106e F Form

What is the 106e F Form

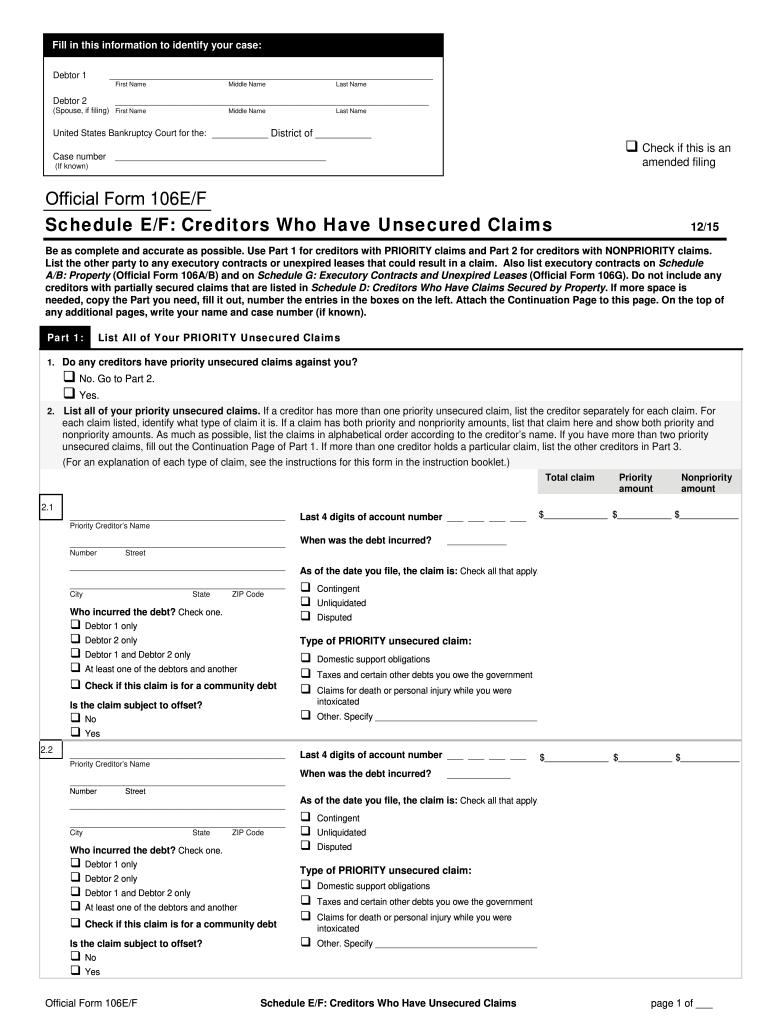

The 106e F Form, also known as the official form creditor claim, is a legal document used in bankruptcy proceedings. It allows creditors to assert their claims against a debtor's estate. This form is crucial for ensuring that creditors are recognized in the bankruptcy process and can receive any payments owed to them. The 106e F Form is part of the broader bankruptcy filing requirements and must be completed accurately to be considered valid.

Steps to complete the 106e F Form

Completing the 106e F Form involves several important steps:

- Gather necessary information: Collect details about the debt, including the amount owed and any relevant documentation.

- Fill out the form: Provide accurate information in each section of the form, including the creditor's name, address, and details of the claim.

- Review for accuracy: Double-check all entries to ensure there are no mistakes or omissions that could affect the claim.

- Sign and date the form: Ensure that the form is signed by the appropriate party, typically the creditor or their representative.

- Submit the form: File the completed form with the bankruptcy court, following the specific submission guidelines provided by the court.

Legal use of the 106e F Form

The 106e F Form is legally binding when completed and submitted according to the rules governing bankruptcy proceedings. It serves as a formal declaration of a creditor's claim, which the court will review during the bankruptcy process. To ensure its legal validity, the form must comply with all relevant regulations, including accurate information and proper signatures. Failure to adhere to these legal requirements may result in the claim being denied.

Key elements of the 106e F Form

Several key elements must be included in the 106e F Form to ensure its completeness and validity:

- Creditor Information: Name, address, and contact details of the creditor.

- Claim Amount: The total amount owed to the creditor.

- Description of the Debt: Details regarding the nature of the debt and any supporting documentation.

- Signature: The form must be signed by the creditor or an authorized representative.

- Date: The date of submission is essential for tracking and compliance purposes.

Form Submission Methods

The 106e F Form can be submitted through various methods, depending on the court's requirements:

- Online Submission: Many courts allow electronic filing through their official platforms.

- Mail: The form can be mailed to the appropriate bankruptcy court, ensuring it is sent to the correct address.

- In-Person: Creditors may also choose to deliver the form directly to the court clerk's office.

Filing Deadlines / Important Dates

Timely submission of the 106e F Form is critical. Each bankruptcy case has specific deadlines that must be adhered to. Generally, creditors should file their claims as soon as possible after the bankruptcy is announced. Missing these deadlines can result in the loss of the right to collect on the claim. It is advisable to check with the bankruptcy court for precise filing dates and any extensions that may apply.

Quick guide on how to complete 106e f form

Effortlessly Prepare 106e F Form on Any Device

Web-based document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly and without delays. Manage 106e F Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to Edit and eSign 106e F Form with Ease

- Find 106e F Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of the documents or obscure confidential information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your edits.

- Select how you want to share your form, via email, SMS, or invite link, or download it to your PC.

Forget about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your choice. Modify and eSign 106e F Form to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 106e f form

How to create an eSignature for a PDF document in the online mode

How to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is a form creditor claim and why is it important?

A form creditor claim is an essential document used to assert a creditor's right to collect debts owed by a debtor. It plays a crucial role in the debt recovery process, allowing creditors to formally present their claims. Utilizing airSlate SignNow can streamline the creation and submission of these forms, ensuring you maintain proper documentation and compliance.

-

How does airSlate SignNow help with the form creditor claim process?

airSlate SignNow simplifies the form creditor claim process by providing users with customizable templates and secure eSignature functionalities. This allows creditors to quickly generate, send, and sign the necessary documentation without the hassle of manual paperwork. As a result, it saves time and enhances the efficiency of claims management.

-

Is there a cost associated with using airSlate SignNow for form creditor claims?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Whether you're a small business or a large organization, you can select a plan that suits your volume of form creditor claims and eSigning activities. The competitive pricing structure makes it a cost-effective solution for managing your claims.

-

Are there any integrations available for airSlate SignNow?

airSlate SignNow integrates seamlessly with numerous applications to enhance productivity. This includes popular platforms such as Google Drive, Salesforce, and Microsoft Office. These integrations ensure that you can manage your form creditor claim documents more efficiently within your existing workflows.

-

What features does airSlate SignNow offer for handling form creditor claims?

airSlate SignNow offers a range of features designed for effective document management, including customizable templates, real-time tracking, and secure cloud storage. Additionally, its eSignature capability ensures that your form creditor claims can be executed swiftly and legally. These features collectively enhance your overall document management experience.

-

Can multiple users collaborate on a form creditor claim in airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on a single form creditor claim document. This feature is particularly beneficial for teams working together to compile necessary information and signatures. Collaboration capabilities ensure that the claims process remains efficient and organized.

-

How secure is airSlate SignNow when processing form creditor claims?

airSlate SignNow takes security very seriously, employing industry-standard encryption and authentication measures to protect your documents. This ensures that your form creditor claim will remain confidential and secure throughout the signing and storage processes. You can trust airSlate SignNow to keep your sensitive information safe.

Get more for 106e F Form

- Kind amp location of form

- Iowa w ithholding tax guide city of burlington iowa form

- Mississippi registration application forms and instructions netchex waynesboroms

- Income tax return 480 20u form

- Modelo sc 2907 a form as 2907 a

- Sc wh 1601 form

- Form sc 1310 statement of person claiming refund due a

- 1350 for sc gestate of south carolina sch tc1depar form

Find out other 106e F Form

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF