Et 706 Instructions Form 2020

What is the Et 706 Instructions Form

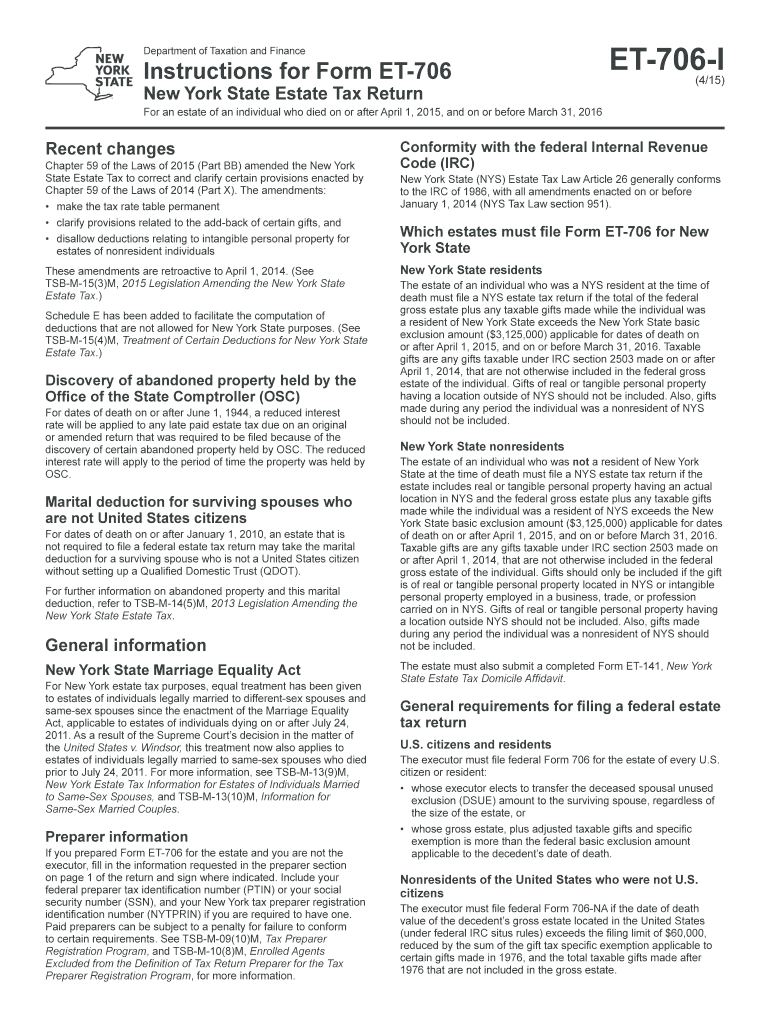

The Et 706 Instructions Form is a crucial document used in the United States for estate tax purposes. It provides detailed guidelines on how to report the value of an estate and calculate any taxes owed. This form is essential for executors or administrators of estates, ensuring compliance with federal tax regulations. The instructions outline the necessary steps, required information, and specific calculations needed to accurately complete the form.

How to use the Et 706 Instructions Form

Using the Et 706 Instructions Form involves several key steps to ensure accurate completion. First, gather all relevant financial information regarding the deceased's assets and liabilities. Next, carefully follow the instructions provided in the form to report the estate's value. It is important to include all necessary documentation, such as appraisals and financial statements, to support the reported values. Additionally, ensure that all signatures are properly obtained to validate the submission.

Steps to complete the Et 706 Instructions Form

Completing the Et 706 Instructions Form requires a systematic approach:

- Begin by reviewing the form's guidelines to understand the required information.

- Collect documentation related to the estate, including asset valuations and debts.

- Fill out the form by entering the necessary data in the specified sections.

- Double-check all entries for accuracy and completeness.

- Obtain the required signatures from the executor or administrator.

- Submit the completed form to the appropriate tax authority by the specified deadline.

Legal use of the Et 706 Instructions Form

The Et 706 Instructions Form is legally binding when completed and submitted according to IRS regulations. It must be filled out accurately to avoid penalties or legal issues. The form serves as an official declaration of the estate's value and the taxes owed, making it essential for compliance with federal estate tax laws. Executors should ensure that all information is truthful and substantiated by proper documentation to uphold the form's legal integrity.

Filing Deadlines / Important Dates

Filing deadlines for the Et 706 Instructions Form are critical to avoid penalties. Typically, the form must be filed within nine months of the date of death. However, extensions may be available in certain circumstances. It is important to stay informed about any changes to deadlines or requirements by consulting the IRS guidelines or a tax professional. Missing the deadline can result in significant financial repercussions for the estate.

Required Documents

To complete the Et 706 Instructions Form, several documents are required:

- Death certificate of the deceased.

- Asset valuations, including appraisals for real estate and personal property.

- Financial statements detailing debts and liabilities.

- Documentation of any prior gifts made by the deceased.

- Tax returns for the deceased, if applicable.

Who Issues the Form

The Et 706 Instructions Form is issued by the Internal Revenue Service (IRS). As the federal agency responsible for tax administration, the IRS provides the necessary forms and guidelines for estate tax reporting. Executors should ensure they are using the most current version of the form to comply with any updates or changes in tax law.

Quick guide on how to complete et 706 instructions 2015 form

Prepare Et 706 Instructions Form easily on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly solution compared to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Et 706 Instructions Form on any device with airSlate SignNow’s Android or iOS applications and enhance any document-based workflow today.

The easiest way to alter and eSign Et 706 Instructions Form effortlessly

- Obtain Et 706 Instructions Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important parts of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your delivery method for the form: via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Alter and eSign Et 706 Instructions Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct et 706 instructions 2015 form

Create this form in 5 minutes!

How to create an eSignature for the et 706 instructions 2015 form

The best way to make an eSignature for a PDF document online

The best way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the Et 706 Instructions Form and why is it important?

The Et 706 Instructions Form is a critical document required for federal estate tax reporting. Understanding its nuances can help ensure compliance with IRS regulations, making it vital for trustees and executors. With the right guidance, completing this form can be streamlined and less stressful.

-

How can airSlate SignNow assist with the Et 706 Instructions Form?

AirSlate SignNow offers an easy-to-use platform that allows users to complete and eSign documents like the Et 706 Instructions Form efficiently. Our features simplify the signing process, ensuring that all necessary parties can quickly and securely authorize documents. This can signNowly reduce turnaround times for estate planning.

-

What are the pricing options for airSlate SignNow related to the Et 706 Instructions Form?

AirSlate SignNow offers flexible pricing plans that cater to different business needs, including those requiring the Et 706 Instructions Form. Our pricing packages are competitive and provide great value for businesses looking for an efficient eSignature solution. You can choose plans based on your document volume and feature requirements.

-

Are there any integrations available for handling the Et 706 Instructions Form?

Yes, airSlate SignNow integrates seamlessly with various applications that can facilitate the management and submission of the Et 706 Instructions Form. These integrations enhance workflow efficiency by allowing users to connect their favorite tools directly to the signing platform. This helps streamline the process of managing estate documents.

-

What features does airSlate SignNow offer for the Et 706 Instructions Form?

AirSlate SignNow provides numerous features designed to make the completion and eSigning of the Et 706 Instructions Form straightforward. Features such as reusable templates, real-time notifications, and audit trails enhance the signing process, ensuring that everything is organized and completed on time. This ensures that users can focus on compliance rather than paperwork.

-

Is it secure to use airSlate SignNow for the Et 706 Instructions Form?

Absolutely! Security is a top priority at airSlate SignNow. We employ strong encryption methods to protect your sensitive information, ensuring that your Et 706 Instructions Form and other documents remain confidential and secure throughout the signing process.

-

Can multiple people sign the Et 706 Instructions Form using airSlate SignNow?

Yes, airSlate SignNow allows multiple parties to eSign the Et 706 Instructions Form in a simple and efficient manner. Our platform enables sequential or simultaneous signing options, making it easy for all necessary participants to complete the form without delays or complications. This collaborative feature is particularly useful in estate management scenarios.

Get more for Et 706 Instructions Form

- Mississippi chancery court divorce forms

- Loden hotel work application form

- The great debaters movie response worksheet answer key pdf form

- Blood pressure log sheets printable form

- Hdfc passbook request form

- Arfur mo transition to high school form

- Micro teaching evaluation form

- Barangay clearance sample form

Find out other Et 706 Instructions Form

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement