Monthly Filer Forms Form ST 809 Series Department of Taxation and 2020

What is the Monthly Filer Forms Form ST 809 Series Department Of Taxation And

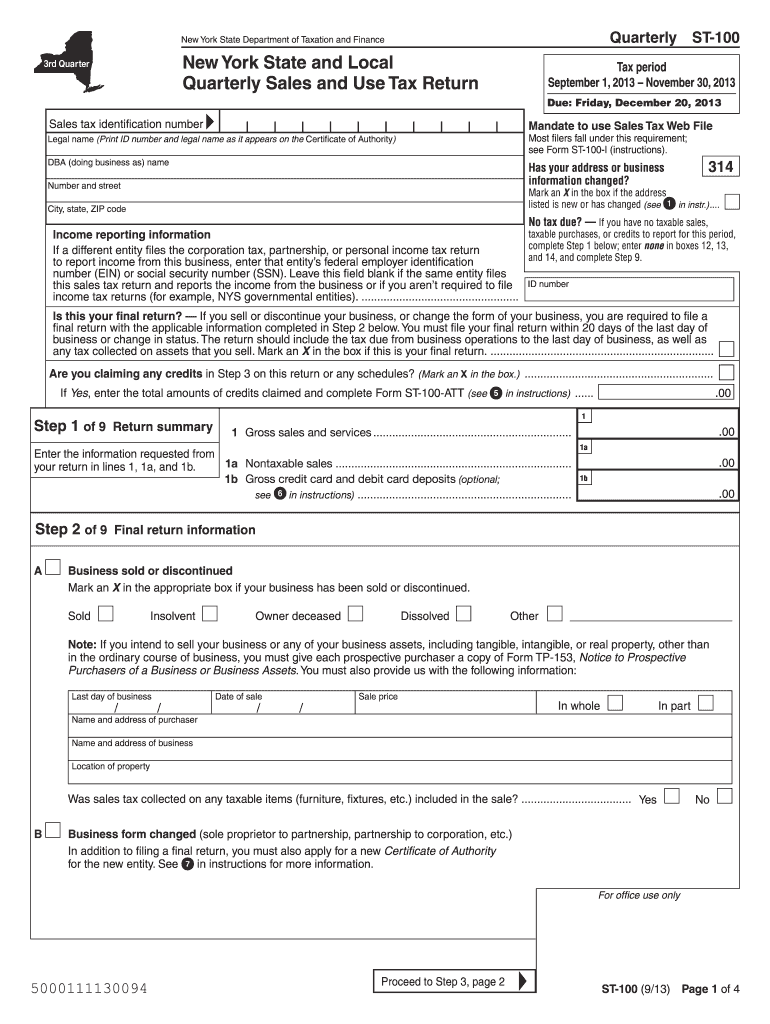

The Monthly Filer Forms Form ST 809 Series is a crucial document used by businesses to report sales and use tax in a timely manner. This form is specifically designed for entities that are required to file their tax returns on a monthly basis. By utilizing this form, businesses ensure compliance with state tax regulations, allowing for accurate reporting of taxable sales and the corresponding tax owed. Understanding the purpose and requirements of this form is essential for maintaining good standing with the Department of Taxation.

Steps to complete the Monthly Filer Forms Form ST 809 Series Department Of Taxation And

Completing the Monthly Filer Forms Form ST 809 Series involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including sales receipts and previous tax filings. Next, accurately fill out each section of the form, ensuring that all figures are correct and reflect your monthly sales activity. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the form by the designated deadline, either electronically or via mail, as per the guidelines provided by the Department of Taxation.

Legal use of the Monthly Filer Forms Form ST 809 Series Department Of Taxation And

The Monthly Filer Forms Form ST 809 Series holds legal significance as it serves as an official record of a business's sales and use tax obligations. To ensure its legal standing, it is important to adhere to the specific filing requirements set forth by state regulations. The form must be completed accurately, and any signatures required should be executed in accordance with eSignature laws, ensuring that the document is legally binding. Utilizing a reliable digital platform for completion can enhance security and compliance with legal standards.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting the Monthly Filer Forms Form ST 809 Series. The most efficient method is often online submission, which allows for immediate processing and confirmation. Alternatively, businesses can choose to mail the completed form to the appropriate tax office, ensuring it is sent with sufficient time to meet the filing deadline. In-person submission is also an option for those who prefer direct interaction with tax officials or need assistance with the form. Each method has its own advantages, and businesses should select the one that best suits their needs.

Filing Deadlines / Important Dates

Timely filing of the Monthly Filer Forms Form ST 809 Series is essential to avoid penalties. Generally, the deadline for submission is the last day of the month following the reporting period. For example, forms for sales made in January must be filed by the end of February. It is important for businesses to keep track of these deadlines and any changes that may occur due to state regulations. Marking these dates on a calendar can help ensure compliance and avoid unnecessary fines.

Key elements of the Monthly Filer Forms Form ST 809 Series Department Of Taxation And

Key elements of the Monthly Filer Forms Form ST 809 Series include sections for reporting gross sales, exempt sales, and the total sales tax collected. Additionally, the form requires identification information about the business, such as the tax identification number and contact details. Accurate reporting of these elements is crucial for determining the correct tax liability. Ensuring all information is complete and precise will help facilitate a smooth filing process and minimize the risk of audits or penalties.

Quick guide on how to complete monthly filer forms form st 809 series department of taxation and

Manage Monthly Filer Forms Form ST 809 Series Department Of Taxation And effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers a convenient eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Handle Monthly Filer Forms Form ST 809 Series Department Of Taxation And on any device with the airSlate SignNow apps for Android or iOS and enhance any document-centric workflow today.

How to modify and electronically sign Monthly Filer Forms Form ST 809 Series Department Of Taxation And with ease

- Obtain Monthly Filer Forms Form ST 809 Series Department Of Taxation And and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form: via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require reprinting fresh copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign Monthly Filer Forms Form ST 809 Series Department Of Taxation And and maintain superior communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct monthly filer forms form st 809 series department of taxation and

Create this form in 5 minutes!

How to create an eSignature for the monthly filer forms form st 809 series department of taxation and

The best way to make an eSignature for a PDF in the online mode

The best way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What are Monthly Filer Forms Form ST 809 Series Department Of Taxation And?

Monthly Filer Forms Form ST 809 Series Department Of Taxation And are specific documents required for businesses to report and pay certain tax obligations. airSlate SignNow simplifies the process of preparing, signing, and submitting these forms electronically, making it easier for businesses to stay compliant.

-

How can airSlate SignNow help with Monthly Filer Forms Form ST 809 Series Department Of Taxation And?

airSlate SignNow offers a user-friendly platform that enables businesses to manage Monthly Filer Forms Form ST 809 Series Department Of Taxation And efficiently. You can create, eSign, and store these forms securely, ensuring that all submissions are accurate and timely, thereby reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for Monthly Filer Forms Form ST 809 Series Department Of Taxation And?

Yes, airSlate SignNow provides various pricing plans to accommodate different business needs. Our plans are designed to deliver cost-effective solutions for managing Monthly Filer Forms Form ST 809 Series Department Of Taxation And, providing value through improved productivity and compliance.

-

What features does airSlate SignNow offer for Monthly Filer Forms Form ST 809 Series Department Of Taxation And?

airSlate SignNow includes features such as customizable templates, secure eSigning, document tracking, and cloud storage for your Monthly Filer Forms Form ST 809 Series Department Of Taxation And. These tools streamline the filing process, making it convenient for businesses to handle their tax obligations efficiently.

-

Can I integrate airSlate SignNow with other platforms for Monthly Filer Forms Form ST 809 Series Department Of Taxation And?

Absolutely! airSlate SignNow supports integration with various applications like Salesforce, Google Drive, and more. This ensures that you can seamlessly manage your Monthly Filer Forms Form ST 809 Series Department Of Taxation And alongside your existing workflows.

-

What are the benefits of using airSlate SignNow for Monthly Filer Forms Form ST 809 Series Department Of Taxation And?

Using airSlate SignNow for Monthly Filer Forms Form ST 809 Series Department Of Taxation And offers several benefits, including enhanced efficiency, reduced paperwork, and improved compliance. Our platform allows you to manage all forms electronically, saving time, minimizing errors, and ensuring that your submissions are filed on time.

-

How secure is airSlate SignNow for handling Monthly Filer Forms Form ST 809 Series Department Of Taxation And?

Security is paramount at airSlate SignNow. We utilize advanced encryption methods and comply with regulations to ensure that your Monthly Filer Forms Form ST 809 Series Department Of Taxation And are stored and transmitted securely, protecting sensitive information throughout the signing process.

Get more for Monthly Filer Forms Form ST 809 Series Department Of Taxation And

Find out other Monthly Filer Forms Form ST 809 Series Department Of Taxation And

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement