Irs 15103 Form

What is the IRS Form 15103?

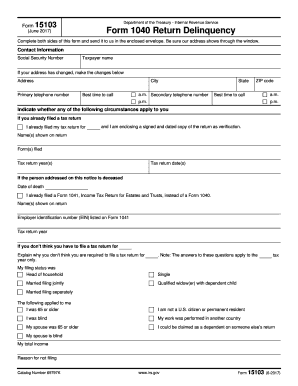

The IRS Form 15103, also known as the Return Delinquency form, is utilized by taxpayers to address issues related to unfiled tax returns. This form provides a structured way for individuals to report their delinquent returns to the IRS, ensuring compliance with federal tax obligations. It is particularly relevant for those who may have missed filing deadlines or need to rectify their tax status with the IRS.

How to Use the IRS Form 15103

Using the IRS Form 15103 involves several steps to ensure accurate completion. Taxpayers must first gather all necessary information regarding their unfiled tax returns, including income statements, deductions, and any relevant documentation. Once the form is filled out, it should be submitted to the IRS as part of the process to resolve any outstanding tax issues. It is essential to follow the instructions carefully to avoid delays in processing.

Steps to Complete the IRS Form 15103

Completing the IRS Form 15103 requires careful attention to detail. Here are the main steps involved:

- Gather Documentation: Collect all relevant financial documents, including W-2s, 1099s, and any records of income.

- Fill Out the Form: Provide accurate information in all required fields, ensuring that the details match your financial records.

- Review for Accuracy: Double-check the form for any errors or omissions before submission.

- Submit the Form: Send the completed form to the IRS, either electronically or by mail, depending on your preference and the IRS guidelines.

Legal Use of the IRS Form 15103

The IRS Form 15103 serves a legal purpose in the context of tax compliance. When used correctly, it can help taxpayers rectify their filing status and avoid potential penalties for non-compliance. It is crucial to understand that submitting this form does not automatically resolve any tax liabilities; taxpayers may still need to address outstanding payments or penalties separately.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 15103 vary depending on individual circumstances. Typically, taxpayers should aim to submit the form as soon as they become aware of their delinquent returns. Keeping track of important dates is essential to avoid further penalties. The IRS may provide specific guidance on deadlines during tax season, so staying informed is beneficial.

Penalties for Non-Compliance

Failure to file the IRS Form 15103 or address delinquent returns can result in significant penalties. The IRS may impose fines, interest on unpaid taxes, and even legal actions in severe cases. Understanding these potential consequences emphasizes the importance of timely filing and compliance with tax regulations.

Quick guide on how to complete irs 15103

Effortlessly Prepare Irs 15103 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed forms, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Handle Irs 15103 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and eSign Irs 15103 with Ease

- Find Irs 15103 and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight important sections of the documents or obscure confidential information with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Irs 15103 to ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs 15103

The way to make an eSignature for a PDF file online

The way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the IRS Form 15103?

IRS Form 15103 is a form used by taxpayers to request a transcript of tax return information. It is important for individuals who need to verify their income or tax information for various purposes, including applying for loans or grants. Understanding how to obtain and use IRS Form 15103 is crucial for maintaining accurate financial records.

-

How can airSlate SignNow help with IRS Form 15103?

airSlate SignNow provides an efficient platform for managing and eSigning IRS Form 15103 documents electronically. This digital solution simplifies the process, allowing you to send, sign, and store tax forms securely in one place. By using airSlate SignNow, you can streamline your document workflow and ensure timely submission of IRS Form 15103.

-

Is there a cost associated with using airSlate SignNow for IRS Form 15103?

Yes, airSlate SignNow operates on a subscription-based model with various pricing plans to suit different needs. The cost-effective solutions provided allow businesses of all sizes to access essential eSigning features without breaking the bank. By investing in airSlate SignNow, you can save time and money while managing forms like IRS Form 15103 efficiently.

-

What features does airSlate SignNow offer for IRS Form 15103?

airSlate SignNow offers features such as electronic signatures, document templates, and real-time tracking for IRS Form 15103. With these tools, users can easily prepare, send, and sign their forms. The platform also ensures compliance with legal regulations, making your workflow more secure and reliable.

-

Can I integrate airSlate SignNow with other applications while working on IRS Form 15103?

Absolutely! airSlate SignNow supports integrations with a variety of popular applications, which can enhance your efficiency while handling IRS Form 15103. You can seamlessly connect with tools like Google Drive, Dropbox, and CRM systems to streamline your document management process.

-

What are the benefits of using airSlate SignNow for IRS Form 15103?

Using airSlate SignNow for IRS Form 15103 offers signNow benefits, including increased efficiency, reduced paper usage, and enhanced security. The convenience of eSigning can expedite the completion of forms and facilitate better tracking and organization of your documents. As a result, businesses can save on operational costs and focus more on their core activities.

-

How secure is the information shared through airSlate SignNow with IRS Form 15103?

airSlate SignNow prioritizes the security of your documents, including IRS Form 15103. The platform employs advanced encryption and compliance protocols to protect your data during transmission and storage. You can trust that your sensitive tax information remains confidential and secure while using airSlate SignNow.

Get more for Irs 15103

Find out other Irs 15103

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe