New York Et 706 Estate Tax Return Form 2020

What is the New York ET-706 Estate Tax Return Form

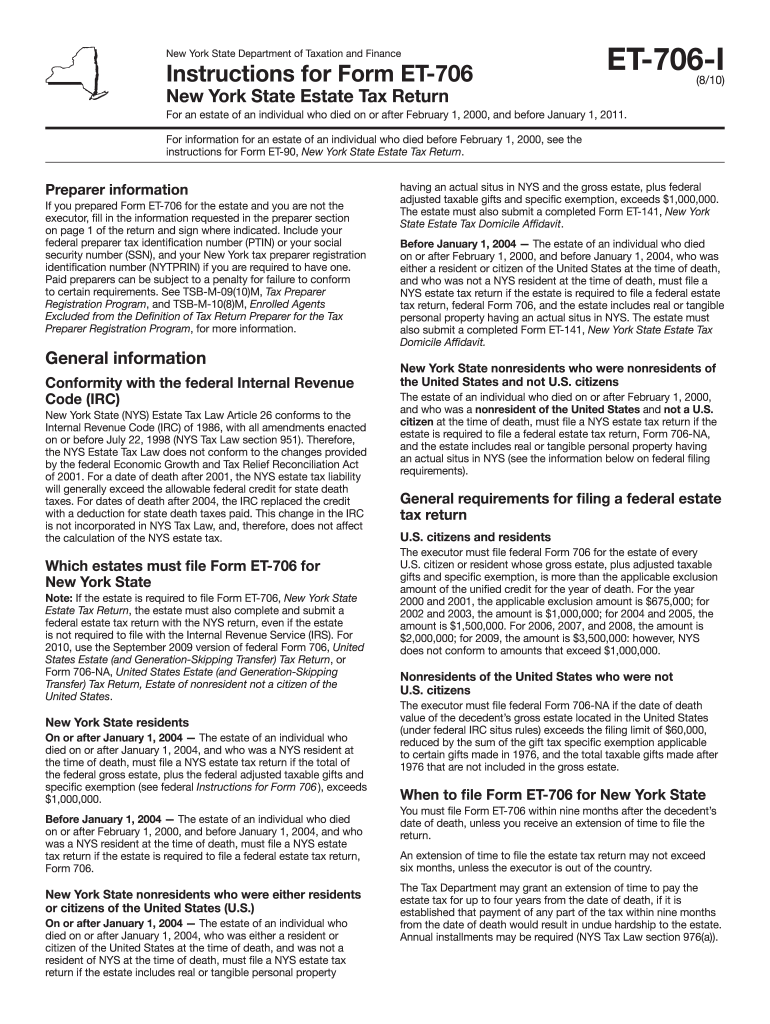

The New York ET-706 Estate Tax Return Form is a crucial document required for reporting the estate tax obligations of decedents who pass away while residing in New York State. This form is used to calculate the estate tax owed based on the value of the deceased's estate, which includes all assets such as real estate, bank accounts, and personal property. The form must be filed with the New York State Department of Taxation and Finance within nine months of the date of death, unless an extension is granted. Understanding the purpose and requirements of this form is essential for executors and administrators managing an estate.

Steps to Complete the New York ET-706 Estate Tax Return Form

Completing the New York ET-706 Estate Tax Return Form involves several key steps:

- Gather necessary information about the decedent's assets, liabilities, and any deductions applicable to the estate.

- Complete the form by accurately reporting the total value of the estate, including real estate, financial accounts, and personal belongings.

- Calculate the estate tax using the appropriate tax rates and brackets as outlined by New York State.

- Ensure all required signatures are obtained from the executor or administrator of the estate.

- Review the completed form for accuracy and completeness before submission.

Legal Use of the New York ET-706 Estate Tax Return Form

The New York ET-706 Estate Tax Return Form is legally binding when properly completed and submitted. It serves as an official declaration of the estate's tax liability and must adhere to the regulations set forth by New York State law. Accurate reporting is essential, as any discrepancies may lead to penalties or legal issues. The form must be filed in accordance with the state's deadlines to avoid additional interest and penalties on unpaid taxes.

Filing Deadlines / Important Dates

Filing the New York ET-706 Estate Tax Return Form is time-sensitive. The form is due within nine months of the decedent's date of death. If additional time is needed, an extension request must be submitted, which may extend the deadline by up to six months. It is important to keep track of these deadlines to ensure compliance and avoid unnecessary penalties. Executors should also be aware of any specific dates related to payment of the estate tax, as these may differ from the filing deadline.

Required Documents

To complete the New York ET-706 Estate Tax Return Form, several documents are required:

- A copy of the decedent's death certificate.

- Documentation of all assets, including appraisals for real estate and valuations for personal property.

- Records of any debts or liabilities owed by the estate.

- Any prior tax returns that may impact the estate tax calculation.

- Proof of any deductions or exemptions that apply to the estate.

Form Submission Methods

The New York ET-706 Estate Tax Return Form can be submitted through various methods. Executors have the option to file the form online through the New York State Department of Taxation and Finance website, or they can choose to mail a paper version of the form. In-person submissions may also be possible at designated tax offices. It is important to retain proof of submission, regardless of the method chosen, to ensure compliance with filing requirements.

Quick guide on how to complete new york et 706 estate tax return 2008 2010 form

Effortlessly Prepare New York Et 706 Estate Tax Return Form on Any Device

The management of online documents has become increasingly favored by both companies and individuals. It offers an excellent environmentally friendly substitute to traditional printed and signed documents, as you can find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle New York Et 706 Estate Tax Return Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign New York Et 706 Estate Tax Return Form with Ease

- Find New York Et 706 Estate Tax Return Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow has specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal authority as a traditional wet signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form: via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign New York Et 706 Estate Tax Return Form and ensure seamless communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york et 706 estate tax return 2008 2010 form

Create this form in 5 minutes!

How to create an eSignature for the new york et 706 estate tax return 2008 2010 form

The way to make an electronic signature for your PDF online

The way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What is the New York Et 706 Estate Tax Return Form?

The New York Et 706 Estate Tax Return Form is a tax document required for reporting the estate tax liability of decedents in New York State. This form helps ensure compliance with state tax regulations, allowing executors to accurately report the value of the estate to determine any tax owed. Completing this form is crucial for settling an estate properly.

-

Why do I need to file the New York Et 706 Estate Tax Return Form?

Filing the New York Et 706 Estate Tax Return Form is essential to ensure that your estate complies with New York State tax laws. If the gross estate exceeds the exemption threshold, failure to file can result in penalties and interest on unpaid taxes. This form protects your estate's beneficiaries by ensuring proper handling of tax obligations.

-

How can airSlate SignNow help with the New York Et 706 Estate Tax Return Form?

airSlate SignNow simplifies the process of preparing and submitting the New York Et 706 Estate Tax Return Form by providing an intuitive platform for document management and eSigning. With our solution, you can easily send, eSign, and store the form securely, ensuring it's ready to be filed on time. This streamlines the workflow, saving you time and reducing errors.

-

What features does airSlate SignNow offer for handling estate tax forms?

airSlate SignNow offers features like customizable templates, advanced eSignature capabilities, and secure cloud storage that are ideal for handling estate tax forms such as the New York Et 706 Estate Tax Return Form. These tools allow users to streamline their document processes, ensuring efficient preparation and compliance with tax requirements. This enhances productivity while safeguarding sensitive information.

-

Is there a cost associated with using airSlate SignNow for my New York Et 706 Estate Tax Return Form?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective compared to traditional solutions. Our pricing plans are flexible, allowing you to choose one that fits your budget and needs, while ensuring you have all the tools necessary for managing your New York Et 706 Estate Tax Return Form effectively. We aim to provide excellent value and support for all users.

-

Can I integrate airSlate SignNow with other software tools?

Absolutely! airSlate SignNow offers integration capabilities with various software tools, enhancing your workflow when working on the New York Et 706 Estate Tax Return Form. Whether you need to connect with accounting software, CRM systems, or cloud storage solutions, our platform supports seamless integration, making it easier to manage your documents in one place.

-

What are the benefits of using airSlate SignNow for tax form management?

Using airSlate SignNow for tax form management, including the New York Et 706 Estate Tax Return Form, brings several benefits such as reduced paperwork, faster processing times, and enhanced security for sensitive information. Our platform's user-friendly interface helps users navigate form preparation effortlessly, ensuring compliance and minimizing the risk of errors during the filing process. This ultimately leads to a smoother estate management experience.

Get more for New York Et 706 Estate Tax Return Form

Find out other New York Et 706 Estate Tax Return Form

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form