, you will need to obtain an ITIN using IRS form W-7. This will allow you to file the appropriate US tax return forms and claim a refund. Depending on your country of residence, the refund could be up to 100% of the tax collected. With an ITIN, you will usually be exempt from the 30% withholding and will not be required to fill out any US tax returns at the end of the year (unless you actually reside in the US, but that is a far more complicated situation). The ITIN application process can be a royal pain in the behind, especially if you wait until after the taxes have been withheld.If your book only makes a few dollars, the hassle is not worth it. But if you hit the self-publishing lottery, you will definitely want to apply for that refund.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

Create this form in 5 minutes!

How to create an eSignature for the tcd on tax form

How to generate an electronic signature for your Tcd On Tax Form in the online mode

How to generate an eSignature for the Tcd On Tax Form in Google Chrome

How to create an electronic signature for signing the Tcd On Tax Form in Gmail

How to generate an eSignature for the Tcd On Tax Form right from your mobile device

How to create an eSignature for the Tcd On Tax Form on iOS devices

How to generate an eSignature for the Tcd On Tax Form on Android devices

People also ask

-

What is a TCD PDF and how does it relate to airSlate SignNow?

A TCD PDF is a document format often used for tax compliance and documentation. With airSlate SignNow, businesses can easily eSign and manage TCD PDFs, streamlining the workflow and ensuring compliance. This solution simplifies the entire process of document handling, making it efficient for users.

-

How can I create a TCD PDF using airSlate SignNow?

Creating a TCD PDF with airSlate SignNow is simple. You can upload your document directly to the platform and use the editing tools to customize it as needed. Once your TCD PDF is ready, you can send it for eSignature, ensuring quick turnaround times.

-

What pricing plans are available for airSlate SignNow regarding TCD PDFs?

airSlate SignNow offers competitive pricing plans that cater to different business needs and document requirements, including TCD PDFs. You can choose from various tiers that provide features suitable for small to large enterprises. It’s an affordable solution for managing and eSigning essential documents.

-

What features does airSlate SignNow offer for managing TCD PDFs?

airSlate SignNow includes features like eSignature, document templates, and workflow automation specifically designed for handling TCD PDFs. Additionally, the platform offers advanced security measures to protect sensitive information. These features make it easy to manage your documents efficiently.

-

What are the benefits of using airSlate SignNow for TCD PDFs?

Utilizing airSlate SignNow for TCD PDFs provides numerous benefits, including time savings and enhanced compliance. The intuitive interface allows users to manage documents seamlessly, reducing the overall processing time. Furthermore, it ensures that all signatures comply with legal regulations for TCD documents.

-

Can I integrate airSlate SignNow with other tools to handle TCD PDFs?

Yes, airSlate SignNow offers integrations with various third-party applications and tools, making it ideal for managing TCD PDFs alongside your existing systems. These integrations help enhance workflow efficiency and ease of access to your documents. You can connect seamlessly to CRM, ERP, and other platforms.

-

Is airSlate SignNow secure for handling sensitive TCD PDFs?

Absolutely. airSlate SignNow employs robust security protocols to protect your sensitive TCD PDFs and other documents. Features such as encryption, secure cloud storage, and user authentication ensure that your data remains confidential and protected from unauthorized access.

Get more for Tcd On Tax Form

- Documentary stamp tax bureau of internal revenue bir form

- 2000 form ph bir 1902 fill online printable fillable blank

- 2551q bir formtaxation in the united statesincome tax

- Identity theft victims packet chandler police department form

- Illinois uniform partnership act statement of dissolution

- Never received regular certificate of title form

- Telephone 804 786 2787 fax 804 367 1003 form

- Opting to tax land and buildings form

Find out other Tcd On Tax Form

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer