Florida Sales Tax Cash 2016-2026

Understanding the Florida Sales Tax Cash

The Florida sales tax cash refers to the amount of money collected by businesses on behalf of the state for sales tax purposes. This cash is essential for ensuring compliance with state tax regulations. Businesses must accurately collect and remit this tax to avoid penalties. The sales tax rate in Florida is six percent, but local jurisdictions may impose additional taxes, leading to varying rates across different areas.

Steps to Complete the Florida Sales Tax Cash

Completing the Florida sales tax cash process involves several key steps:

- Determine the applicable sales tax rate based on your business location.

- Collect the correct amount of sales tax from customers during transactions.

- Maintain accurate records of sales and tax collected for reporting purposes.

- File the appropriate sales tax return with the Florida Department of Revenue.

- Remit the collected sales tax cash to the state by the specified deadline.

Legal Use of the Florida Sales Tax Cash

The legal use of the Florida sales tax cash is strictly regulated. Businesses are required to use the collected sales tax solely for remittance to the state. Misuse of these funds, such as using them for operational expenses, can lead to severe penalties, including fines and potential criminal charges. It is crucial for businesses to remain compliant with all state regulations regarding sales tax collection and remittance.

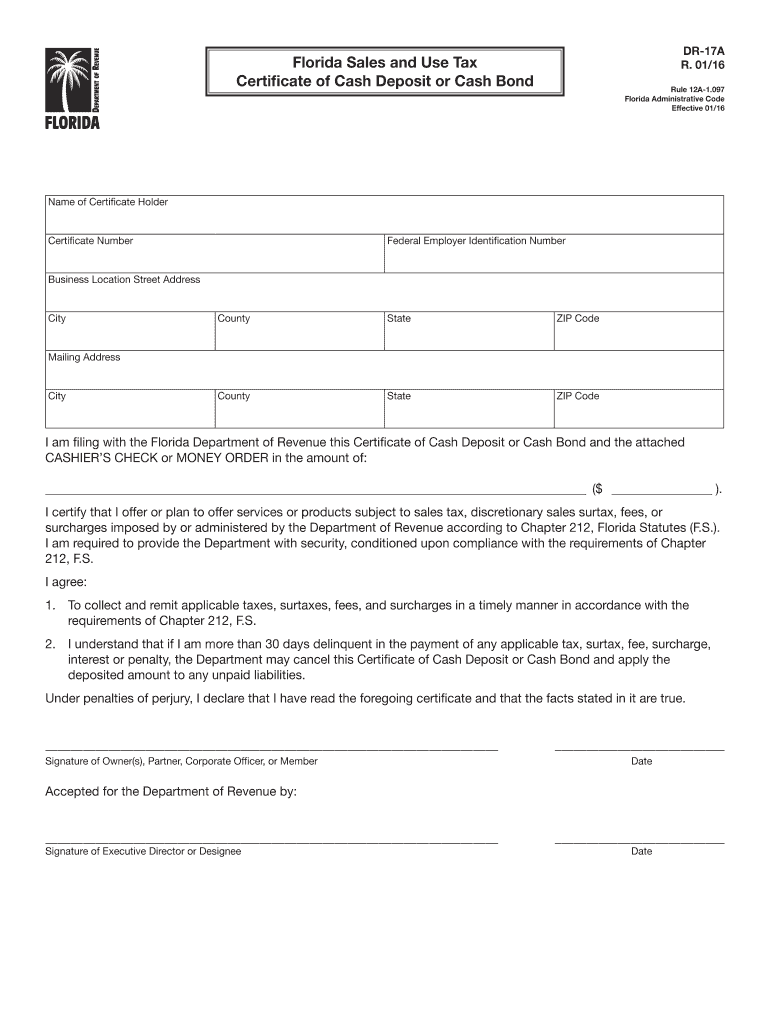

Required Documents for Florida Sales Tax Cash

To properly manage Florida sales tax cash, businesses need to prepare certain documents:

- Sales tax registration certificate from the Florida Department of Revenue.

- Accurate sales records detailing transactions and tax collected.

- Completed sales tax return forms, such as the DR-15.

- Documentation of any exemptions claimed by customers.

Filing Deadlines / Important Dates

Filing deadlines for Florida sales tax cash are critical to avoid penalties. Businesses must file their sales tax returns monthly, quarterly, or annually, depending on their sales volume. Key dates include:

- Monthly filers: Due on the first day of the month following the reporting period.

- Quarterly filers: Due on the first day of the month following the end of the quarter.

- Annual filers: Due on January 1 for the previous calendar year.

Examples of Using the Florida Sales Tax Cash

Examples of how businesses utilize the Florida sales tax cash include:

- A retail store collecting sales tax on merchandise sold to customers.

- An online business charging sales tax on orders shipped to Florida residents.

- A service provider applying sales tax to taxable services rendered within the state.

Quick guide on how to complete florida sales tax cash

Complete Florida Sales Tax Cash effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Florida Sales Tax Cash on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Florida Sales Tax Cash with ease

- Find Florida Sales Tax Cash and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to share your form: via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Florida Sales Tax Cash and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida sales tax cash

Create this form in 5 minutes!

How to create an eSignature for the florida sales tax cash

How to generate an electronic signature for your PDF document online

How to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is a Florida use tax certificate deposit?

A Florida use tax certificate deposit is a document that allows businesses to signNow their eligibility for purchasing goods tax-free in the state of Florida. This certificate is important for businesses to comply with Florida tax regulations and avoid unnecessary tax liabilities. By obtaining this certificate, businesses can streamline their purchasing process and ensure compliance with state laws.

-

How can airSlate SignNow help with Florida use tax certificate deposit management?

airSlate SignNow offers a user-friendly platform that simplifies the management of Florida use tax certificate deposits. With our easy-to-use electronic signatures, you can quickly sign and share your documents, ensuring swift approval of your tax certificates. This can signNowly reduce your administrative workload and help maintain accurate records.

-

What are the pricing options for using airSlate SignNow for Florida use tax certificate deposits?

airSlate SignNow offers various pricing plans to meet the needs of businesses looking to manage Florida use tax certificate deposits. Our plans are designed to be cost-effective, providing you with essential features at competitive rates. This ensures that you can efficiently manage your tax certificates without straining your budget.

-

Are there any benefits to using airSlate SignNow for Florida use tax certificate deposit processing?

Yes, using airSlate SignNow for Florida use tax certificate deposit processing comes with numerous benefits. It not only streamlines the signing and sharing of documents but also enhances compliance with state regulations. Additionally, our platform allows for easy integration with existing business workflows, making the entire process more efficient.

-

How do I integrate airSlate SignNow with my current systems for Florida use tax certificate deposits?

Integrating airSlate SignNow into your existing systems for managing Florida use tax certificate deposits is straightforward. Our platform provides various integration options with popular business applications and tools. This flexibility ensures that you can seamlessly include our eSignature solution into your operations without disruption.

-

Can I customize the Florida use tax certificate deposit forms in airSlate SignNow?

Yes, you can customize Florida use tax certificate deposit forms in airSlate SignNow to meet your specific needs. Our platform allows you to modify templates and create tailored forms that align with your business requirements. This feature enhances your document management, ensuring that all necessary information is captured efficiently.

-

Is airSlate SignNow compliant with Florida's regulations regarding use tax certificates?

Absolutely! airSlate SignNow is compliant with Florida regulations regarding use tax certificates, ensuring that your documents adhere to state requirements. Our platform is built with security and compliance in mind, providing peace of mind as you handle Florida use tax certificate deposits and other important documents.

Get more for Florida Sales Tax Cash

- Ol 124 form

- Vehicle condition report 2 doc form

- Agreement to add carrier form

- Jury information houstonjury information houstonjury information houstonjury information houston

- Notice hearing 495366908 form

- Nueces county divorce forms

- Annual report on location condition and well being of ward form

- Hr 028 child abuse registry check consent form revised september

Find out other Florida Sales Tax Cash

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney