Documentary Stamp Tax Bureau of Internal Revenue BIR 2018-2026

What is the Documentary Stamp Tax Bureau of Internal Revenue BIR?

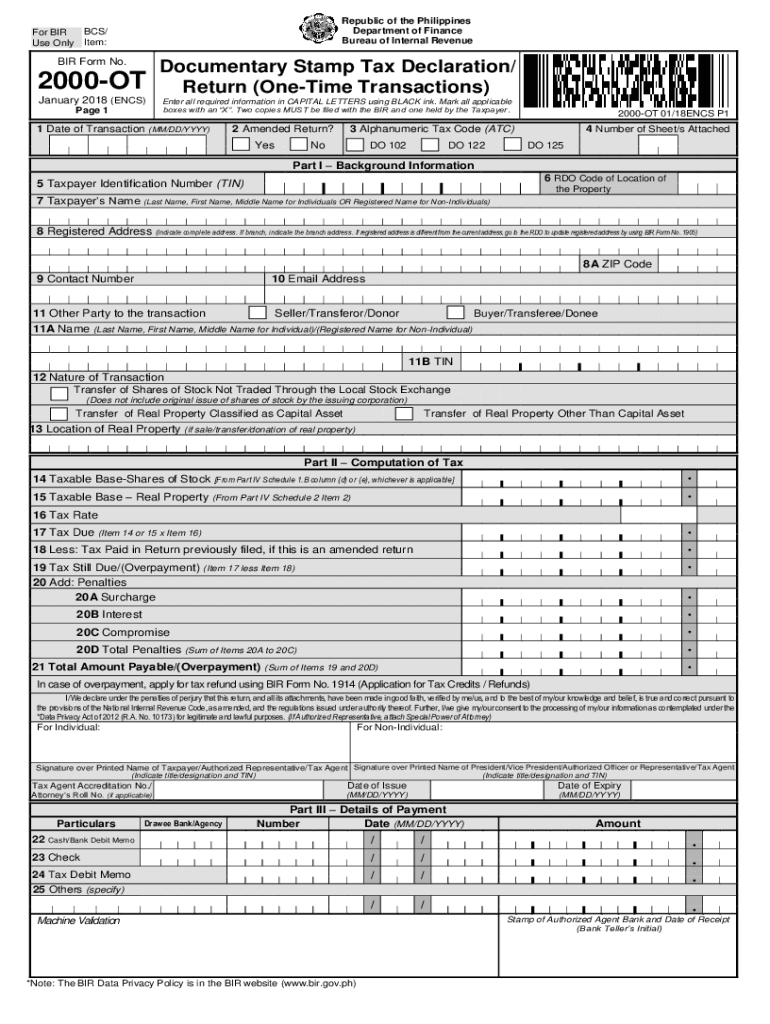

The Documentary Stamp Tax (DST) is a tax imposed on certain documents, transactions, and agreements that are executed or signed in the Philippines. The Bureau of Internal Revenue (BIR) administers this tax, which applies to documents such as contracts, loans, and other financial instruments. The tax is calculated based on the value of the transaction or the amount stated in the document. Understanding the DST is crucial for individuals and businesses engaging in transactions that require documentation, as it ensures compliance with tax regulations.

Steps to Complete the Documentary Stamp Tax Bureau of Internal Revenue BIR

Completing the Documentary Stamp Tax involves several key steps to ensure proper filing and compliance. Here’s a structured approach:

- Determine the applicable transactions: Identify the documents that require DST, such as contracts and agreements.

- Calculate the tax due: Use the prescribed rates to compute the DST based on the transaction value.

- Fill out the necessary forms: Complete the required BIR forms, ensuring all details are accurate.

- Pay the tax: Submit payment through authorized banks or online platforms as specified by the BIR.

- Obtain the documentary stamp: After payment, secure the documentary stamp to affix on the relevant documents.

Legal Use of the Documentary Stamp Tax Bureau of Internal Revenue BIR

The legal use of the Documentary Stamp Tax is essential for validating documents in various transactions. Affixing the documentary stamp signifies that the tax has been paid and the document is legally executed. This is particularly important in legal agreements, loan documents, and property transactions, as it can affect the enforceability of the contract. Non-compliance with DST regulations may lead to penalties or invalidation of the documents, making adherence to these laws critical for all parties involved.

Required Documents for the Documentary Stamp Tax Bureau of Internal Revenue BIR

When preparing to file for the Documentary Stamp Tax, certain documents are essential to ensure a smooth process. These typically include:

- Completed BIR forms relevant to the DST.

- Proof of transaction value, such as contracts or agreements.

- Payment receipts from authorized banks or online payment confirmations.

- Any additional documentation required by the BIR for specific transactions.

Filing Deadlines / Important Dates

Adhering to filing deadlines for the Documentary Stamp Tax is crucial to avoid penalties. Generally, the tax must be paid and the forms submitted within five days from the date of the transaction or execution of the document. It is advisable to check the BIR's official announcements for any specific deadlines or extensions that may apply, especially during tax season or due to extraordinary circumstances.

Penalties for Non-Compliance

Failure to comply with the Documentary Stamp Tax regulations can result in significant penalties. These may include:

- Fines for late payment or failure to pay the tax.

- Additional interest on unpaid taxes.

- Legal consequences that may affect the enforceability of the documents involved.

Understanding these penalties emphasizes the importance of timely and accurate compliance with DST requirements.

Quick guide on how to complete documentary stamp tax bureau of internal revenue bir

Accomplish Documentary Stamp Tax Bureau Of Internal Revenue BIR effortlessly on any device

Digital document administration has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Documentary Stamp Tax Bureau Of Internal Revenue BIR on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and electronically sign Documentary Stamp Tax Bureau Of Internal Revenue BIR without hassle

- Obtain Documentary Stamp Tax Bureau Of Internal Revenue BIR and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal authority as a conventional wet ink signature.

- Review all information and click the Done button to finalize your modifications.

- Select your preferred method of sending the form, whether via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Documentary Stamp Tax Bureau Of Internal Revenue BIR and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct documentary stamp tax bureau of internal revenue bir

Create this form in 5 minutes!

How to create an eSignature for the documentary stamp tax bureau of internal revenue bir

The best way to make an electronic signature for a PDF in the online mode

The best way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is bir form 2000 ot and how does it work?

The bir form 2000 ot is a tax form required for certain businesses, and airSlate SignNow simplifies the process of filling and submitting this form. With our user-friendly interface, you can easily complete, eSign, and send the bir form 2000 ot digitally, ensuring compliance and accuracy.

-

What are the key features of airSlate SignNow for handling bir form 2000 ot?

airSlate SignNow offers a range of features for effective handling of the bir form 2000 ot, including secure eSigning, document templates, and automated workflows. These features streamline the process, allowing you to focus on your business rather than paperwork.

-

Is there a free trial available for using airSlate SignNow for bir form 2000 ot?

Yes, airSlate SignNow provides a free trial that allows you to explore its features related to the bir form 2000 ot. This trial gives you the chance to see how our solutions can enhance your document management and eSigning processes before committing to a subscription.

-

How does airSlate SignNow ensure the security of my bir form 2000 ot documents?

AirSlate SignNow employs robust security measures, including encryption and secure cloud storage, to protect your bir form 2000 ot documents. You can confidently eSign and share sensitive information, knowing that your data is safe from unauthorized access.

-

Can I integrate airSlate SignNow with other applications for managing bir form 2000 ot?

Absolutely! airSlate SignNow offers seamless integrations with various applications, which helps you manage bir form 2000 ot and other documents more efficiently. Integrating with tools like Google Drive, Dropbox, and CRM systems will streamline your workflow and enhance productivity.

-

What are the pricing options for using airSlate SignNow for bir form 2000 ot?

airSlate SignNow provides flexible pricing plans to cater to different business needs for managing the bir form 2000 ot. Whether you’re a small business or a large enterprise, you can choose a plan that fits your budget while getting access to essential features and functionalities.

-

How does airSlate SignNow improve the efficiency of completing bir form 2000 ot?

Using airSlate SignNow for bir form 2000 ot allows you to streamline document flow and reduce time spent on manual processes. With features like bulk eSignature requests and automated reminders, your team can complete necessary tasks faster, improving overall efficiency.

Get more for Documentary Stamp Tax Bureau Of Internal Revenue BIR

- Split interest trust annual return form 5227internal revenue service

- 2022 form 8689 allocation of individual income tax to the us virgin islands

- Interesesinternal revenue service irs tax forms

- Wwwirsgovpubirs pdf2022 form w 3pr internal revenue service

- Form 8915 d 624654109

- Inst 1040 schedule c form

- Form 13614 nr nonresident alien intake and interview sheet formupack

- About form 2441 child and dependent care expensesabout form 2441 child and dependent care expenses2021 form 2441 irs tax

Find out other Documentary Stamp Tax Bureau Of Internal Revenue BIR

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors