Iowa W Ithholding Tax Guide City of Burlington, Iowa Form

Understanding the 2016 Iowa Form 44-095

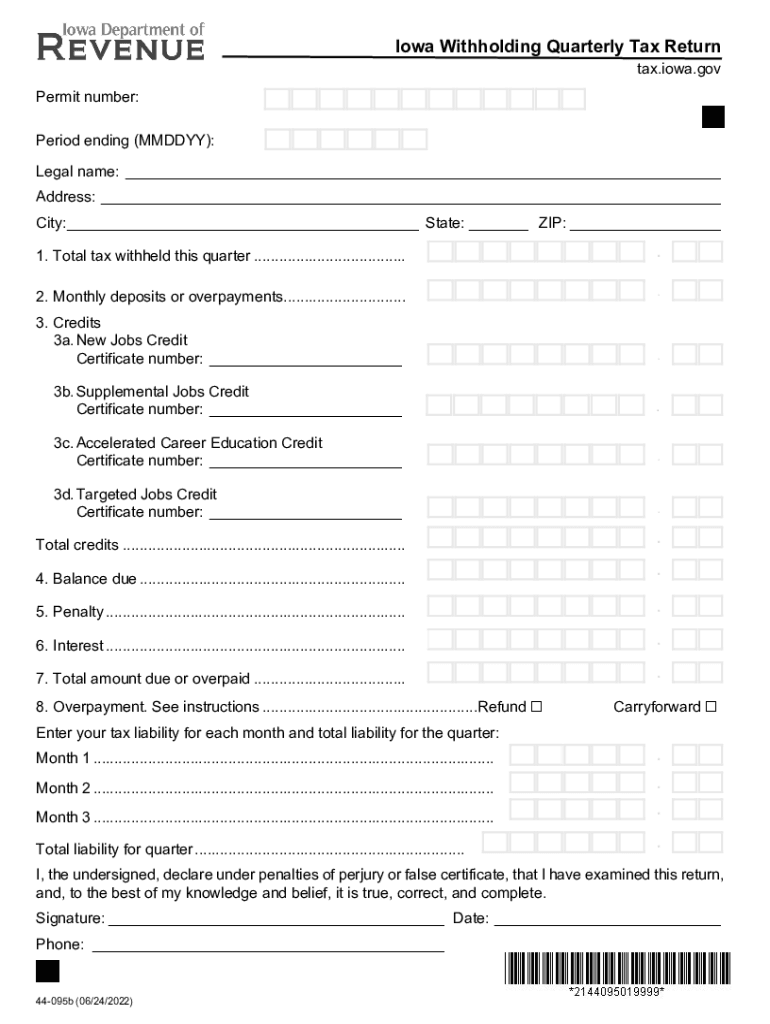

The 2016 Iowa Form 44-095 is a crucial document for individuals and businesses in Iowa that need to report their withholding tax. This form is specifically designed for employers to report state income tax withheld from employees' wages. It ensures compliance with Iowa tax laws and provides the state with necessary information regarding tax collections.

Steps to Complete the 2016 Iowa Form 44-095

Filling out the 2016 Iowa Form 44-095 involves several key steps:

- Gather all necessary employee information, including names, social security numbers, and wages paid.

- Calculate the total amount of state income tax withheld for each employee during the reporting period.

- Enter the total withholding amounts in the designated fields on the form.

- Review the completed form for accuracy before submission.

Filing Deadlines for the 2016 Iowa Form 44-095

It is essential to be aware of the filing deadlines associated with the 2016 Iowa Form 44-095. Employers must submit this form quarterly, with specific due dates for each quarter. Typically, the deadlines are as follows:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: October 31

- Fourth quarter: January 31 of the following year

Legal Use of the 2016 Iowa Form 44-095

The 2016 Iowa Form 44-095 is legally binding when completed and submitted according to Iowa tax regulations. Employers must ensure that the information provided is accurate and complete to avoid penalties. The form serves as an official record of withholding tax obligations and compliance with state tax laws.

Who Issues the 2016 Iowa Form 44-095

The Iowa Department of Revenue is responsible for issuing the 2016 Iowa Form 44-095. This state agency oversees tax collection and compliance, ensuring that employers adhere to withholding tax requirements. Employers can obtain the form directly from the Iowa Department of Revenue's website or through authorized tax preparation services.

Penalties for Non-Compliance with the 2016 Iowa Form 44-095

Failure to comply with the requirements of the 2016 Iowa Form 44-095 can result in significant penalties. Employers may face fines for late submissions or inaccuracies in reporting. It is crucial to file the form on time and ensure all information is correct to avoid these penalties, which can impact both the business and its employees.

Quick guide on how to complete iowa w ithholding tax guide city of burlington iowa

Effortlessly Prepare Iowa W Ithholding Tax Guide City Of Burlington, Iowa on Any Device

Digital document management has gained signNow traction among both enterprises and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without delays. Manage Iowa W Ithholding Tax Guide City Of Burlington, Iowa on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and Electronically Sign Iowa W Ithholding Tax Guide City Of Burlington, Iowa Hassle-Free

- Obtain Iowa W Ithholding Tax Guide City Of Burlington, Iowa and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, invite link, or download it to your computer.

Eliminate the worry of missing or lost documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Iowa W Ithholding Tax Guide City Of Burlington, Iowa while ensuring exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iowa w ithholding tax guide city of burlington iowa

Create this form in 5 minutes!

How to create an eSignature for the iowa w ithholding tax guide city of burlington iowa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2016 Iowa Form 44 095 used for?

The 2016 Iowa Form 44 095 is utilized for various tax purposes, primarily related to business taxes. This form allows businesses to report specific financial information to the state of Iowa, helping ensure compliance with tax regulations. Understanding this form is essential for accurate tax filing and financial reporting.

-

How can airSlate SignNow help with the 2016 Iowa Form 44 095?

AirSlate SignNow provides an effortless platform for businesses to electronically sign and send the 2016 Iowa Form 44 095. Our solution enhances efficiency by streamlining document management and eSignature processes, allowing you to focus on other essential tasks. This makes the filing process simpler and more accurate.

-

Is there a cost associated with using airSlate SignNow for the 2016 Iowa Form 44 095?

Yes, airSlate SignNow offers a variety of pricing plans to fit different business needs. While there is a cost associated with utilizing our services, many users find that the benefits, including time savings and improved organization, outweigh the expense. For specific pricing related to the 2016 Iowa Form 44 095, please visit our pricing page.

-

What features does airSlate SignNow offer for document workflows like the 2016 Iowa Form 44 095?

AirSlate SignNow provides robust features including customizable templates, automated workflows, and document tracking, which are beneficial for handling the 2016 Iowa Form 44 095. These features allow users to manage their documents efficiently from start to finish. Additionally, users can easily gather eSignatures, making the whole process seamless.

-

Can I integrate airSlate SignNow with other software for managing the 2016 Iowa Form 44 095?

Yes, airSlate SignNow seamlessly integrates with various software applications to enhance your document workflow for the 2016 Iowa Form 44 095. Whether you use CRM systems, cloud storage, or other business applications, our integrations ensure that you can manage documents efficiently. Check our integrations page for a full list of compatible software.

-

What are the benefits of using airSlate SignNow for the 2016 Iowa Form 44 095?

Using airSlate SignNow for the 2016 Iowa Form 44 095 provides numerous benefits such as improved speed, accuracy, and security in document management. The platform allows businesses to quickly send and sign documents, reducing delays in processing. Additionally, it minimizes the risk of errors associated with manual handling.

-

Is airSlate SignNow suitable for all types of businesses using the 2016 Iowa Form 44 095?

Absolutely! AirSlate SignNow is designed to cater to businesses of all sizes that need to manage documents like the 2016 Iowa Form 44 095. From small enterprises to large corporations, our platform is versatile and scalable to meet varied business needs. This adaptability makes it a perfect solution for anyone dealing with important tax forms.

Get more for Iowa W Ithholding Tax Guide City Of Burlington, Iowa

- Nscaa conference interactive session plan interactive session plan created by academy soccer coach co uk with session diagram form

- Rent certificate 483651645 form

- Ceo certificate of electrical completion naga city naga gov form

- Ka and kb calculations worksheet form

- Anthem rx direct form

- American cancer society po box 22718 oklahoma city ok 73123 1718 matching donations form

- Request for release of patient information breastscreen qld gov

- Landlord agreement template form

Find out other Iowa W Ithholding Tax Guide City Of Burlington, Iowa

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast