Personal Tax Credits Return Td1 University of New Brunswick 2024-2026

What is the Personal Tax Credits Return Td1 University Of New Brunswick

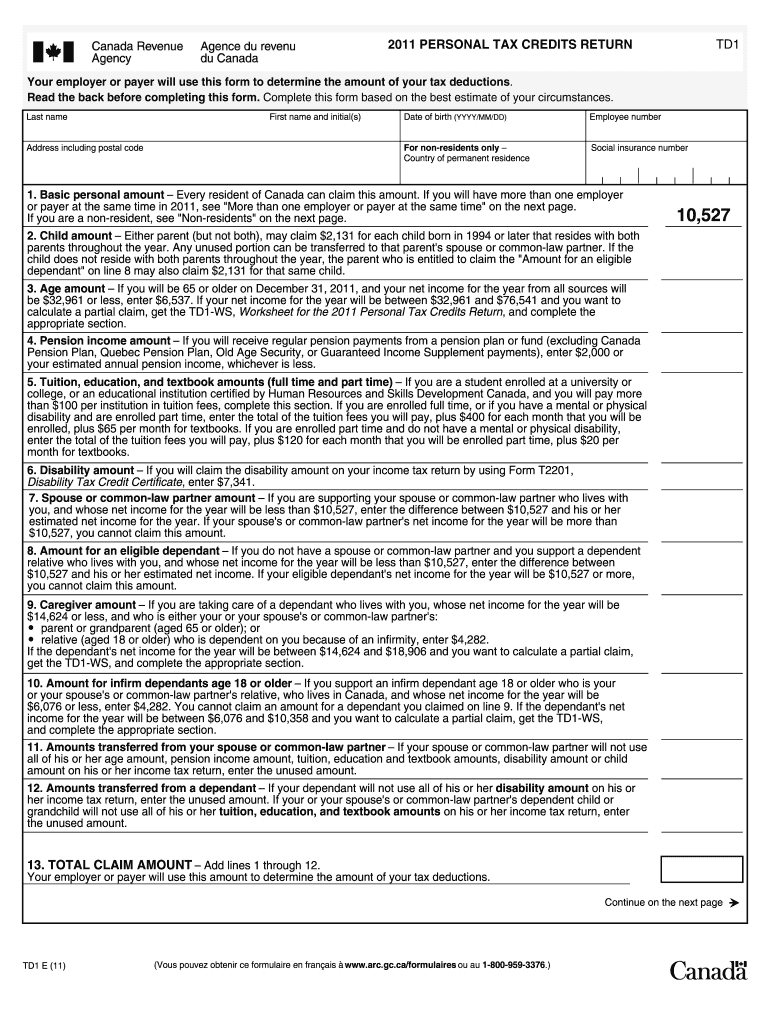

The Personal Tax Credits Return Td1 is a form used in Canada, specifically for individuals attending the University of New Brunswick. This form allows students and other taxpayers to claim personal tax credits, which can reduce their overall tax liability. It is essential for those who want to ensure they are receiving the correct amount of tax credits based on their personal circumstances, such as education expenses or dependents.

How to use the Personal Tax Credits Return Td1 University Of New Brunswick

To effectively use the Personal Tax Credits Return Td1, individuals should first gather all necessary information, including personal identification details and any relevant financial information. Next, fill out the form accurately, ensuring that all sections are completed based on your eligibility for various tax credits. Once completed, the form should be submitted to the appropriate tax authority as part of your annual tax return process.

Steps to complete the Personal Tax Credits Return Td1 University Of New Brunswick

Completing the Personal Tax Credits Return Td1 involves several key steps:

- Gather all required documentation, such as proof of enrollment at the University of New Brunswick and any relevant financial records.

- Download or obtain the Td1 form from the appropriate tax authority.

- Fill out the form, ensuring to provide accurate information regarding your personal tax situation.

- Review the completed form for any errors or omissions.

- Submit the form according to the guidelines provided, either electronically or via mail.

Key elements of the Personal Tax Credits Return Td1 University Of New Brunswick

Key elements of the Personal Tax Credits Return Td1 include personal identification information, eligibility criteria for various tax credits, and specific sections for claiming credits related to education and dependents. Understanding these elements is crucial for maximizing potential tax benefits and ensuring compliance with tax regulations.

Eligibility Criteria

Eligibility for the Personal Tax Credits Return Td1 generally includes being a resident of Canada, attending the University of New Brunswick, and meeting specific financial criteria related to income and education expenses. It is important to review the eligibility requirements carefully to ensure that all conditions are met before submitting the form.

Form Submission Methods

The Personal Tax Credits Return Td1 can be submitted through various methods. Individuals may choose to file the form online through the tax authority's electronic filing system, mail a physical copy of the completed form, or submit it in person at designated tax offices. Each method has its own guidelines and processing times, so it is advisable to choose the one that best suits your needs.

Create this form in 5 minutes or less

Find and fill out the correct personal tax credits return td1 university of new brunswick

Create this form in 5 minutes!

How to create an eSignature for the personal tax credits return td1 university of new brunswick

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Personal Tax Credits Return Td1 for University Of New Brunswick students?

The Personal Tax Credits Return Td1 for University Of New Brunswick students is a form that allows students to claim various tax credits. This form helps students reduce their taxable income, ensuring they pay the least amount of tax possible. Completing the Td1 accurately can maximize your tax benefits while studying.

-

How can I access the Personal Tax Credits Return Td1 for University Of New Brunswick?

You can access the Personal Tax Credits Return Td1 for University Of New Brunswick through the university's financial aid office or their official website. Additionally, many online tax preparation services provide easy access to this form. Ensure you have all necessary information ready to complete the form efficiently.

-

What are the benefits of filing the Personal Tax Credits Return Td1 for University Of New Brunswick?

Filing the Personal Tax Credits Return Td1 for University Of New Brunswick allows students to claim credits for tuition, education, and other eligible expenses. This can lead to signNow tax savings, especially for full-time students. It also helps in managing your finances better while pursuing your education.

-

Are there any costs associated with filing the Personal Tax Credits Return Td1 for University Of New Brunswick?

Filing the Personal Tax Credits Return Td1 for University Of New Brunswick is typically free if you complete it yourself. However, if you choose to use a tax preparation service, there may be associated fees. It's advisable to compare options to find a cost-effective solution that meets your needs.

-

Can I integrate the Personal Tax Credits Return Td1 for University Of New Brunswick with other tax software?

Yes, many tax software programs allow you to integrate the Personal Tax Credits Return Td1 for University Of New Brunswick seamlessly. This integration can simplify the filing process and ensure that all relevant information is accurately captured. Check with your chosen software for specific integration capabilities.

-

What features should I look for in a tool to help with the Personal Tax Credits Return Td1 for University Of New Brunswick?

When selecting a tool for the Personal Tax Credits Return Td1 for University Of New Brunswick, look for features like user-friendly interfaces, step-by-step guidance, and automatic calculations. Additionally, ensure the tool provides access to the latest tax regulations and forms to stay compliant. These features can signNowly ease the filing process.

-

How does airSlate SignNow assist with the Personal Tax Credits Return Td1 for University Of New Brunswick?

airSlate SignNow empowers users to easily eSign and send documents, including the Personal Tax Credits Return Td1 for University Of New Brunswick. Its cost-effective solution simplifies the document management process, allowing students to focus on their studies while ensuring their tax forms are filed accurately and on time.

Get more for Personal Tax Credits Return Td1 University Of New Brunswick

- Declaration of conformity template

- Mountain of fire storyworks form

- Vs 44 form

- Emergency contact for school form

- Fire department incident report form

- Building macromolecules activity answer key pdf form

- How ecosystems change active reading answer key form

- Ccc 576 1 appraisalproduction report noninsured crop disaster assistance program for and subsequent years ccc576 1 pdf form

Find out other Personal Tax Credits Return Td1 University Of New Brunswick

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form