Csp15 Form

What is the csp15 form?

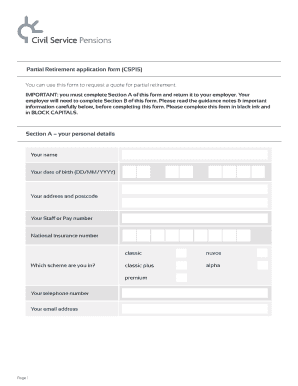

The csp15 form, also known as the csp 15 partial retirement form, is a document used by employees seeking to apply for partial retirement benefits. This form is essential for individuals who wish to transition from full-time work to a part-time status while still receiving certain retirement benefits. It outlines the necessary information regarding the applicant’s employment history, retirement plans, and any other pertinent details required for processing the application.

How to use the csp15 form

Using the csp15 form involves several steps to ensure accurate completion and submission. First, obtain the editable csp15 form from a reliable source. Next, fill in the required fields, including personal information, employment details, and retirement preferences. It is important to review the information for accuracy before signing. Once completed, the form can be submitted electronically or through traditional mail, depending on the requirements set by the issuing authority.

Steps to complete the csp15 form

Completing the csp15 form requires careful attention to detail. Follow these steps:

- Download the editable csp15 form from a trusted platform.

- Provide your full name, contact information, and Social Security number.

- Detail your current employment status and the nature of your retirement request.

- Include any additional information that may support your application.

- Review the form for completeness and accuracy.

- Sign and date the form electronically or in print.

- Submit the form according to the specified submission methods.

Legal use of the csp15 form

The csp15 form is legally binding when filled out correctly and submitted according to the established guidelines. To ensure its validity, it must meet the requirements set forth by relevant legislation, including compliance with eSignature laws such as ESIGN and UETA. Using a trusted platform like signNow can enhance the legal standing of the document by providing secure signing options and maintaining an audit trail of the transaction.

Key elements of the csp15 form

Several key elements must be included in the csp15 form for it to be considered complete and valid. These elements include:

- Personal identification details, such as name and Social Security number.

- Employment history, including current position and tenure.

- Specific request for partial retirement, including desired hours and benefits.

- Signature of the applicant, which may be electronic or handwritten.

- Date of submission to establish the timeline for processing.

Eligibility Criteria

To qualify for the benefits associated with the csp15 form, applicants must meet specific eligibility criteria. Generally, these criteria include:

- A minimum number of years of service with the employer.

- Age requirements, typically defined by the organization’s retirement policies.

- Current employment status, ensuring the applicant is still an active employee.

- Compliance with any additional organizational policies regarding retirement.

Quick guide on how to complete csp15 form

Effortlessly Prepare Csp15 Form on Any Device

Digital document management has gained traction among organizations and individuals. It offers an excellent eco-conscious substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Csp15 Form on any platform with airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

Efficiently Edit and eSign Csp15 Form with Ease

- Locate Csp15 Form and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Select relevant sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you would prefer to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and eSign Csp15 Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the csp15 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the csp15 form and how does it work?

The csp15 form is a specific type of document used for a variety of administrative purposes. With airSlate SignNow, you can easily fill out and eSign the csp15 form online, streamlining the process and saving time. Our tool ensures that all necessary fields are completed accurately, making document management efficient.

-

How much does it cost to use airSlate SignNow for the csp15 form?

airSlate SignNow offers various pricing plans tailored to your business needs. Whether you're an individual user or part of a larger organization, our pricing is designed to be cost-effective, especially for those needing to eSign documents like the csp15 form. Visit our pricing page for detailed information and to find the best plan for you.

-

What features does airSlate SignNow provide for completing the csp15 form?

airSlate SignNow offers a range of features for filling out the csp15 form, including easy text editing, signature fields, document templates, and real-time collaboration. With its intuitive interface, you can efficiently create, fill, and eSign the csp15 form in minutes. Additionally, you can track the status of your documents to ensure timely completion.

-

Can I integrate airSlate SignNow with other applications to manage the csp15 form?

Yes, airSlate SignNow supports integration with various applications, allowing you to manage the csp15 form seamlessly within your existing workflows. Integrations with CRM, cloud storage, and productivity tools facilitate easier access and management of your documents. This enhances efficiency and keeps your processes streamlined.

-

What benefits does using airSlate SignNow provide for the csp15 form?

Using airSlate SignNow for the csp15 form offers numerous benefits, such as reducing paper waste, accelerating document turnaround times, and enhancing collaboration among team members. The platform's eSignature capabilities also ensure that your documents are legally binding and secure. Overall, it simplifies the signing process, allowing you to focus on what matters most.

-

Is it secure to eSign the csp15 form with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security and compliance, providing a safe environment for signing the csp15 form. Our platform utilizes advanced encryption and adheres to industry standards to protect your data. You can trust that your documents are secure and accessible only by authorized users.

-

How can I track the status of my csp15 form using airSlate SignNow?

With airSlate SignNow, you can easily track the status of your csp15 form in real-time. The dashboard provides updates on whether the document has been viewed, signed, or requires further action from any participants. This feature enhances visibility and accountability in the document signing process.

Get more for Csp15 Form

- Form 4506 t ez rev 11 2021 short form request for individual tax return transcript

- 2021 form 1098 t tuition statement

- 2021 form 990 return of organization exempt from income tax

- Federal form 1098 mortgage interest statement info copy

- Form 1120 excel template fill online printable

- Form 941 x rev july 2021 adjusted employers quarterly federal tax return or claim for refund

- Fillable online you cannot claim the ptc if your filing form

- 2021 form w 3 transmittal of wage and tax statements

Find out other Csp15 Form

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement