Td1 Federal 2019

What is the Td1 Federal?

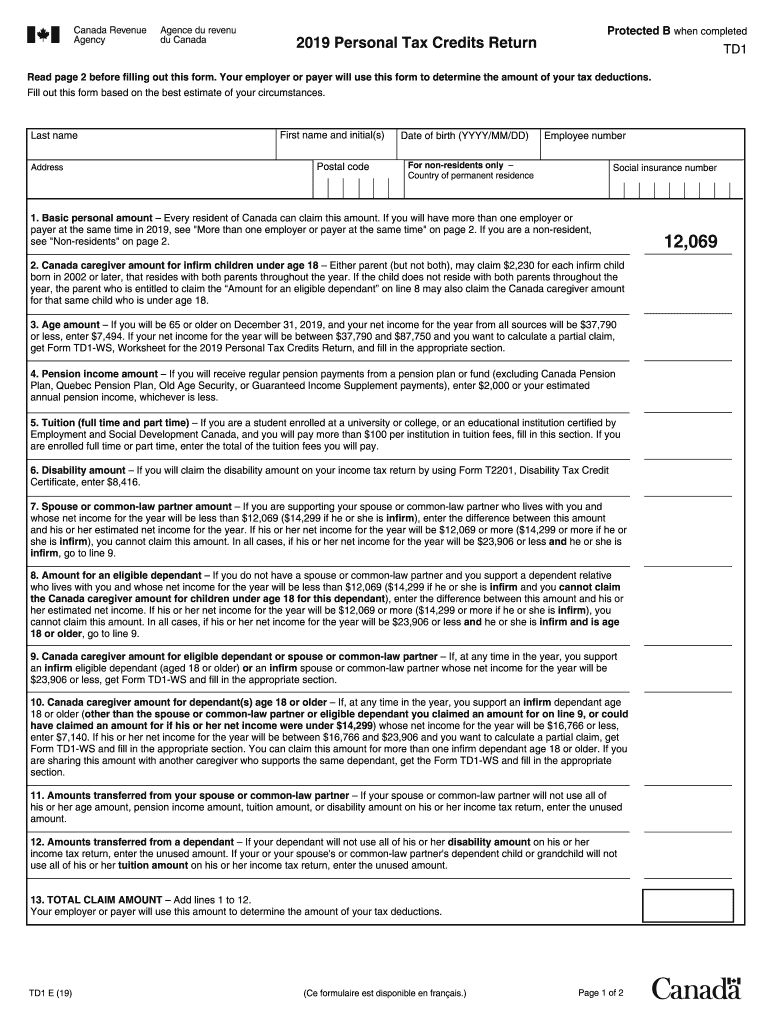

The Td1 Federal form is a crucial document used by individuals in Canada to determine their tax deductions at source. It is primarily designed for employees and those receiving pension income. By completing the Td1 form, taxpayers can inform their employers or payers of their personal tax credits and deductions, which helps in calculating the correct amount of tax to withhold from their earnings. This form is essential for ensuring that individuals do not overpay or underpay their taxes throughout the year.

Steps to Complete the Td1 Federal

Completing the Td1 Federal form involves several straightforward steps:

- Obtain the Form: Download the Td1 form from the official Revenue Canada website or obtain a printed copy from your employer.

- Fill in Personal Information: Provide your name, address, and social insurance number at the top of the form.

- Claim Personal Tax Credits: Indicate any applicable personal tax credits, such as those for dependents or disability, in the designated sections.

- Sign and Date: Ensure you sign and date the form to validate it before submission.

- Submit the Form: Return the completed form to your employer or payer, who will use it to adjust your tax withholdings.

Legal Use of the Td1 Federal

The Td1 Federal form is legally recognized as a valid document for tax purposes in Canada. For it to be considered legally binding, it must be completed accurately and submitted to the appropriate parties. The form adheres to the requirements set forth by the Canada Revenue Agency (CRA), ensuring that the information provided is used solely for tax withholding calculations. It is important to keep a copy of the submitted form for your records, as it may be needed for future reference or in case of audits.

Form Submission Methods

There are various methods for submitting the Td1 Federal form:

- Online Submission: Many employers allow employees to submit the Td1 form electronically through their payroll systems.

- Mail: You can print the completed form and send it directly to your employer via postal mail.

- In-Person: Alternatively, you may deliver the form in person to your employer's HR or payroll department.

Who Issues the Form

The Td1 Federal form is issued by the Canada Revenue Agency (CRA). While the CRA provides the official template and guidelines for completing the form, it is the responsibility of the taxpayer to ensure that the form is filled out correctly and submitted to their employer or payer. Employers may also provide their own versions of the form, but these must still comply with CRA standards.

Examples of Using the Td1 Federal

There are several scenarios in which the Td1 Federal form is utilized:

- New Employees: When starting a new job, employees must complete the Td1 form to ensure proper tax deductions from their paychecks.

- Change in Personal Circumstances: If a taxpayer's situation changes, such as marriage or the birth of a child, they should submit a new Td1 form to reflect their updated tax credits.

- Retirement Income: Individuals receiving pension income must also complete the Td1 form to inform their pension provider of any applicable tax credits.

Quick guide on how to complete td1 federal 2020

Prepare Td1 Federal with ease on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and safely store it online. airSlate SignNow provides you with all the resources you need to create, alter, and electronically sign your documents quickly without delays. Handle Td1 Federal on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The simplest way to modify and eSign Td1 Federal effortlessly

- Find Td1 Federal and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, laborious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and eSign Td1 Federal and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct td1 federal 2020

Create this form in 5 minutes!

How to create an eSignature for the td1 federal 2020

The best way to make an eSignature for a PDF file in the online mode

The best way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What is the Revenue Canada TD1 form and why is it important?

The Revenue Canada TD1 form is a tax form used to determine the amount of tax deductions for employees in Canada. Completing this form accurately is crucial as it affects your take-home pay and ensures correct tax withholding throughout the year.

-

How can airSlate SignNow help with the Revenue Canada TD1 form?

airSlate SignNow simplifies the process of completing and submitting the Revenue Canada TD1 form by allowing users to electronically sign and securely send documents. This streamlines the often tedious paperwork, making it faster and more efficient for both employers and employees.

-

Is there a cost associated with using airSlate SignNow for the Revenue Canada TD1 form?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses. Each plan includes features that facilitate the completion and management of documents like the Revenue Canada TD1 form, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other tools for handling the Revenue Canada TD1 form?

Absolutely! airSlate SignNow provides seamless integrations with various business applications, allowing you to manage the Revenue Canada TD1 form alongside other crucial tasks. This enhances your workflow and ensures that all data is synchronized and easily accessible.

-

What are the benefits of using airSlate SignNow for the Revenue Canada TD1 form?

Using airSlate SignNow for the Revenue Canada TD1 form offers several benefits, including time savings, reduced paper use, and enhanced security. The digital process makes it easier to track submissions and ensures compliance with tax regulations.

-

How secure is the information provided in the Revenue Canada TD1 form when using airSlate SignNow?

airSlate SignNow ensures that all information provided in the Revenue Canada TD1 form is protected with advanced encryption and security protocols. This ensures that sensitive data remains safe and that your tax documentation is handled with the utmost care.

-

Is airSlate SignNow user-friendly for submitting the Revenue Canada TD1 form?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible for everyone. The intuitive interface allows users to easily navigate through the process of completing and submitting the Revenue Canada TD1 form without any prior technical experience.

Get more for Td1 Federal

- Letter from landlord to tenant as notice to remove unauthorized inhabitants utah form

- Utah tenant notice form

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat utah form

- Utah release lien 497427485 form

- Conditional waiver 497427487 form

- Utah waiver 497427488 form

- Utah release form

- Utah month to month form

Find out other Td1 Federal

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document