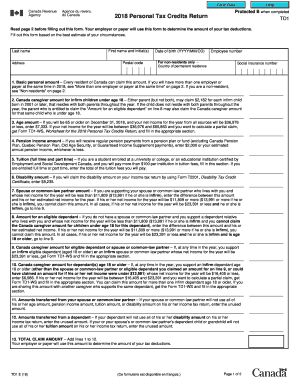

Personal Tax Credits Return Canada Ca 2021

What is the Personal Tax Credits Return Canada ca

The Personal Tax Credits Return Canada ca is a form used by individuals to claim various personal tax credits available under Canadian tax law. It is essential for taxpayers who want to ensure they receive the appropriate credits that can reduce their overall tax liability. This form is typically submitted alongside the annual income tax return and helps the Canada Revenue Agency (CRA) assess eligibility for credits such as the basic personal amount, age amount, and disability tax credit.

Steps to complete the Personal Tax Credits Return Canada ca

Completing the Personal Tax Credits Return Canada ca involves several key steps:

- Gather necessary personal information, including your Social Insurance Number (SIN) and details about your spouse or common-law partner, if applicable.

- Identify the tax credits you are eligible for by reviewing the criteria outlined by the CRA.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the completed form for any errors or omissions.

- Submit the form along with your income tax return, either electronically or by mail.

Legal use of the Personal Tax Credits Return Canada ca

The legal use of the Personal Tax Credits Return Canada ca is governed by Canadian tax laws. It is crucial to fill out the form truthfully and accurately, as any misrepresentation can lead to penalties or legal repercussions. The form must be submitted within the designated filing period to ensure compliance with tax regulations. Utilizing electronic signature tools can enhance the security and legality of the submission process, ensuring that the document is recognized as valid by the CRA.

Eligibility Criteria

To qualify for the credits claimed on the Personal Tax Credits Return Canada ca, individuals must meet specific eligibility criteria, which may include:

- Being a resident of Canada for tax purposes.

- Meeting age requirements for certain credits, such as the age amount.

- Having a valid Social Insurance Number (SIN).

- Providing documentation to support claims for disability or other specific credits.

Form Submission Methods (Online / Mail / In-Person)

The Personal Tax Credits Return Canada ca can be submitted through various methods:

- Online: Many taxpayers choose to file electronically through certified tax software, which streamlines the process and allows for immediate confirmation of submission.

- Mail: Individuals can print the completed form and send it to the CRA via postal service. This method may take longer for processing.

- In-Person: Some individuals may opt to deliver their forms directly to a local CRA office, although this is less common.

Filing Deadlines / Important Dates

Filing deadlines for the Personal Tax Credits Return Canada ca align with the annual income tax return deadlines. Typically, individual taxpayers must submit their returns by April 30 of the following year. If April 30 falls on a weekend, the deadline may be extended to the next business day. It is essential to be aware of these dates to avoid late filing penalties and ensure timely processing of tax credits.

Quick guide on how to complete 2018 personal tax credits return canadaca

Easily Prepare Personal Tax Credits Return Canada ca on Any Device

The management of documents online has gained signNow traction among both organizations and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and effortlessly. Handle Personal Tax Credits Return Canada ca across any platform using airSlate SignNow's Android or iOS applications and simplify any document-oriented task today.

How to Edit and Electronically Sign Personal Tax Credits Return Canada ca with Ease

- Find Personal Tax Credits Return Canada ca and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize crucial sections of your documents or obscure sensitive information with the tools specifically designed by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and electronically sign Personal Tax Credits Return Canada ca to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 personal tax credits return canadaca

Create this form in 5 minutes!

How to create an eSignature for the 2018 personal tax credits return canadaca

The way to generate an electronic signature for a PDF document in the online mode

The way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the Personal Tax Credits Return Canada ca?

The Personal Tax Credits Return Canada ca is a form used by individuals to claim various tax credits when filing their income tax. By using this return, eligible taxpayers can reduce their overall tax burden. Properly completing the Personal Tax Credits Return Canada ca ensures you take full advantage of available credits.

-

How does airSlate SignNow help with the Personal Tax Credits Return Canada ca process?

airSlate SignNow simplifies the process of signing and submitting the Personal Tax Credits Return Canada ca electronically. With its user-friendly interface, users can easily fill out and eSign forms, ensuring a smoother and faster submission. This integration helps to minimize errors and enhances the overall efficiency of filing tax returns.

-

What are the pricing options for using airSlate SignNow to file the Personal Tax Credits Return Canada ca?

airSlate SignNow offers competitive pricing plans tailored to fit different business needs. Whether you're an individual or a business, you can choose a plan that provides access to essential features for managing documents like the Personal Tax Credits Return Canada ca. Pricing is transparent, allowing you to budget effectively for your tax needs.

-

Are there any specific features of airSlate SignNow that assist with the Personal Tax Credits Return Canada ca?

Yes, airSlate SignNow offers features like document templates, customizable workflows, and secure cloud storage which can signNowly aid in the completion of the Personal Tax Credits Return Canada ca. These features ensure that you have everything you need at your fingertips, making the entire e-filing experience seamless and efficient.

-

Can I integrate airSlate SignNow with other tax software for the Personal Tax Credits Return Canada ca?

Absolutely! airSlate SignNow is designed to integrate smoothly with various tax software and accounting tools, facilitating easy management of the Personal Tax Credits Return Canada ca. This integration means you can sync your documents and data, enhancing accuracy and saving time in your tax filing process.

-

What benefits does using airSlate SignNow provide for managing the Personal Tax Credits Return Canada ca?

Using airSlate SignNow for the Personal Tax Credits Return Canada ca offers numerous benefits such as time-saving electronic signatures and secure document handling. Its streamlined approach reduces the risk of paperwork loss and ensures compliance with tax regulations. Overall, it enhances the convenience and efficiency of your tax preparation process.

-

Is airSlate SignNow secure for handling sensitive information related to the Personal Tax Credits Return Canada ca?

Yes, airSlate SignNow prioritizes the security of your documents, including sensitive information related to the Personal Tax Credits Return Canada ca. Utilizing industry-standard encryption and secure access measures, users can trust that their data is protected throughout the entire eSigning process. Your privacy and data security are our top concerns.

Get more for Personal Tax Credits Return Canada ca

- Univision internship application to print form

- Ace recommendation form glendale community college

- Health and safety checklist classroom or area date coscorm train form

- Arvest pdf form

- Inhome support form

- Fitness to return certification form

- Yoga instructor contract template form

- Yoga teacher contract template form

Find out other Personal Tax Credits Return Canada ca

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate