Early Ira Distribution Form 2015-2026

What is the Early IRA Distribution Form

The Early IRA Distribution Form is a crucial document used by individuals who wish to withdraw funds from their Individual Retirement Account (IRA) before reaching the age of fifty-nine and a half. This form is necessary to report the distribution and to comply with IRS regulations. Early withdrawals may incur penalties, and this form helps ensure that all necessary information is documented and submitted correctly.

How to use the Early IRA Distribution Form

To effectively use the Early IRA Distribution Form, individuals need to gather relevant information about their IRA account, including account numbers and the amount they wish to withdraw. The form typically requires personal identification details, the reason for the withdrawal, and acknowledgment of any potential penalties. Once completed, the form should be submitted to the financial institution managing the IRA for processing.

Steps to complete the Early IRA Distribution Form

Completing the Early IRA Distribution Form involves several key steps:

- Gather personal information, including your Social Security number and IRA account details.

- Indicate the amount you wish to withdraw and the reason for the early distribution.

- Review the potential tax implications and penalties associated with early withdrawal.

- Sign and date the form to confirm your request.

- Submit the completed form to your IRA custodian or financial institution.

Legal use of the Early IRA Distribution Form

The legal use of the Early IRA Distribution Form is essential for ensuring compliance with IRS regulations. This form serves as a formal request for withdrawal and documents the taxpayer's acknowledgment of any penalties that may apply. Proper use of the form protects individuals from potential legal issues related to unauthorized distributions or incorrect reporting of income.

Eligibility Criteria

To qualify for an early distribution from an IRA, individuals must meet specific eligibility criteria. Generally, these criteria include being under the age of fifty-nine and a half, experiencing financial hardship, or meeting other IRS-defined exceptions such as disability or medical expenses. Understanding these criteria is vital to avoid unnecessary penalties and ensure compliance with tax regulations.

Required Documents

When submitting the Early IRA Distribution Form, individuals may need to provide additional documentation to support their request. Required documents can include:

- Proof of identity, such as a government-issued ID.

- Documentation of the reason for withdrawal, if applicable.

- Any previous correspondence with the financial institution regarding the IRA.

Form Submission Methods

The Early IRA Distribution Form can typically be submitted through various methods, depending on the policies of the financial institution managing the IRA. Common submission methods include:

- Online submission through the financial institution's secure portal.

- Mailing a physical copy of the form to the institution's address.

- In-person submission at a local branch or office.

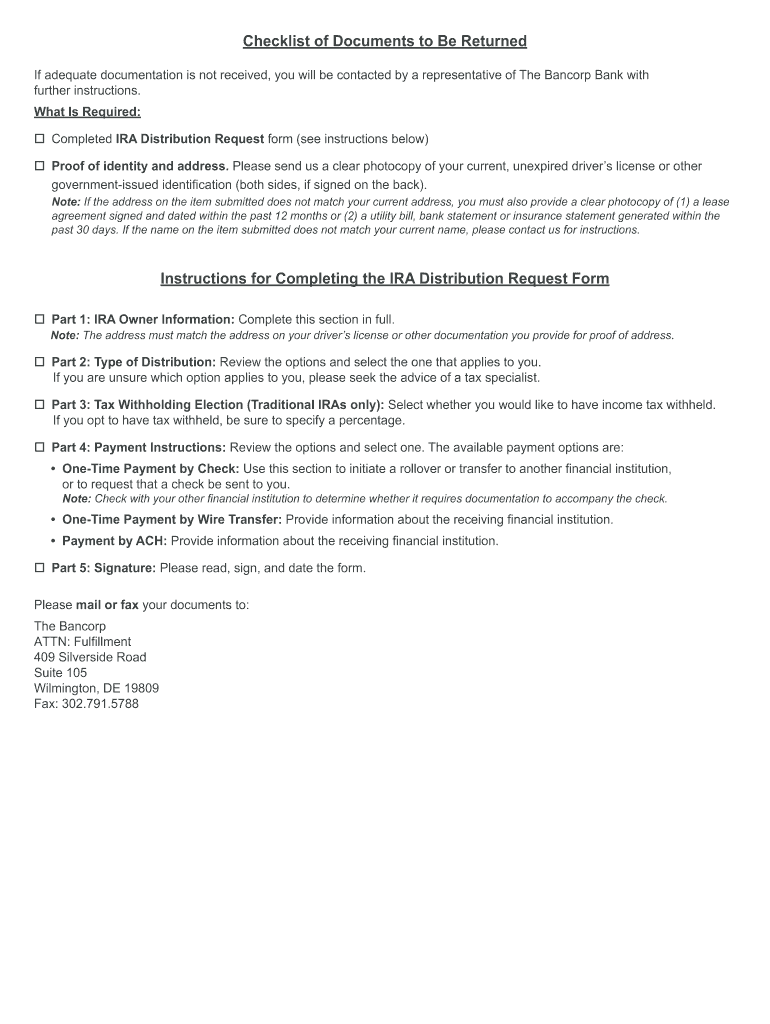

Quick guide on how to complete ira distribution request form the bancorp bank

The simplest method to locate and sign Early Ira Distribution Form

Across the entirety of your organization, unproductive workflows related to document approval can consume a substantial amount of work hours. Signing documents such as Early Ira Distribution Form is an essential aspect of operations in every sector, which is why the effectiveness of each contract’s lifecycle signNowly impacts the overall productivity of the business. With airSlate SignNow, signing your Early Ira Distribution Form can be as straightforward and quick as possible. You will discover on this platform the latest version of nearly any document. Even better, you can sign it immediately without the necessity of downloading additional software on your device or printing hard copies.

How to obtain and sign your Early Ira Distribution Form

- Explore our library by category or use the search bar to find the document you require.

- View the document preview by clicking Learn more to confirm it’s the correct one.

- Click Get form to begin editing immediately.

- Fill out your form and input any essential details using the toolbar.

- When finished, click the Sign tool to sign your Early Ira Distribution Form.

- Choose the signature option that suits you best: Draw, Create initials, or upload a picture of your handwritten signature.

- Click Done to complete editing and move on to document-sharing choices if necessary.

With airSlate SignNow, you possess everything you need to manage your documents efficiently. You can locate, complete, modify, and even send your Early Ira Distribution Form all within a single tab with no fuss. Enhance your workflows by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

I need help filling out this IRA form to withdraw money. How do I fill this out?

I am confused on the highlighted part.

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

How do I fill out the dd form for SBI bank?

Write the name of the beneficiary in the space after “in favour of “ and the branch name where the beneficiary would encash it in the space “payable at”.Fill in the amount in words and figures and the appropriate exchange .Fill up your name and address in “Applicant's name” and sign at “ applicant's signature”

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I fill out the Andhra Bank account opening form?

Follow the step by step process for filling up the Andhra Bank account opening form.Download Account Opening FormIf you don't want to read the article, watch this video tutorial or continue the post:Andhra Bank Account Opening Minimum Balance:The minimum amount required for opening Savings Account in Andhra Bank isRs. 150Andhra Bank Account Opening Required Documents:Two latest passport size photographsProof of identity - Passport, Driving license, Voter’s ID card, etc.Proof of address - Passport, Driving license, Voter’s ID card, etc. If temporary address and permanent address are different, then both addresses will have to submitted.PAN cardForm 16 (only if PAN card is not available)See More Acceptable Documents for Account OpeningNow Finally let's move to filling your Andhra Bank Account Opening Form:Step 1:Step 2:Read More…

-

How do I fill out the Axis Bank account closure form?

How To Fill Axis Bank Account Closure FormTo close your axis bank account, first you have to download the bank account closure form then submit it to your bank branch.Click the link and download the form:http://bit.ly/accntclosurepdfAfter downloading the account closure form, you have to fill up exactly as I have show below with detail. Kindly go through the filled form below and after filling the form, take all the kit like credit card, debit card, passbook and etc and submit it to your bank with the filled form.Source: How To Fill Axis Bank Account Closure Form

Create this form in 5 minutes!

How to create an eSignature for the ira distribution request form the bancorp bank

How to make an electronic signature for your Ira Distribution Request Form The Bancorp Bank in the online mode

How to generate an eSignature for your Ira Distribution Request Form The Bancorp Bank in Chrome

How to create an electronic signature for putting it on the Ira Distribution Request Form The Bancorp Bank in Gmail

How to generate an eSignature for the Ira Distribution Request Form The Bancorp Bank right from your mobile device

How to create an eSignature for the Ira Distribution Request Form The Bancorp Bank on iOS

How to make an electronic signature for the Ira Distribution Request Form The Bancorp Bank on Android

People also ask

-

What is a Bancorp IRA distribution form?

The Bancorp IRA distribution form is a document required to withdraw funds from your Bancorp IRA account. It ensures that the distribution is recorded and processed correctly. Completing this form is essential for a smooth transition of funds to your chosen account.

-

How do I obtain a Bancorp IRA distribution form?

You can obtain the Bancorp IRA distribution form directly from the Bancorp website or by contacting their customer service. The form is typically available as a downloadable PDF, making it easy to fill out. Ensure you have your account details handy while accessing the form.

-

What information is needed to complete the Bancorp IRA distribution form?

To complete the Bancorp IRA distribution form, you will need your personal information, account number, and details about the distribution amount and desired method. It’s important to provide accurate and complete information to avoid delays in processing your request.

-

Are there any fees associated with using the Bancorp IRA distribution form?

Fees may apply when processing a distribution from a Bancorp IRA, but the Bancorp IRA distribution form itself does not incur any costs. It's advisable to review your account statements or contact Bancorp for any applicable fees that may be associated with your distribution.

-

How long does it take to process a Bancorp IRA distribution form?

Typically, it takes 5 to 10 business days for Bancorp to process a distribution request after submitting the Bancorp IRA distribution form. Factors such as the method of distribution may affect processing times. Always check with Bancorp for the most accurate timelines.

-

Can I use airSlate SignNow to eSign my Bancorp IRA distribution form?

Yes, airSlate SignNow offers a user-friendly platform that allows you to easily eSign your Bancorp IRA distribution form. This service enhances the speed and efficiency of the signing process, ensuring your documents are processed quickly. Utilizing airSlate SignNow can streamline your experience signNowly.

-

What are the benefits of using airSlate SignNow for Bancorp IRA distribution forms?

Using airSlate SignNow for your Bancorp IRA distribution forms provides a cost-effective and secure solution for document signing. It simplifies the process, allows for real-time tracking, and ensures compliance with legal requirements. You can save time while ensuring your forms are accurate and completed on time.

Get more for Early Ira Distribution Form

Find out other Early Ira Distribution Form

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document