LINEAL HEIR HOMESTEAD DENSITY EXEMPTION AP PLICA TION Levy Levycounty Form

Understanding the linear heir homestead density exemption application

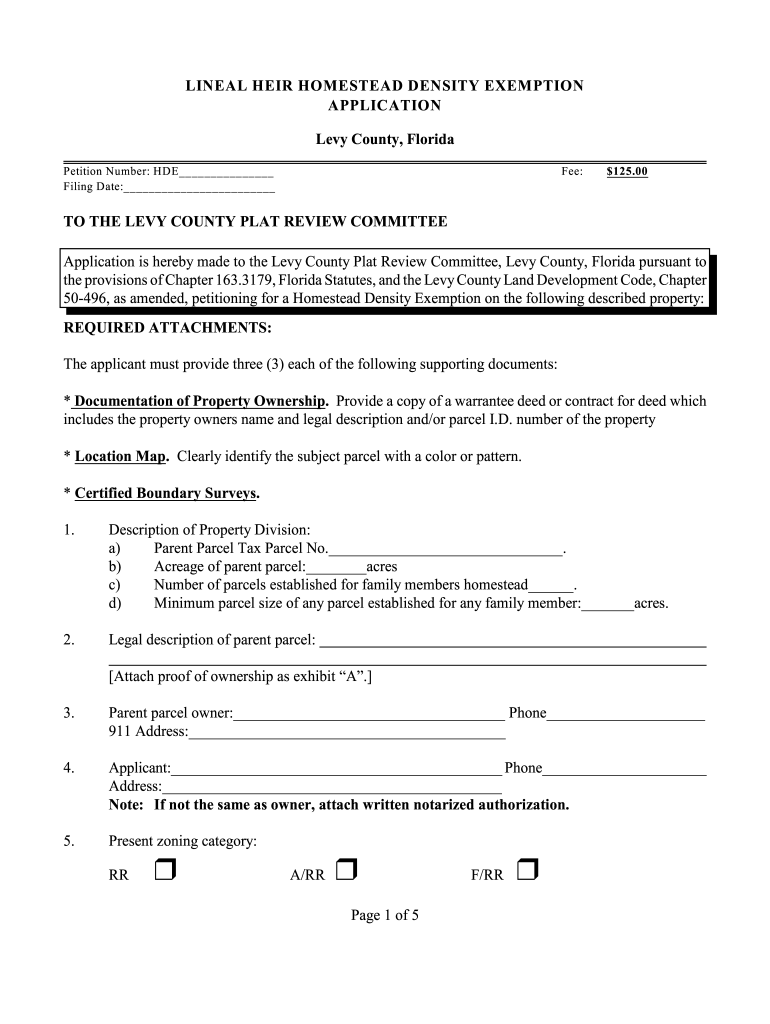

The linear heir homestead density exemption application is a legal document that allows eligible heirs to claim a density exemption for homestead properties. This exemption is typically available to heirs who inherit property from a family member and meet specific criteria set by state laws. The purpose of this exemption is to encourage the preservation of family-owned properties and to provide financial relief by reducing property tax burdens.

Steps to complete the linear heir homestead density exemption application

Completing the linear heir homestead density exemption application involves several key steps:

- Gather necessary documentation, including proof of inheritance and property ownership.

- Fill out the application form accurately, ensuring all required fields are completed.

- Review the application for any errors or omissions before submission.

- Submit the application through the designated method, whether online, by mail, or in person.

Eligibility criteria for the linear heir homestead density exemption

To qualify for the linear heir homestead density exemption, applicants must meet specific eligibility criteria. Generally, these criteria include:

- The applicant must be a direct descendant of the previous property owner.

- The property must be used as a primary residence.

- The property must not exceed a certain size or value, as defined by state regulations.

Required documents for the linear heir homestead density exemption application

When applying for the linear heir homestead density exemption, it is essential to provide the necessary documentation to support your claim. Commonly required documents include:

- Proof of relationship to the deceased property owner, such as a birth certificate or marriage license.

- A copy of the property deed or title.

- Any relevant tax documents or prior exemption approvals.

Form submission methods for the linear heir homestead density exemption application

Applicants can submit the linear heir homestead density exemption application through various methods, depending on local regulations. Common submission methods include:

- Online submission through the appropriate state or county website.

- Mailing the completed application to the designated office.

- In-person submission at local government offices.

Legal use of the linear heir homestead density exemption application

The legal use of the linear heir homestead density exemption application is governed by state laws and regulations. It is crucial for applicants to understand the legal implications of claiming this exemption, including potential audits and the requirement to maintain eligibility. Failure to comply with the legal stipulations may result in penalties or the revocation of the exemption.

Quick guide on how to complete lineal heir homestead density exemption ap plica tion levy levycounty

Effortlessly Prepare LINEAL HEIR HOMESTEAD DENSITY EXEMPTION AP PLICA TION Levy Levycounty on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to access the necessary forms and securely archive them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Handle LINEAL HEIR HOMESTEAD DENSITY EXEMPTION AP PLICA TION Levy Levycounty on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

Easily Modify and Electronically Sign LINEAL HEIR HOMESTEAD DENSITY EXEMPTION AP PLICA TION Levy Levycounty

- Locate LINEAL HEIR HOMESTEAD DENSITY EXEMPTION AP PLICA TION Levy Levycounty and click Get Form to begin.

- Use the tools we provide to complete your document.

- Select important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign LINEAL HEIR HOMESTEAD DENSITY EXEMPTION AP PLICA TION Levy Levycounty to ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lineal heir homestead density exemption ap plica tion levy levycounty

How to make an eSignature for a PDF document in the online mode

How to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the linear heir homestead density exemption?

The linear heir homestead density exemption is a property tax exemption that allows heirs to retain the homestead status of a property under specific density criteria. This exemption can signNowly reduce property taxes for eligible heirs. Understanding this exemption is crucial for families looking to inherit property and maintain affordability.

-

How can the linear heir homestead density exemption benefit me?

The linear heir homestead density exemption can benefit you by lowering your overall property taxes, making it more affordable to keep family-owned land within the family. This exemption preserves the homestead status even after inheritance, ensuring that heirs are not burdened by high tax rates. This protection can facilitate long-term financial stability for families.

-

Are there specific eligibility requirements for the linear heir homestead density exemption?

Yes, the eligibility requirements for the linear heir homestead density exemption vary by state but typically include criteria related to property ownership and usage. Heirs must meet certain conditions regarding the density of the property to qualify. It's important for prospective customers to check local regulations to ensure compliance.

-

How do I apply for the linear heir homestead density exemption?

To apply for the linear heir homestead density exemption, you will need to submit an application to your local tax assessor’s office. This application usually requires proof of ownership and may need supporting documents regarding the property’s density. Make sure to complete the application before any deadlines to ensure your eligibility.

-

Is there a cost associated with applying for the linear heir homestead density exemption?

Typically, there is no application fee for the linear heir homestead density exemption; however, fees may vary by jurisdiction. It's advisable to check with your local tax assessor’s office for any potential costs or charges. Understanding these details can help you plan effectively when applying for the exemption.

-

What documents do I need for the linear heir homestead density exemption application?

For the linear heir homestead density exemption application, you may need documents such as the property deed, proof of heirship, and evidence of homestead use. Additional documentation may be required to demonstrate compliance with density requirements. Gathering all necessary documents in advance can streamline the application process.

-

Can the linear heir homestead density exemption be combined with other benefits?

Yes, the linear heir homestead density exemption can often be combined with other property tax exemptions, enhancing your overall savings on property taxes. It’s important to inquire about local laws to see how this exemption works alongside others. This combination can provide signNow financial benefits to heirs of property.

Get more for LINEAL HEIR HOMESTEAD DENSITY EXEMPTION AP PLICA TION Levy Levycounty

- Irrevocable documentary credit application 14764002 form

- Financial statement template form

- Nc tort claims forms

- Dfeh pre complaint inquiry form

- Mcps form 455 20 montgomery county public schools montgomeryschoolsmd

- Form ms dor 89 350 fill online printable

- 505 nonresident income tax return instructions form

- Form 84 105 mississippi department of revenue ms gov

Find out other LINEAL HEIR HOMESTEAD DENSITY EXEMPTION AP PLICA TION Levy Levycounty

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed