Ohio it 1040 Do Not Staple or Paper Clip Hio 2023

What is the Ohio IT 1040

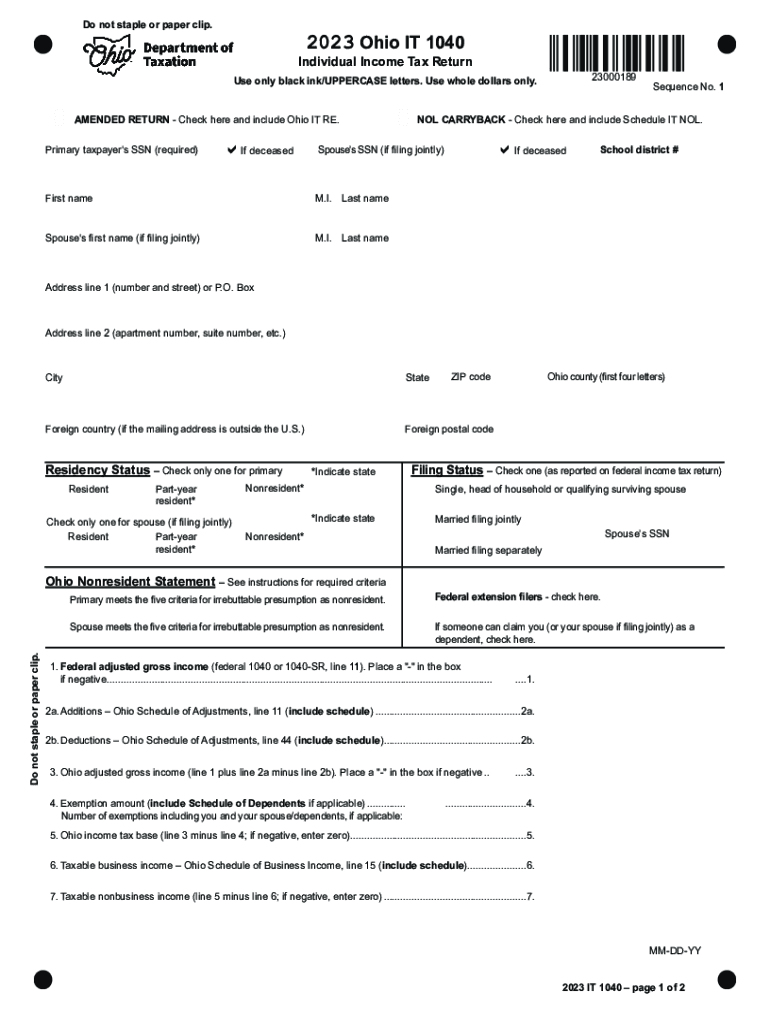

The Ohio IT 1040 is the individual income tax return form required by the state of Ohio for residents and certain non-residents who earn income within the state. This form is essential for reporting income, calculating tax liability, and claiming any applicable credits or deductions. It is specifically designed for individuals filing their state tax returns and is a critical component of the annual tax process in Ohio.

Steps to complete the Ohio IT 1040

Completing the Ohio IT 1040 involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out the personal information section, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring accuracy to avoid issues.

- Calculate your adjustments, deductions, and credits to determine your taxable income.

- Compute the tax owed or refund due based on the current Ohio tax rates.

- Review the form for completeness and accuracy before submission.

How to obtain the Ohio IT 1040

The Ohio IT 1040 form can be obtained in several ways. It is available for download as a printable PDF from the Ohio Department of Taxation's website. Additionally, physical copies can often be found at local tax offices or public libraries. For those who prefer digital options, tax preparation software typically includes the Ohio IT 1040, allowing for easier completion and submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Ohio IT 1040 to avoid penalties. Generally, the deadline for filing individual income tax returns in Ohio is April 15 of the following year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should also note any specific deadlines for extensions or estimated payments.

Form Submission Methods

Taxpayers have multiple options for submitting the Ohio IT 1040. The form can be filed electronically through authorized e-filing services, which is often the quickest method. Alternatively, individuals can mail a completed paper form to the appropriate address provided by the Ohio Department of Taxation. In some cases, in-person submissions may be accepted at local tax offices, but it is advisable to check ahead for availability.

Key elements of the Ohio IT 1040

Understanding the key elements of the Ohio IT 1040 is essential for accurate filing. Important components include:

- Personal Information: Required details such as name, address, and Social Security number.

- Income Reporting: Sections for detailing various income sources.

- Deductions and Credits: Areas to claim applicable deductions and tax credits.

- Signature: A signature is required to validate the form upon submission.

Penalties for Non-Compliance

Failing to file the Ohio IT 1040 by the deadline can result in penalties and interest on any unpaid taxes. The state may impose a late filing penalty, which can increase the longer the return is overdue. Additionally, taxpayers may face interest charges on the amount owed from the due date until the payment is made. It is advisable to file even if unable to pay the full amount to reduce penalties.

Quick guide on how to complete ohio it 1040 do not staple or paper clip hio

Complete Ohio IT 1040 Do Not Staple Or Paper Clip Hio effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as a flawless eco-friendly substitute for conventional printed and signed papers, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents efficiently without delays. Manage Ohio IT 1040 Do Not Staple Or Paper Clip Hio on any device with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to modify and electronically sign Ohio IT 1040 Do Not Staple Or Paper Clip Hio with ease

- Locate Ohio IT 1040 Do Not Staple Or Paper Clip Hio and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, text message (SMS), or invite link, or download it to your PC.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Ohio IT 1040 Do Not Staple Or Paper Clip Hio and guarantee effective communication at any phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ohio it 1040 do not staple or paper clip hio

Create this form in 5 minutes!

How to create an eSignature for the ohio it 1040 do not staple or paper clip hio

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio state tax form 2020 and who needs to file it?

The Ohio state tax form 2020 is a document required by the Ohio Department of Taxation for residents to report their income and calculate their tax liability. It is essential for anyone earning income in Ohio, including state residents and non-residents with Ohio-sourced income, to file this form accurately.

-

How can I access the Ohio state tax form 2020 using airSlate SignNow?

You can easily access the Ohio state tax form 2020 through airSlate SignNow by utilizing our intuitive document management system. Simply upload a copy of the form, and you can fill it out electronically, ensuring a streamlined process for completion and submission.

-

What features does airSlate SignNow offer for completing the Ohio state tax form 2020?

airSlate SignNow offers various features for completing the Ohio state tax form 2020, including document templates, e-signatures, and secure cloud storage. These features enhance efficiency, allowing you to manage your tax filing with ease, all in one platform.

-

Is airSlate SignNow cost-effective for eSigning the Ohio state tax form 2020?

Yes, airSlate SignNow is a cost-effective solution for eSigning the Ohio state tax form 2020. Our pricing plans are designed to accommodate businesses of all sizes, ensuring you can manage your documents efficiently without breaking the bank.

-

Can airSlate SignNow integrate with other accounting software for filing the Ohio state tax form 2020?

Certainly! airSlate SignNow can integrate with various accounting and tax preparation software, simplifying the process of filing the Ohio state tax form 2020. This integration allows users to transfer data seamlessly and eliminate data entry errors, improving overall efficiency.

-

What are the benefits of using airSlate SignNow for the Ohio state tax form 2020?

Using airSlate SignNow for the Ohio state tax form 2020 offers numerous benefits, including increased efficiency, secure document management, and electronic signatures that expedite the filing process. Additionally, you gain access to a user-friendly interface that simplifies tax filing.

-

How secure is airSlate SignNow when handling the Ohio state tax form 2020?

airSlate SignNow prioritizes security and employs advanced encryption protocols to safeguard your documents, including the Ohio state tax form 2020. Our platform ensures that your personal and financial information remains confidential throughout the signing and filing process.

Get more for Ohio IT 1040 Do Not Staple Or Paper Clip Hio

- Mdvip com form

- Healthcare conversation tracker life senior services lifeseniorservices form

- Prudential annuity change form

- Patient demographics sheet acrsurgeonscom form

- Invesco change of ownership form

- Interglobal medical claim form 2014

- Click here to download the general referral form university of miami obgyn med miami

- St 9 sales and use tax return mass form

Find out other Ohio IT 1040 Do Not Staple Or Paper Clip Hio

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online