Rt6n 2017

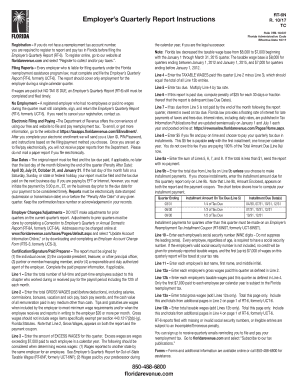

What is the RT-6N?

The RT-6N is a Florida Department of Revenue form used for reporting and remitting unemployment compensation taxes. This form is essential for employers in Florida, as it provides the state with necessary information about employee wages and taxes withheld. Completing the RT-6N accurately ensures compliance with state regulations and helps maintain the integrity of the unemployment compensation system.

Steps to Complete the RT-6N

Completing the RT-6N involves several key steps to ensure accuracy and compliance:

- Gather employee wage information for the reporting period.

- Calculate the total wages paid to employees, including any bonuses or commissions.

- Determine the unemployment tax rate applicable to your business.

- Fill out the RT-6N form, ensuring all fields are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the RT-6N by the designated deadline, either online or by mail.

Legal Use of the RT-6N

The RT-6N must be used in accordance with Florida state laws regarding unemployment compensation. This includes timely filing and accurate reporting of wages and taxes. Failing to comply with these legal requirements can result in penalties, including fines and interest on unpaid taxes. Employers should ensure that they understand their obligations under Florida law to avoid potential legal issues.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines for submitting the RT-6N. Typically, the form is due quarterly, with deadlines set for the last day of the month following the end of each quarter. For example:

- Q1 (January - March): Due by April 30

- Q2 (April - June): Due by July 31

- Q3 (July - September): Due by October 31

- Q4 (October - December): Due by January 31

Required Documents

To complete the RT-6N, employers need to gather several documents, including:

- Payroll records for the reporting period.

- Employee tax withholding information.

- Any previous RT-6N forms submitted, if applicable.

Having these documents ready will streamline the completion process and help ensure accuracy in reporting.

Form Submission Methods

The RT-6N can be submitted through various methods to accommodate different employer preferences:

- Online submission via the Florida Department of Revenue's eServices portal.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated Department of Revenue offices.

Employers should choose the method that best suits their operational needs while ensuring timely submission.

Penalties for Non-Compliance

Failure to file the RT-6N on time or inaccuracies in reporting can lead to significant penalties. These may include:

- Fines for late submissions.

- Interest on unpaid taxes.

- Potential legal action for repeated non-compliance.

Understanding these consequences emphasizes the importance of timely and accurate reporting for all Florida employers.

Quick guide on how to complete rt6n

Complete Rt6n effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Rt6n on any device using airSlate SignNow’s Android or iOS applications and enhance any document-focused process today.

How to alter and eSign Rt6n with ease

- Obtain Rt6n and click on Get Form to begin.

- Utilize the tools provided to finalize your document.

- Emphasize pertinent sections of your documents or obscure sensitive data using tools specifically made available by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Purge your worries about lost or misplaced documents, exhaustive form searching, or inaccuracies that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you choose. Edit and eSign Rt6n and ensure excellent communication at any point of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rt6n

Create this form in 5 minutes!

How to create an eSignature for the rt6n

The way to generate an eSignature for your PDF in the online mode

The way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is a Florida RT account and how does it work?

A Florida RT account is a specialized account designed for residents in Florida to manage and sign documents electronically. It allows users to create, edit, and send documents securely while ensuring compliance with state regulations. This streamlined process helps businesses save time and reduce paperwork efficiently.

-

What features does a Florida RT account offer?

A Florida RT account includes features such as electronic signatures, document templates, real-time collaboration, and secure cloud storage. Users can easily track document status and send reminders, which enhances workflow efficiency. The platform is intuitive, making it accessible for all types of users.

-

Is there a cost associated with a Florida RT account?

Yes, creating a Florida RT account comes with various pricing plans that cater to different business needs. The pricing is competitive, and there are options for monthly or annual subscriptions. Additionally, you might find free trials or discounts available for new users who want to explore the service.

-

How can I benefit from using a Florida RT account?

Using a Florida RT account streamlines document management and enhances your business processes. By enabling electronic signatures, you can expedite approvals and agreements, helping your business operate faster. It also minimizes paper use, making it a more eco-friendly choice.

-

Can I integrate my Florida RT account with other software?

Yes, a Florida RT account offers integrations with various third-party applications, including CRMs, project management tools, and more. This allows for seamless data transfer and workflow enhancements within your existing systems. Check the platform's integration options to see a full list of compatible applications.

-

Is my data secure with a Florida RT account?

Absolutely. A Florida RT account prioritizes data security, employing encryption protocols and compliance with regulations like GDPR. Your sensitive information is safeguarded, ensuring that your documents are protected from unauthorized access throughout the signing process.

-

How can I get support for my Florida RT account?

Support for your Florida RT account is readily available through multiple channels, including live chat, email, and a comprehensive knowledge base. You can access helpful tutorials and FAQs on the website to assist with common issues. Our dedicated support team is here to resolve your queries efficiently.

Get more for Rt6n

- Immunization forms

- Genetic counseling referral form genedx com

- Group employer information this section should be completed by pastoral rcdony

- Sstgb form f0003 fillable 211482

- Form 414 general information texas secretary of state sos state tx

- Usapa da form 31

- Selling agent commission verification first integrity title firstintegritytitle form

- Sublease termination agreement template form

Find out other Rt6n

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe