Principal Business Code Form

What is the Principal Business Code

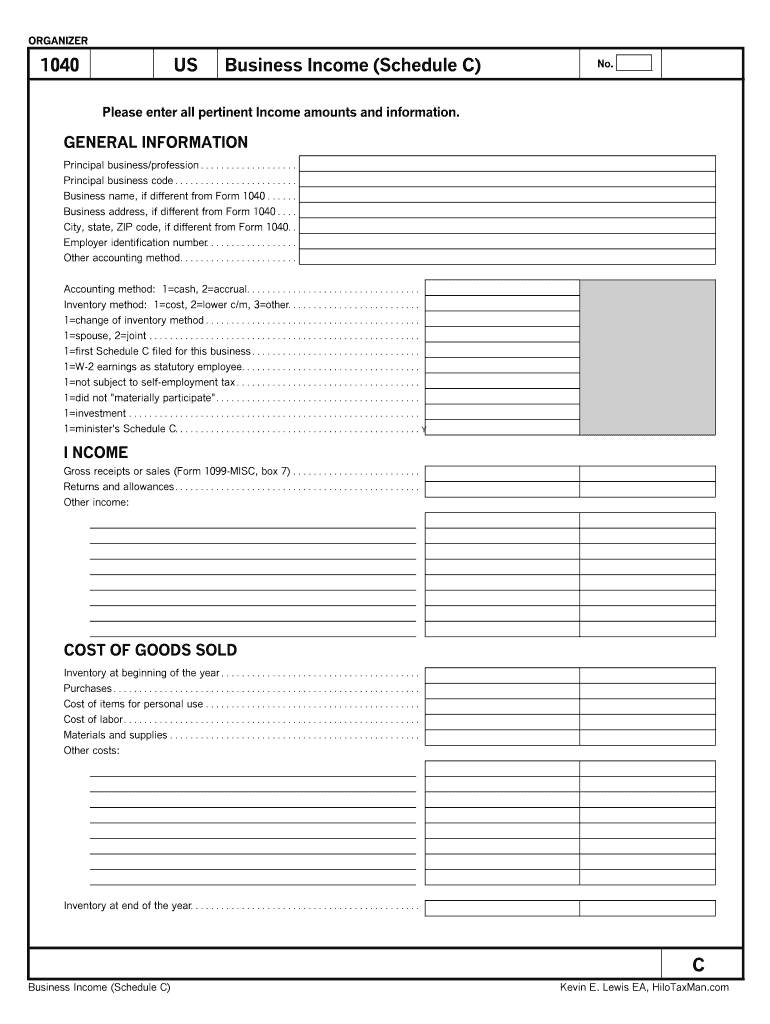

The principal business code is a numeric identifier that categorizes the primary business activity of an entity. For businesses operating in the United States, this code is essential for tax reporting purposes. The IRS assigns specific codes to various industries, enabling businesses to report their activities accurately on tax forms, such as Schedule C. The business code 999000 is designated for businesses that do not fit into any specific category, often referred to as "other." Understanding this code helps ensure compliance with IRS regulations and facilitates accurate tax filings.

How to Use the Principal Business Code

Using the principal business code involves accurately identifying the code that corresponds to your primary business activity. When filling out tax forms, such as the Schedule C, you will need to enter the appropriate code in the designated section. This code informs the IRS about the nature of your business, which can affect tax obligations and eligibility for certain deductions. It is crucial to ensure that the code reflects your primary business activity to avoid potential issues with tax compliance.

Steps to Complete the Principal Business Code

Completing the principal business code requires a few straightforward steps:

- Determine your primary business activity by reviewing your operations and services.

- Consult the IRS list of business codes to find the one that best matches your activity.

- Enter the selected code on your tax form, ensuring accuracy to prevent any discrepancies.

- Keep a record of the code used for your filings for future reference and compliance checks.

Legal Use of the Principal Business Code

The legal use of the principal business code is crucial for ensuring compliance with federal tax laws. The IRS requires businesses to accurately report their primary activities using the appropriate codes. Misrepresentation or incorrect coding can lead to audits, penalties, or other legal repercussions. By using the correct business code, entities affirm their commitment to transparency and adherence to tax regulations, which is essential for maintaining good standing with the IRS.

IRS Guidelines

The IRS provides specific guidelines regarding the use of principal business codes. It is important to refer to the IRS instructions for Schedule C or other relevant forms to ensure compliance. These guidelines outline how to select the appropriate code based on your business activities and detail the implications of using incorrect codes. Staying informed about these guidelines helps businesses navigate tax reporting effectively and avoid potential pitfalls.

Required Documents

When filing taxes and using the principal business code, certain documents are typically required. These may include:

- Financial statements that detail income and expenses.

- Tax forms, such as Schedule C, where the principal business code will be entered.

- Supporting documentation for any deductions claimed, which may be influenced by the business code.

Having these documents organized and ready will facilitate a smoother filing process and ensure compliance with IRS requirements.

Quick guide on how to complete what is a principal business code on schedule c form

Complete Principal Business Code effortlessly on any device

Managing documents online has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Principal Business Code on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to alter and electronically sign Principal Business Code with ease

- Find Principal Business Code and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize crucial sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Edit and eSign Principal Business Code to ensure excellent communication at every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What is the shipping postal code, and how do I fill out this form?

It seems to me that in your country, you'd call this a Post Code.

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

How can a chicken merchant or a fish seller fill the PAN form and what business code does he need to use?

First of all obtain a PAN application form and read it thoroughly. There is no column where in you have to mention whether you are selling chicken ,fish, pork or beef. In the form you have to mention whether you are an Individual, Firm, HUF, AOP, BOI or a limited company if so private or public. If you are an individual you have to affix two photographs and attest them. In case of HUF you have to give an affidavit mentioning date of formation of HUF and names and addresses of Co-parcenors.In case of others you have to give proof of registration. Hope this helps.

-

Everytime when I get a question or fill out a form, it always asks for a promo code, what is a promo code?

In e-commerce and online shopping a coupon code, or promo code, is a computer-generated code, consisting of letters or numbers that consumers can enter into a promotional box on a site's shopping cart to obtain a discount on their purchase.

-

What forms should I fill out to start a business?

From a legal business entity standpoint, one does not normally have to file any forms with the state the business is located in to be considered a sole proprietor (SP). However, this highly unadvisable since a SP provides no liability protection.The most popular, and most advisable business entities are a Limited Liability Company (LLC) and a Corporation. These entities are state created entities meaning that you must file the necessary paperwork in the state where you will have the business headquarters. The state’s secretary of state’s office will have all the necessary documents, forms, and rules needed to create the entity of your choice. You will also have to pay a filing fee.It is important that you further discuss the issue with experienced counsel as they will be able to help you decide which entity is best for you, and help you with the filing.

Create this form in 5 minutes!

How to create an eSignature for the what is a principal business code on schedule c form

How to create an eSignature for your What Is A Principal Business Code On Schedule C Form in the online mode

How to make an electronic signature for the What Is A Principal Business Code On Schedule C Form in Google Chrome

How to create an eSignature for signing the What Is A Principal Business Code On Schedule C Form in Gmail

How to generate an electronic signature for the What Is A Principal Business Code On Schedule C Form right from your smart phone

How to make an electronic signature for the What Is A Principal Business Code On Schedule C Form on iOS devices

How to make an electronic signature for the What Is A Principal Business Code On Schedule C Form on Android OS

People also ask

-

What is a Principal Business Code and why do I need it?

A Principal Business Code is a classification code that identifies the primary business activity of your organization. It’s essential for various processes, including tax filings, business registrations, and compliance. Understanding your Principal Business Code can help ensure that your business is categorized correctly, which is crucial for reporting and regulatory purposes.

-

How can airSlate SignNow help me with my Principal Business Code?

airSlate SignNow streamlines the document signing process, making it easier to manage forms that may require your Principal Business Code. You can create, send, and electronically sign documents efficiently, ensuring that all necessary information, including your Principal Business Code, is accurately captured and stored.

-

Is there a cost associated with using airSlate SignNow for documenting my Principal Business Code?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses of all sizes. These plans provide access to features that can help manage your Principal Business Code documentation seamlessly. You can choose a plan that fits your budget while benefiting from our robust eSigning capabilities.

-

What features does airSlate SignNow offer that relate to my Principal Business Code?

airSlate SignNow provides features such as customizable templates and automated workflows, which can help ensure that your Principal Business Code is included in all relevant documents. Additionally, the platform offers secure storage and easy retrieval of signed documents, making it simple to reference your Principal Business Code when needed.

-

Can I integrate airSlate SignNow with other tools to manage my Principal Business Code?

Absolutely! airSlate SignNow integrates with various applications, allowing you to connect your workflow and manage documents that involve your Principal Business Code effectively. Whether you’re using CRM systems or accounting software, our integration capabilities can help streamline your document management process.

-

How does airSlate SignNow ensure the security of documents containing my Principal Business Code?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption technologies and adheres to industry standards to protect all documents, including those containing your Principal Business Code. You can confidently send and store sensitive information, knowing that it is secure.

-

What benefits will I gain from using airSlate SignNow for my business documents related to Principal Business Code?

Using airSlate SignNow can signNowly enhance your document management efficiency, especially for documents related to your Principal Business Code. You’ll experience faster turnaround times for signatures, reduced paper usage, and improved compliance with regulations, all while saving costs on traditional document handling.

Get more for Principal Business Code

Find out other Principal Business Code

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later