it 203 SI Department of Taxation and Finance NY Gov 2024-2026

What is the IT-203-SI?

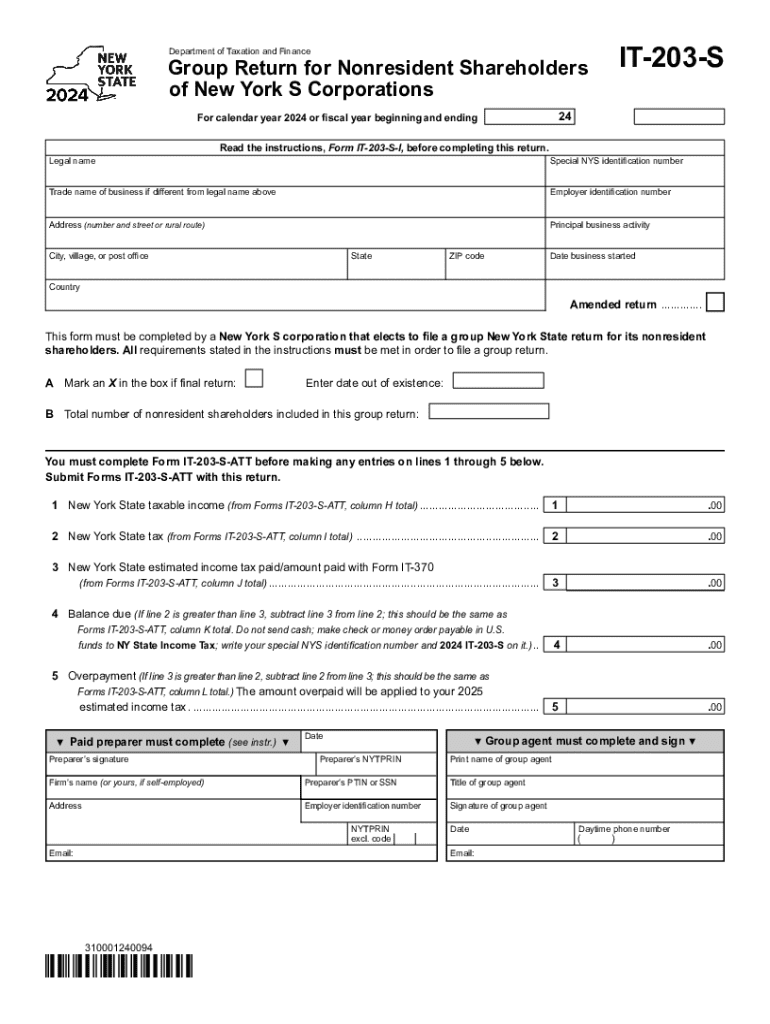

The IT-203-SI is a specific form issued by the New York State Department of Taxation and Finance. It is designed for non-resident and part-year resident taxpayers who need to report their income earned in New York State. This form helps individuals calculate their New York State tax liability based on the income they earned while residing outside of New York or only part of the year. Understanding the purpose and requirements of the IT-203-SI is essential for ensuring accurate tax reporting and compliance.

Steps to Complete the IT-203-SI

Completing the IT-203-SI requires careful attention to detail. Here are the general steps to follow:

- Gather necessary information: Collect all relevant income documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: List all income earned from New York sources, ensuring you include only the amounts that apply to the tax year in question.

- Calculate tax liability: Use the provided tax tables or formulas to determine your tax due based on the reported income.

- Review and sign: Double-check all entries for accuracy before signing and dating the form.

How to Obtain the IT-203-SI

The IT-203-SI form can be obtained directly from the New York State Department of Taxation and Finance website. It is available in both digital and printable formats, allowing taxpayers to choose the method that best suits their needs. Additionally, physical copies can often be found at local tax offices or libraries. Ensuring you have the correct version for the applicable tax year is crucial for compliance.

Filing Deadlines for the IT-203-SI

Taxpayers must be aware of the filing deadlines associated with the IT-203-SI. Typically, the form must be filed by April 15 of the year following the tax year in question. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Timely submission is vital to avoid penalties and ensure compliance with state tax regulations.

Required Documents for IT-203-SI

When preparing to file the IT-203-SI, certain documents are essential. These include:

- W-2 forms: To report wages earned in New York.

- 1099 forms: For reporting other types of income, such as freelance or contract work.

- Proof of residency: Documentation supporting your status as a non-resident or part-year resident.

- Previous tax returns: If applicable, to provide context for your current filing.

Key Elements of the IT-203-SI

The IT-203-SI includes several key elements that taxpayers must understand. These elements consist of:

- Income Calculation: A section dedicated to detailing income earned from New York sources.

- Tax Credits: Information on applicable credits that may reduce overall tax liability.

- Signature Section: A requirement for the taxpayer to sign and date the form, affirming the accuracy of the information provided.

Create this form in 5 minutes or less

Find and fill out the correct it 203 si department of taxation and finance ny gov

Create this form in 5 minutes!

How to create an eSignature for the it 203 si department of taxation and finance ny gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 203 SI Department Of Taxation And Finance NY gov?

The IT 203 SI Department Of Taxation And Finance NY gov is a tax form used by non-residents and part-year residents of New York to report income earned in the state. It is essential for ensuring compliance with New York tax laws and can be easily completed using airSlate SignNow's eSigning features.

-

How can airSlate SignNow help with the IT 203 SI Department Of Taxation And Finance NY gov?

airSlate SignNow simplifies the process of completing and submitting the IT 203 SI Department Of Taxation And Finance NY gov by allowing users to eSign documents securely and efficiently. Our platform ensures that all necessary signatures are collected, making tax filing easier and more organized.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting from a basic plan to more advanced options. Each plan provides access to features that can assist with forms like the IT 203 SI Department Of Taxation And Finance NY gov, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are particularly useful for managing tax documents like the IT 203 SI Department Of Taxation And Finance NY gov. These features streamline the process and enhance collaboration among users.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, including CRM systems and cloud storage services. This allows users to manage their IT 203 SI Department Of Taxation And Finance NY gov documents alongside other business processes, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like the IT 203 SI Department Of Taxation And Finance NY gov offers numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform ensures that your documents are handled with care and that all necessary compliance measures are met.

-

Is airSlate SignNow secure for handling sensitive tax information?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect sensitive tax information such as the IT 203 SI Department Of Taxation And Finance NY gov. You can trust that your data is safe while using our platform.

Get more for IT 203 SI Department Of Taxation And Finance NY gov

Find out other IT 203 SI Department Of Taxation And Finance NY gov

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now