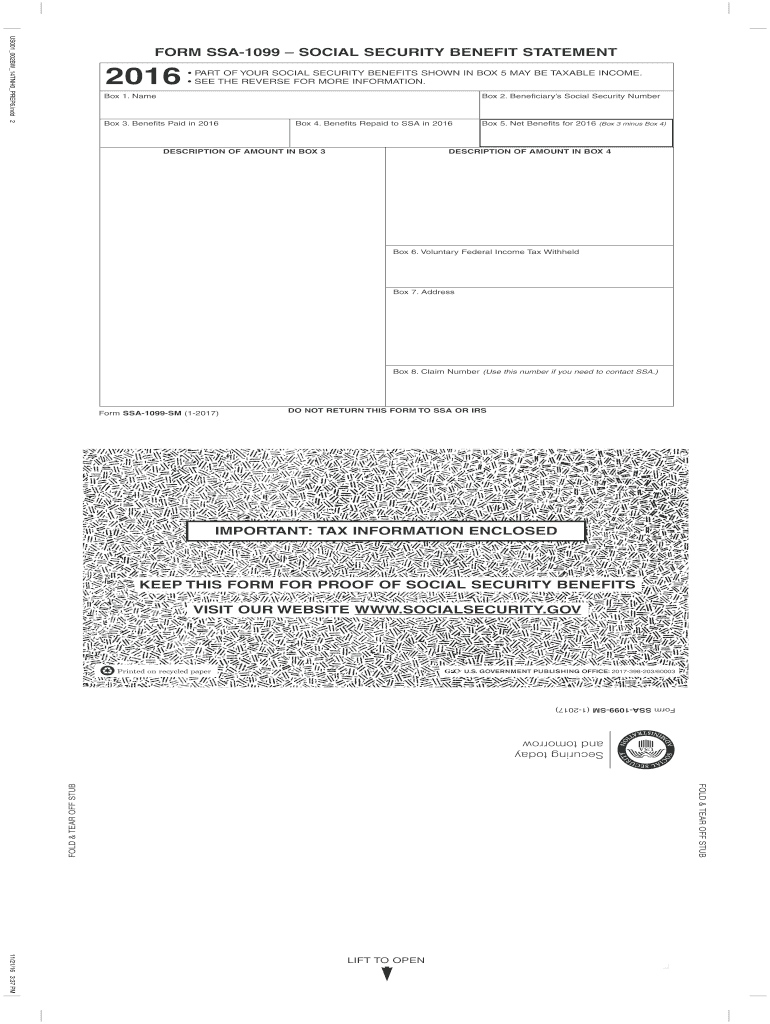

Social Security 1099 Form 2017

What makes the social security 1099 form legally binding?

Because the society ditches in-office working conditions, the execution of paperwork more and more takes place online. The social security 1099 form isn’t an exception. Working with it utilizing electronic tools is different from doing this in the physical world.

An eDocument can be viewed as legally binding given that certain needs are fulfilled. They are especially vital when it comes to stipulations and signatures related to them. Typing in your initials or full name alone will not guarantee that the institution requesting the form or a court would consider it executed. You need a reliable solution, like airSlate SignNow that provides a signer with a electronic certificate. Furthermore, airSlate SignNow keeps compliance with ESIGN, UETA, and eIDAS - key legal frameworks for eSignatures.

How to protect your social security 1099 form when completing it online?

Compliance with eSignature laws is only a portion of what airSlate SignNow can offer to make form execution legal and safe. Furthermore, it gives a lot of possibilities for smooth completion security wise. Let's rapidly run through them so that you can be certain that your social security 1099 form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment information.

- FERPA, CCPA, HIPAA, and GDPR: major privacy regulations in the USA and Europe.

- Dual-factor authentication: provides an extra layer of security and validates other parties' identities via additional means, such as a Text message or phone call.

- Audit Trail: serves to catch and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: sends the data securely to the servers.

Filling out the social security 1099 form with airSlate SignNow will give greater confidence that the output form will be legally binding and safeguarded.

Quick guide on how to complete social security 1099 form

Complete Social Security 1099 Form effortlessly on any gadget

Web-based document management has gained traction with organizations and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to compose, modify, and eSign your documents swiftly without delays. Manage Social Security 1099 Form on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Social Security 1099 Form effortlessly

- Obtain Social Security 1099 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as an old-fashioned wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or disorganized files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Update and eSign Social Security 1099 Form and ensure outstanding communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct social security 1099 form

Create this form in 5 minutes!

How to create an eSignature for the social security 1099 form

The way to create an electronic signature for a PDF file in the online mode

The way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The way to make an eSignature for a PDF file on Android

People also ask

-

How can I get a copy of my 1099 online?

Request a Copy of Your Form 1099G Log in to myEDD and select UI Online. Select Payments. Select Form 1099G. Select View next to the desired year. ... Select Request Paper Copy to request an official paper copy of your Form 1099G. Confirm your address on the Form 1099G Address Confirmation screen.

-

What happens if I didn't get a 1099 from Social Security?

If you did not receive your SSA-1099 or have misplaced it, you can get a replacement online if you have a My Social Security account. Sign in to your account and click the link for Replacement Documents. You'll be able to access your form and save a printable copy.

-

How do I get my 1099 form from Social Security?

Need a replacement copy of your SSA-1099 or SSA-1042S, also known as a Benefit Statement? You can instantly download a printable copy of the tax form by logging in to or creating a free my Social Security account.

-

Can I look up my 1099 online?

Log in to myEDD and select UI Online. Select Payments. Select Form 1099G. Select View next to the desired year.

-

Can I get a digital copy of my 1099?

Sign in to your my Social Security account to get your copy Creating a free my Social Security account takes less than 10 minutes, lets you download your SSA-1099 or SSA-1042S and gives you access to many other online services.

-

How can I get a copy of my 1099 if I lost it?

Taxpayers should first contact the employer, payer or issuing agency directly for copies. Taxpayers who haven't received a W-2 or Form 1099 should contact the employer, payer or issuing agency and request a copy of the missing document or a corrected document.

-

Do I have to file SSA-1099 on my taxes?

You must include the taxable part of a lump-sum payment of benefits received in the current year (reported to you on Form SSA-1099, Social Security Benefit Statement) in your current year's income, even if the payment includes benefits for an earlier year.

-

How do I retrieve a 1099 from the IRS?

If you are looking for 1099s from earlier years, you can contact the IRS and order a “wage and income transcript”. The transcript should include all of the income that you had as long as it was reported to the IRS. All you need to do is fill out a Form 4506-T and mail or fax it off to the IRS.

Get more for Social Security 1099 Form

- Shellys science spot earthworm dissection answers form

- Monitoring indicators of scholarly language form

- Florida revocation of general durable power of attorney form

- Hsbc bank statement form

- State tax form software updates

- 4891 michigan corporate income tax annual return 708156460 form

- 4976 michigan home heating credit claim mi 1040cr 7 form

- Chapter 253 permit applications 1 cover sheet check form

Find out other Social Security 1099 Form

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free