How to Be 12c Form

Understanding the BE12C Form

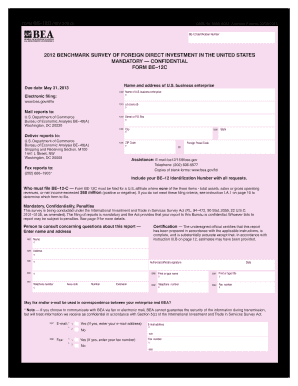

The BE12C form is a crucial document used for reporting certain financial information to the U.S. Bureau of Economic Analysis (BEA). This form is specifically designed for U.S. persons who have not filed a BE-12C claim for not filing in previous years. It is essential for maintaining compliance with U.S. regulations regarding foreign investments and transactions. The form collects data on foreign direct investment and is part of the BEA's efforts to monitor and analyze economic activity related to international investments.

How to Complete the BE12C Form

Filling out the BE12C form requires careful attention to detail. Start by gathering all necessary financial documents related to your foreign investments. Ensure you have accurate information about your ownership interests, financial transactions, and any relevant income. The form typically includes sections for reporting ownership, financial data, and other pertinent information. It is crucial to provide complete and accurate information to avoid penalties for non-compliance.

Legal Use of the BE12C Form

The BE12C form must be filed in accordance with U.S. laws and regulations. Filing this form is not only a legal requirement but also a means to ensure that the U.S. government has accurate data on international economic activity. Failure to file the BE12C form, or submitting incorrect information, can result in significant penalties. It is important to understand the legal implications of this form and to ensure compliance with all reporting requirements.

Filing Deadlines for the BE12C Form

Timely submission of the BE12C form is critical. The filing deadlines may vary based on the specific reporting year and the nature of the investments. Generally, the BEA sets specific dates by which the form must be submitted. It is advisable to keep track of these deadlines to avoid late submissions, which can lead to penalties or additional scrutiny from regulatory authorities.

Penalties for Non-Compliance

Not filing the BE12C form or submitting it late can result in substantial penalties. The U.S. government imposes fines for non-compliance, which can escalate depending on the duration of the delay and the amount of information that should have been reported. Understanding these penalties can motivate timely and accurate filing, helping to avoid unnecessary financial burdens.

Required Documents for the BE12C Form

When preparing to file the BE12C form, it is essential to have all required documents readily available. This may include financial statements, records of foreign investments, and any previous correspondence with the BEA. Ensuring that you have the correct documentation will facilitate a smoother filing process and help ensure that all information provided is accurate and complete.

Quick guide on how to complete how to be 12c form

Prepare How To Be 12c Form effortlessly on any device

Web-based document management has become highly favored by both businesses and individuals. It presents an ideal environmentally friendly substitute for traditional printed and signed forms, as you can access the correct document and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without holdups. Manage How To Be 12c Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign How To Be 12c Form with ease

- Find How To Be 12c Form and click on Get Form to begin.

- Utilize the tools we offer to fill in your document.

- Emphasize important sections of your documents or obscure confidential information with the tools specifically provided by airSlate SignNow for such tasks.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to finalize your changes.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of missing or lost files, tedious form hunts, and mistakes that necessitate printing new copies of documents. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device you prefer. Modify and eSign How To Be 12c Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to be 12c form

How to make an eSignature for your PDF in the online mode

How to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is a be12c claim for not filing?

A be12c claim for not filing refers to the process by which taxpayers can address and potentially rectify their tax obligations when they have failed to file required returns. This claim can help individuals gain clarity on their tax status and avoid penalties. It is an important step for those wanting to settle unpaid taxes through proper channels.

-

How can airSlate SignNow assist with a be12c claim for not filing?

airSlate SignNow can streamline the process of preparing and eSigning the necessary documents for a be12c claim for not filing, making it easier to submit them on time. With its user-friendly interface, users can quickly create, send, and legally sign documents related to their tax filing obligations. This ensures compliance and improves overall efficiency.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to fit different needs, including options for individuals, teams, and businesses. Each plan includes capabilities that can assist in managing a be12c claim for not filing. Check their website for specific pricing details and the features included in each plan.

-

Is airSlate SignNow compliant with legal regulations for tax documents?

Yes, airSlate SignNow complies with all relevant legal regulations to ensure that documents sent through the platform, including those related to a be12c claim for not filing, are legally binding and secure. This compliance helps users safely manage their important tax-related documentation.

-

Can I integrate airSlate SignNow with my existing software for better tax management?

Absolutely! airSlate SignNow integrates seamlessly with various other software programs that you may already be using for tax management. This integration can enhance how you handle a be12c claim for not filing by allowing you to merge your workflows efficiently.

-

What features make airSlate SignNow stand out for businesses addressing tax issues?

Key features of airSlate SignNow include easy document sending, customizable templates, and automated workflows, all of which help simplify the process surrounding a be12c claim for not filing. These tools empower businesses to manage their documentation efficiently and ensure timely submissions.

-

What benefits can I expect from using airSlate SignNow for my tax documentation?

Using airSlate SignNow for your tax documentation, including be12c claims for not filing, means you’ll save time and reduce the likelihood of errors. With its intuitive interface, you enhance productivity and ensure that all documents are securely signed and stored, providing peace of mind.

Get more for How To Be 12c Form

- Deni maternity pay form

- Reading log dream big read reading log form

- Pdf agriinvest program appeal submission form canada ca

- Ca de4 form

- It 203 si department of taxation and finance ny gov form

- Interior design service contract template form

- Interior design fee structure contract template form

- Football sign contract template form

Find out other How To Be 12c Form

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online