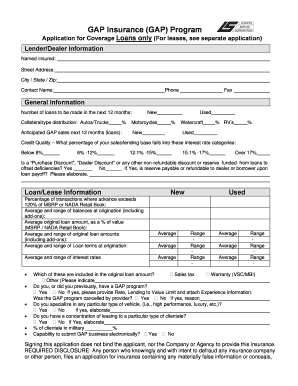

GAP Insurance GAP Program Application for Coverage Loans Form

Understanding the lenders letter for gap insurance

A lenders letter for gap insurance is a crucial document that outlines the terms and conditions under which gap insurance can be applied. This letter typically details the lender's requirements and the specific coverage provided by the gap insurance policy. It serves as a bridge between the borrower and the insurance provider, ensuring that all parties are aware of their responsibilities and the extent of the coverage. Understanding this letter is essential for borrowers to ensure they are adequately protected in case of a total loss of their vehicle.

Steps to complete the lenders letter for gap insurance

Completing the lenders letter for gap insurance involves several key steps. First, gather all necessary information, including your vehicle details, loan amount, and insurance policy number. Next, fill out the required fields in the letter, ensuring accuracy to avoid delays. Once completed, review the document for any errors or omissions. After verification, sign the letter electronically using a trusted eSignature platform. This process not only streamlines the submission but also enhances the document's legal standing.

Key elements of the lenders letter for gap insurance

The lenders letter for gap insurance should include several important elements. These typically encompass the borrower's name and contact information, the lender's details, the vehicle identification number (VIN), and the loan amount. Additionally, it should specify the gap insurance coverage limits and any conditions that may apply. Including these elements ensures that the letter is comprehensive and meets the lender's requirements, facilitating a smoother claims process in the future.

Eligibility criteria for gap insurance

Eligibility for gap insurance often depends on several factors, including the type of vehicle, the loan amount, and the insurance provider's policies. Generally, new or leased vehicles are more likely to qualify for gap insurance, as they depreciate quickly. Lenders may also consider the borrower's credit history and payment history when determining eligibility. Understanding these criteria helps borrowers assess their options and make informed decisions regarding gap insurance coverage.

Form submission methods for the lenders letter

Submitting the lenders letter for gap insurance can be done through various methods. Many lenders now accept electronic submissions, allowing borrowers to send the document via email or through a secure online portal. Alternatively, some may require physical copies to be mailed or delivered in person. It's essential to check with the specific lender for their preferred submission method to ensure timely processing of the letter.

Legal use of the lenders letter for gap insurance

The lenders letter for gap insurance is legally binding when executed correctly. To ensure its legality, the document must be signed by all relevant parties, and it should comply with applicable state laws regarding insurance and lending. Utilizing a reliable eSignature service can enhance the document's legal standing by providing a digital certificate that verifies the signer's identity and the integrity of the document. This compliance is crucial for protecting both the borrower and the lender in the event of a claim.

Quick guide on how to complete gap insurance gap program application for coverage loans

Complete GAP Insurance GAP Program Application For Coverage Loans effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, adjust, and eSign your documents swiftly without delays. Handle GAP Insurance GAP Program Application For Coverage Loans on any device with the airSlate SignNow Android or iOS applications and enhance any document-oriented operation today.

The easiest way to modify and eSign GAP Insurance GAP Program Application For Coverage Loans without difficulty

- Obtain GAP Insurance GAP Program Application For Coverage Loans and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Modify and eSign GAP Insurance GAP Program Application For Coverage Loans and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gap insurance gap program application for coverage loans

The way to create an eSignature for your PDF document online

The way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What is a lenders letter for gap insurance?

A lenders letter for gap insurance is a document that provides verification of the insurance coverage gap for a financed vehicle. It serves as proof for lenders that gap insurance is in place, protecting both the borrower and the lender in case of an accident. This document can be easily generated via airSlate SignNow to expedite the financing process.

-

How can airSlate SignNow help me with a lenders letter for gap insurance?

With airSlate SignNow, you can quickly create and send a lenders letter for gap insurance. Our platform provides an easy-to-use interface that enables you to fill out necessary details and eSign documents in minutes. This streamlined process reduces administrative burdens and helps you meet your financing requirements efficiently.

-

Is there a cost associated with obtaining a lenders letter for gap insurance through airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Creating and sending a lenders letter for gap insurance is part of our service package, making it a cost-effective solution for businesses. The price may vary depending on the features and volume of documents you require.

-

What features does airSlate SignNow offer for creating a lenders letter for gap insurance?

AirSlate SignNow provides features such as customizable templates, electronic signatures, and easy document sharing, which are essential for creating a lenders letter for gap insurance. Additionally, our platform includes tracking and reminders to ensure timely document handling. These features simplify the document management process and improve workflow efficiency.

-

Can I integrate airSlate SignNow with other software for managing my lenders letter for gap insurance?

Yes, airSlate SignNow offers seamless integrations with various software applications, including CRM systems and financial platforms. This functionality allows you to manage tasks related to a lenders letter for gap insurance more effectively. By integrating with your existing tools, you can streamline processes and enhance productivity.

-

What are the benefits of using airSlate SignNow for a lenders letter for gap insurance?

Using airSlate SignNow for a lenders letter for gap insurance offers numerous benefits, including speed, efficiency, and security. The electronic signature feature ensures quick approval, while the secure storage keeps your documents safe. Furthermore, our user-friendly platform helps you manage your documents effortlessly.

-

How does the eSigning process work for a lenders letter for gap insurance?

The eSigning process for a lenders letter for gap insurance on airSlate SignNow is straightforward. After creating your document, you can send it to relevant parties for their signatures via email. Recipients can securely sign from any device, and you will receive notifications once the document is finalized, ensuring a quick turnaround.

Get more for GAP Insurance GAP Program Application For Coverage Loans

- State of new hampshire258 berts form 258

- Alaska housing finance corporation pur form

- My voice my choice idaho 611257867 form

- Fillable f62674a form

- Applying for a companion card queensland companion card application form

- Motion for hearing to correct third reappraisaler form

- Sample job application form

- Form 50 230 motion for hearing to correct one third over appraisal error motion for hearing to correct one third over appraisal

Find out other GAP Insurance GAP Program Application For Coverage Loans

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors