Asg Tax Office 2011-2026

What is the ASG Tax Office

The American Samoa Government (ASG) Tax Office is the official agency responsible for administering tax laws and regulations within American Samoa. This office oversees the collection of taxes, including income taxes, property taxes, and other revenue-generating assessments. It plays a crucial role in ensuring compliance with local tax laws and provides resources and assistance to taxpayers.

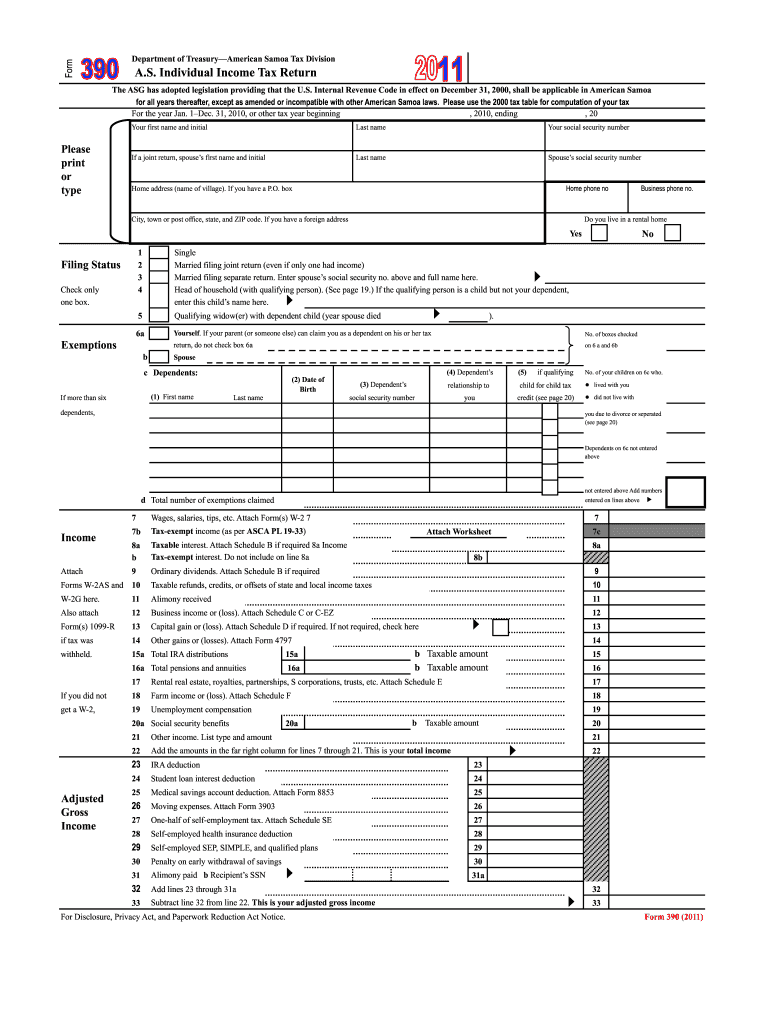

Steps to Complete the ASG Tax Office Form 390

Completing the American Samoa tax form 390 requires careful attention to detail. Begin by gathering all necessary documentation, such as income statements and any previous tax returns. Next, fill out the form accurately, ensuring that all required fields are completed. Review the form for any errors or omissions before submission. It is advisable to consult the ASG Tax Office guidelines to confirm that you have included all necessary attachments and information. Once finalized, submit the form according to the specified methods.

Filing Deadlines / Important Dates

Filing deadlines for the American Samoa tax form 390 can vary each year. Typically, individual income tax returns are due by April 15. However, it is essential to check for any updates or extensions that may apply. Mark your calendar with important dates to ensure timely submission and avoid penalties. Keeping track of these deadlines can help streamline your tax filing process.

Required Documents

When preparing to file the American Samoa tax form 390, certain documents are essential. These may include:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents ready will facilitate a smoother filing experience and ensure compliance with tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The ASG Tax Office offers various methods for submitting the tax form 390. Taxpayers can file online through the official ASG portal, which provides a secure and efficient way to submit documents. Alternatively, forms can be mailed directly to the tax office or delivered in person. Each submission method has its own guidelines, so it is important to follow the instructions provided by the ASG Tax Office to ensure successful processing.

Penalties for Non-Compliance

Failure to comply with the requirements of the American Samoa tax form 390 can result in penalties. These may include fines, interest on unpaid taxes, and potential legal consequences. It is crucial for taxpayers to adhere to filing deadlines and accurately report income to avoid these penalties. Understanding the implications of non-compliance can help motivate timely and accurate tax submissions.

Quick guide on how to complete american samoa 390 tax form

Uncover the most efficient method to complete and endorse your Asg Tax Office

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow provides a superior approach to finish and endorse your Asg Tax Office and related forms for public services. Our advanced electronic signature platform equips you with everything required to handle paperwork swiftly and in compliance with official standards - comprehensive PDF editing, managing, safeguarding, endorsing, and sharing features all available within a user-friendly interface.

Only a few steps are necessary to fill out and endorse your Asg Tax Office:

- Upload the editable template to the editor using the Get Form button.

- Review what information you need to furnish in your Asg Tax Office.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your details.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is signNow or Cover up sections that are no longer necessary.

- Click on Sign to generate a legally valid electronic signature using any method of your choice.

- Insert the Date next to your signature and conclude your task with the Done button.

Store your completed Asg Tax Office in the Documents folder within your account, download it, or export it to your preferred cloud storage. Our service also offers versatile file sharing options. There's no need to print your templates when you want to send them to the relevant public office - transmit them via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it now!

Create this form in 5 minutes or less

FAQs

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

Create this form in 5 minutes!

How to create an eSignature for the american samoa 390 tax form

How to generate an eSignature for your American Samoa 390 Tax Form online

How to generate an electronic signature for your American Samoa 390 Tax Form in Chrome

How to generate an eSignature for putting it on the American Samoa 390 Tax Form in Gmail

How to generate an eSignature for the American Samoa 390 Tax Form straight from your mobile device

How to create an electronic signature for the American Samoa 390 Tax Form on iOS devices

How to generate an electronic signature for the American Samoa 390 Tax Form on Android devices

People also ask

-

What is the American Samoa tax form 390?

The American Samoa tax form 390 is a specific tax form used by residents of American Samoa to report their income and calculate their tax obligations. It is crucial for ensuring compliance with local tax laws and for claiming any applicable deductions or credits. Understanding how to correctly fill out this form is essential for all taxpayers in American Samoa.

-

How can airSlate SignNow help with filling out the American Samoa tax form 390?

airSlate SignNow offers a user-friendly platform that allows you to easily fill out and eSign the American Samoa tax form 390. With built-in templates and guides, you can ensure that you meet all the requirements without any hassle. Our platform enhances accuracy and speeds up the submission process.

-

Is there a cost associated with using airSlate SignNow for the American Samoa tax form 390?

airSlate SignNow provides a flexible pricing structure that can accommodate various business sizes. You can choose from different plans, ensuring you only pay for the features you need when completing the American Samoa tax form 390. Pricing is transparent, with no hidden fees.

-

What benefits does airSlate SignNow offer for managing the American Samoa tax form 390?

Using airSlate SignNow for the American Samoa tax form 390 simplifies the tax preparation process with its intuitive interface and electronic signature capabilities. This means you can complete your tax forms quickly and securely while maintaining compliance. Additionally, our platform allows you to track form statuses efficiently.

-

Are there integrations available for submitting the American Samoa tax form 390 through airSlate SignNow?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software that can help streamline the submission of the American Samoa tax form 390. This connectivity allows you to import data directly, reducing the need for manual entry and minimizing errors. It's a practical solution for your tax management needs.

-

Can multiple users collaborate on the American Samoa tax form 390 in airSlate SignNow?

Absolutely! airSlate SignNow supports collaborative features that enable multiple users to work on the American Samoa tax form 390 simultaneously. This is particularly useful for teams or accountants assisting clients, as everyone can contribute in real time while maintaining version control.

-

What security measures does airSlate SignNow implement for the American Samoa tax form 390?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like the American Samoa tax form 390. We use advanced encryption protocols and secure cloud storage to protect your information. Additionally, our platform complies with industry standards to ensure your data remains confidential and secure.

Get more for Asg Tax Office

- Mankwe college online application for 2021 form

- Mercedes benz bursary form

- Khanyisa nursing college online application 2021 form

- Open capitec account online application form

- Tshwane south college online application 2021 form

- Uif forms 15783650

- Department of labour forms

- Elangeni college online application for 2021 form

Find out other Asg Tax Office

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form