Va 760 Instruction 2020

What is the VA 760 Instruction?

The VA 760 Instruction refers to the official guidelines for completing the Virginia income tax return form. This form is essential for residents of Virginia to report their income and calculate their state tax obligations. It provides detailed instructions on how to fill out the form accurately, ensuring compliance with state tax laws. Understanding the VA 760 Instruction is crucial for taxpayers to avoid errors that could lead to penalties or delays in processing their returns.

Steps to Complete the VA 760 Instruction

Completing the VA 760 Instruction involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Review the instructions carefully to understand the requirements for your specific tax situation.

- Fill out the form accurately, ensuring all income, deductions, and credits are reported.

- Double-check your calculations to minimize errors that could trigger audits or adjustments.

- Sign and date the form before submission, as an unsigned form may be considered invalid.

How to Obtain the VA 760 Instruction

The VA 760 Instruction can be obtained through several methods:

- Visit the official Virginia Department of Taxation website, where you can download the form and instructions in a printable format.

- Request a physical copy by contacting the Virginia Department of Taxation directly.

- Access local libraries or community centers that may provide tax assistance and resources.

Legal Use of the VA 760 Instruction

The VA 760 Instruction is legally binding when completed according to the guidelines set forth by the Virginia Department of Taxation. It must be filled out truthfully and accurately to ensure compliance with state tax laws. Failing to adhere to these instructions can lead to legal consequences, including fines or audits. It is important to keep records of all submitted forms and correspondence with tax authorities for future reference.

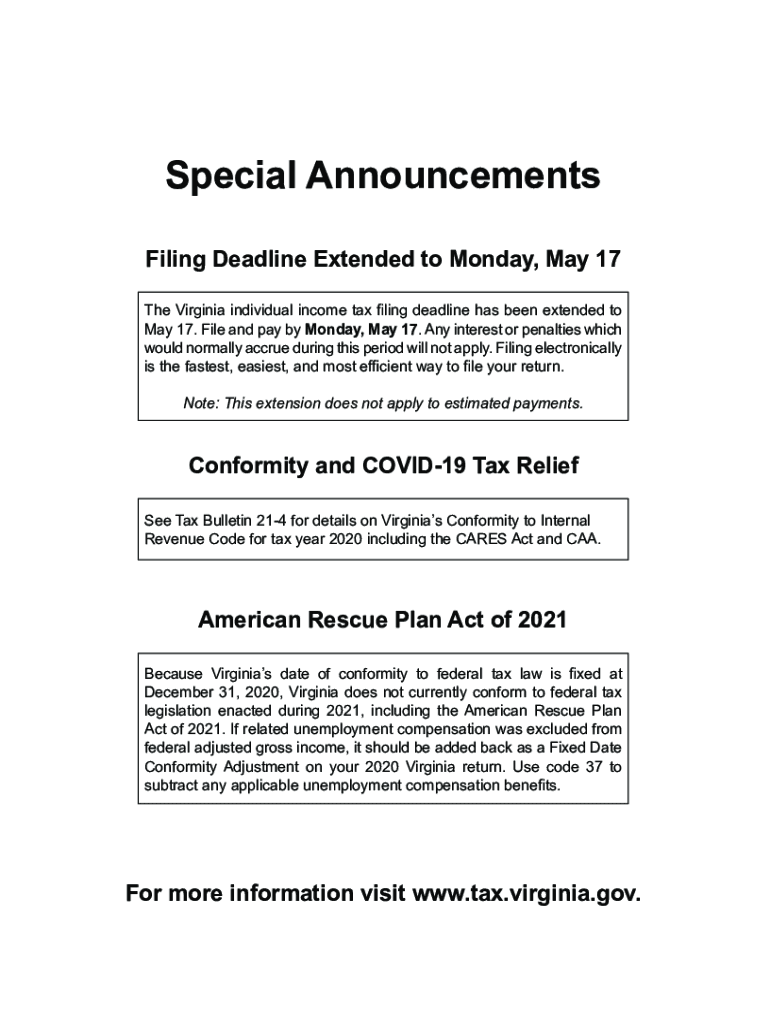

Filing Deadlines / Important Dates

Filing deadlines for the VA 760 Instruction are critical to avoid penalties. Typically, the due date for submitting your Virginia income tax return is May 1 of the year following the tax year. If the due date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, as well as specific deadlines for estimated tax payments.

Required Documents

To complete the VA 760 Instruction, certain documents are necessary:

- W-2 forms from employers, detailing annual wages and withheld taxes.

- 1099 forms for other income sources, such as freelance work or interest income.

- Documentation of any deductions or credits you plan to claim, such as receipts for charitable donations or medical expenses.

Form Submission Methods (Online / Mail / In-Person)

The VA 760 Instruction can be submitted through various methods:

- Online submission via the Virginia Department of Taxation's e-file system, which allows for quick processing and confirmation.

- Mailing a paper copy of the completed form to the appropriate address provided in the instructions.

- In-person submission at designated tax offices, which may offer assistance for taxpayers needing help with their forms.

Quick guide on how to complete va 760 instruction 2020

Complete Va 760 Instruction effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides all the resources you require to create, edit, and electronically sign your documents swiftly without delays. Handle Va 760 Instruction on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Va 760 Instruction with ease

- Find Va 760 Instruction and click Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which only takes a few seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to save your updates.

- Choose how you prefer to send your form, whether by email, SMS, invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searching, or mistakes requiring new copies to be printed. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign Va 760 Instruction and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct va 760 instruction 2020

Create this form in 5 minutes!

How to create an eSignature for the va 760 instruction 2020

The way to make an electronic signature for a PDF online

The way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the va income tax instructions form?

The va income tax instructions form is a document that provides guidelines on how to correctly fill out Virginia income tax returns. It includes details on deductions, exemptions, and credits applicable to taxpayers. Understanding this form is essential for ensuring compliance and maximizing your potential refund.

-

How can airSlate SignNow help with the va income tax instructions form?

airSlate SignNow allows users to easily eSign and send the va income tax instructions form electronically. This simplifies the process by eliminating the need for physical paperwork and ensuring timely submissions. With airSlate SignNow, you can securely manage your documents from anywhere.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers a range of pricing plans tailored to different business needs. Users can choose from basic, advanced, or enterprise plans depending on the volume of documents and features required. Each plan provides access to essential tools for managing forms like the va income tax instructions form.

-

Are there any integrations available for the va income tax instructions form with airSlate SignNow?

Yes, airSlate SignNow integrates with various applications to streamline the process of handling the va income tax instructions form. Popular integrations include Google Drive, Microsoft Office, and Salesforce. This allows for seamless document management and enhances your productivity.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents like the va income tax instructions form offers numerous benefits. It provides an efficient and secure way to handle sensitive information, reduces turnaround time, and simplifies the eSigning process. Furthermore, the user-friendly interface makes it accessible for everyone.

-

Is eSigning the va income tax instructions form legally binding?

Yes, eSigning the va income tax instructions form through airSlate SignNow is legally binding. The platform complies with eSignature laws, ensuring the authenticity and integrity of your signed documents. This provides peace of mind when submitting your tax forms electronically.

-

What support is available for users working with the va income tax instructions form?

airSlate SignNow provides extensive support for users dealing with the va income tax instructions form. Customers can access a comprehensive help center, tutorials, and customer service representatives to answer any questions. This ensures that you can efficiently navigate the eSigning process.

Get more for Va 760 Instruction

- Csp15 form

- Karate training camp application form

- Field trip swimming permission form ohio department of pleasant treca

- Acu srwc form

- A raisin in the sun anticipation guide answers form

- Driver services department of the illinois secretary of state form

- Universal title application form

- Tenancy lease agreement template form

Find out other Va 760 Instruction

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF