Be 120 Make Form

What is the Be 120 form?

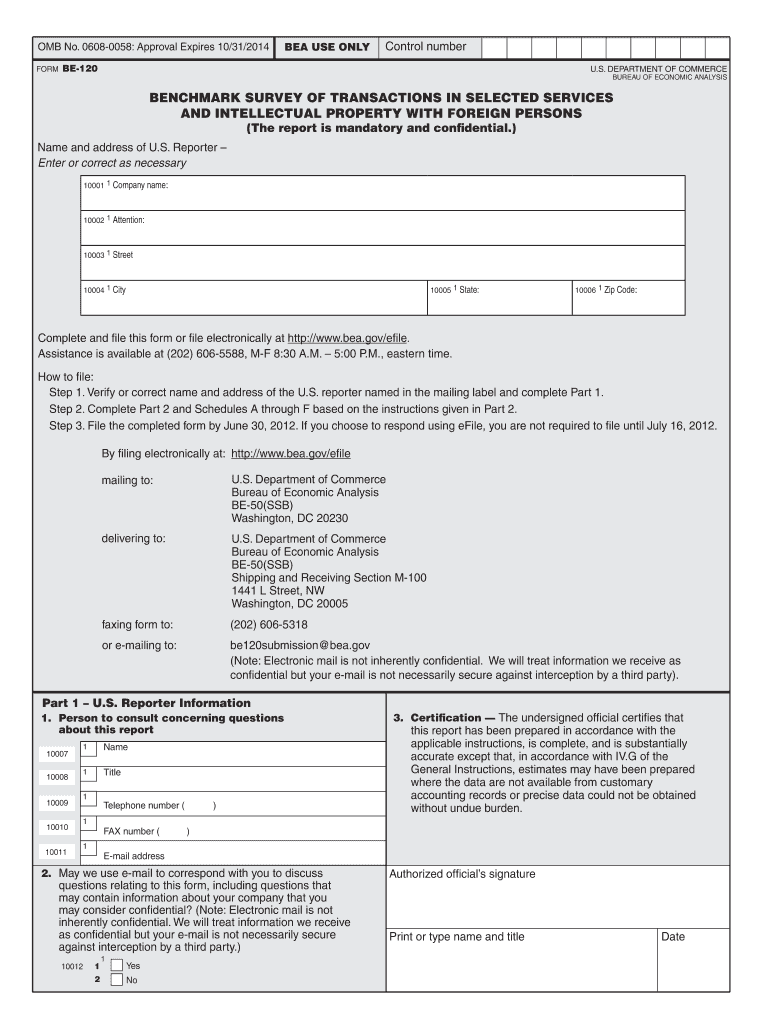

The Be 120 form is a critical document used primarily for tax purposes in the United States. It serves as a declaration for specific financial transactions and is often required by various state and federal agencies. Understanding the purpose of this form is essential for compliance and accurate reporting. The Be 120 form helps ensure that individuals and businesses report their income and expenses correctly, thereby facilitating proper tax assessments and obligations.

How to complete the Be 120 form

Completing the Be 120 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense receipts, and any relevant tax records. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. Pay special attention to the financial figures you report, as discrepancies can lead to penalties. Once completed, review the form for any errors before submission. It is advisable to consult with a tax professional if you have questions about specific entries or requirements.

Legal use of the Be 120 form

The Be 120 form must be used in accordance with applicable laws and regulations to be considered legally valid. This includes adhering to the guidelines set forth by the Internal Revenue Service (IRS) and any state-specific requirements. The form is legally binding when filled out correctly and submitted within the designated time frames. Failure to comply with these legal stipulations can result in penalties or legal repercussions. It is crucial to understand the legal implications of the Be 120 form to ensure that all transactions are conducted within the law.

Filing Deadlines / Important Dates

Filing deadlines for the Be 120 form can vary depending on the specific requirements set by the IRS and state authorities. Typically, forms must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. However, certain circumstances may allow for extensions. It is important to stay informed about any changes to these deadlines to avoid late filing penalties. Keeping a calendar of important dates related to the Be 120 form can help ensure timely submissions.

Required Documents

To complete the Be 120 form accurately, several documents are typically required. These may include:

- Income statements (W-2s, 1099s)

- Expense receipts and invoices

- Previous tax returns for reference

- Any supporting documentation for deductions or credits claimed

Having these documents organized and readily available can streamline the completion process and reduce the likelihood of errors.

Form Submission Methods

The Be 120 form can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the jurisdiction. Common submission methods include:

- Online submission through authorized e-filing platforms

- Mailing a physical copy to the appropriate tax authority

- In-person submission at designated tax offices

Each method has its own set of guidelines and processing times, so it is important to choose the one that best suits your needs.

Examples of using the Be 120 form

The Be 120 form can be utilized in various scenarios, including:

- Individuals reporting freelance income

- Small businesses declaring annual revenue

- Non-profit organizations documenting donations received

Understanding these examples can help clarify when and how to use the Be 120 form effectively in different financial situations.

Quick guide on how to complete be 120 make

Effortlessly Prepare Be 120 Make on Any Device

Digital document management has become widely embraced by both businesses and individuals. It offers an ideal environmentally friendly option to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and eSign your documents swiftly without delays. Manage Be 120 Make on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign Be 120 Make with Minimal Effort

- Find Be 120 Make and click on Get Form to begin.

- Use the tools available to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Edit and eSign Be 120 Make and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the be 120 make

How to make an eSignature for your PDF file in the online mode

How to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is the be 120 form and why is it important?

The be 120 form is a crucial document used for various business purposes, including contracts and agreements. Understanding how to utilize the be 120 form effectively can streamline your business processes and ensure compliance with legal standards.

-

How can airSlate SignNow help me with the be 120 form?

airSlate SignNow provides a user-friendly platform to easily create, send, and eSign the be 120 form. Our features ensure that your document is secure, legally binding, and can be completed swiftly, enhancing your efficiency.

-

What are the pricing options for using airSlate SignNow for the be 120 form?

airSlate SignNow offers flexible pricing plans tailored to different business sizes. Depending on your needs, you can select a plan that allows you to manage the be 120 form and other documents efficiently without exceeding your budget.

-

Are there any integrations available for the be 120 form in airSlate SignNow?

Yes, airSlate SignNow supports various integrations with popular applications, allowing you to connect the be 120 form with your existing tools. This functionality saves time and enhances workflow by keeping all your documents and communications in one place.

-

What are the benefits of eSigning the be 120 form?

eSigning the be 120 form through airSlate SignNow offers several benefits, including faster turnaround times and improved document security. It helps in reducing paper usage and managing documents digitally, promoting a sustainable and efficient workflow.

-

Is the be 120 form legally binding when signed with airSlate SignNow?

Absolutely! The be 120 form signed through airSlate SignNow is legally binding and compliant with eSignature laws. Our platform employs high-level encryption and security measures to protect your signed documents.

-

Can I track the status of the be 120 form sent through airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking of the be 120 form and other documents you send. You’ll receive notifications when the document is viewed and signed, ensuring you stay updated throughout the process.

Get more for Be 120 Make

Find out other Be 120 Make

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation