Ca Corporation Franchise Tax Form 3805q 2018

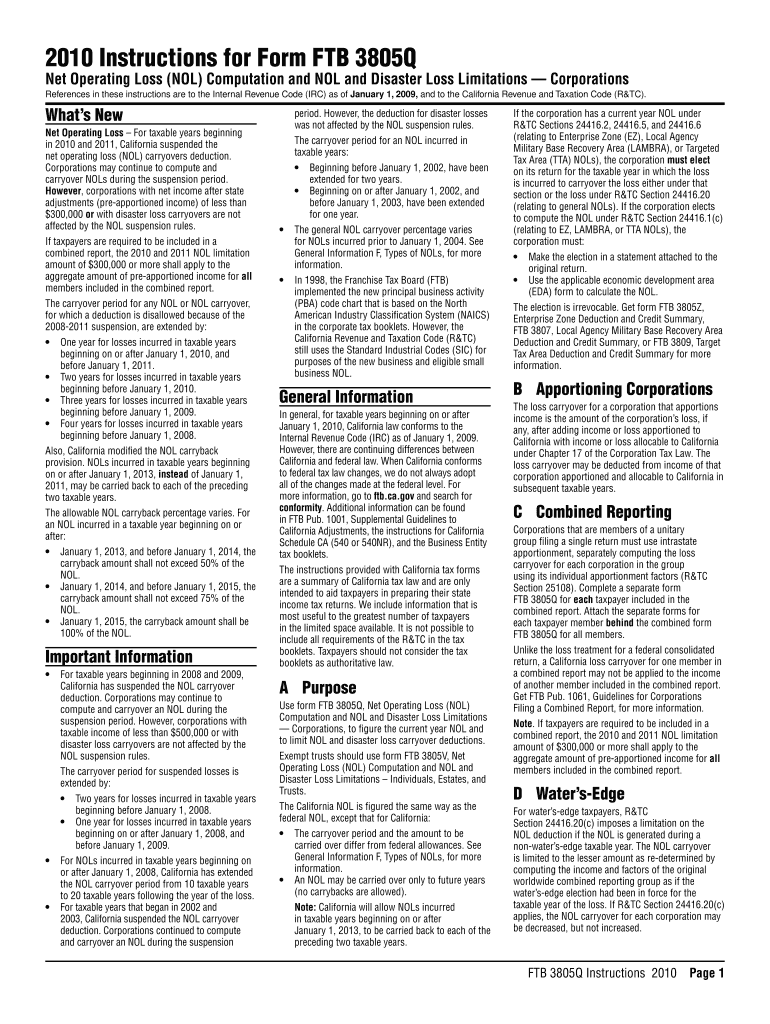

What is the Ca Corporation Franchise Tax Form 3805q

The Ca Corporation Franchise Tax Form 3805q is a tax form used by corporations in California to report and pay their franchise tax obligations. This form is specifically designed for corporations that are classified as S corporations, allowing them to calculate their tax liability based on their income and other relevant factors. Understanding the purpose of this form is crucial for compliance with state tax regulations and ensuring that your business remains in good standing.

Steps to complete the Ca Corporation Franchise Tax Form 3805q

Completing the Ca Corporation Franchise Tax Form 3805q involves several key steps. First, gather all necessary financial documents, including income statements and balance sheets. Next, accurately fill out the form by entering your corporation's income, deductions, and credits as applicable. Ensure that you calculate the franchise tax owed based on the instructions provided with the form. Finally, review the completed form for accuracy before submitting it to the California Franchise Tax Board.

How to obtain the Ca Corporation Franchise Tax Form 3805q

The Ca Corporation Franchise Tax Form 3805q can be obtained directly from the California Franchise Tax Board's website. The form is available for download in PDF format, allowing you to print and complete it manually. Alternatively, you may also access the form through various tax preparation software that supports California tax filings, making it easier to fill out electronically.

Legal use of the Ca Corporation Franchise Tax Form 3805q

For the Ca Corporation Franchise Tax Form 3805q to be considered legally valid, it must be completed in accordance with California tax laws and regulations. This includes providing accurate information and ensuring that all required signatures are included. Using electronic signature solutions can enhance the legal validity of the form, as they comply with the necessary eSignature laws, ensuring that your submission is secure and recognized by the authorities.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Ca Corporation Franchise Tax Form 3805q to avoid penalties. Typically, the form must be filed by the 15th day of the third month following the close of your corporation's tax year. For corporations operating on a calendar year, this means the deadline is March 15. Staying informed about these important dates helps ensure timely compliance with state tax obligations.

Form Submission Methods (Online / Mail / In-Person)

The Ca Corporation Franchise Tax Form 3805q can be submitted through various methods. Corporations have the option to file the form online through the California Franchise Tax Board's e-file system, which is often the fastest method. Alternatively, you can mail the completed form to the appropriate address provided by the Franchise Tax Board or submit it in person at designated locations. Choosing the right submission method can streamline the filing process and ensure timely receipt by the tax authorities.

Quick guide on how to complete ca corporation franchise tax form 3805q

Complete Ca Corporation Franchise Tax Form 3805q effortlessly on any device

Digital document management has become widely favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, enabling you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Ca Corporation Franchise Tax Form 3805q on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and eSign Ca Corporation Franchise Tax Form 3805q with ease

- Find Ca Corporation Franchise Tax Form 3805q and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Ca Corporation Franchise Tax Form 3805q and ensure excellent communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ca corporation franchise tax form 3805q

Create this form in 5 minutes!

How to create an eSignature for the ca corporation franchise tax form 3805q

The way to create an eSignature for your PDF online

The way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The way to create an eSignature for a PDF on Android

People also ask

-

What is the CA Corporation Franchise Tax Form 3805Q?

The CA Corporation Franchise Tax Form 3805Q is a tax form used by California corporations to report their franchise tax obligations. This form is essential for compliance with state tax laws and helps ensure accurate filing of taxes by corporations operating in California.

-

How can airSlate SignNow help with the CA Corporation Franchise Tax Form 3805Q?

airSlate SignNow simplifies the process of completing and electronically signing the CA Corporation Franchise Tax Form 3805Q. Our platform allows you to easily manage your documents, ensuring you can fill out and send your tax forms securely and efficiently.

-

What features does airSlate SignNow offer for tax form management?

airSlate SignNow offers a range of features for tax form management, including customizable templates, secure eSignatures, and document tracking. These functionalities enhance the process for handling forms like the CA Corporation Franchise Tax Form 3805Q, saving time and reducing errors.

-

Is there a pricing plan for businesses using airSlate SignNow for CA Corporation Franchise Tax Form 3805Q?

Yes, airSlate SignNow offers various pricing plans tailored to fit the needs of businesses, regardless of size. Each plan provides access to essential features for managing documents such as the CA Corporation Franchise Tax Form 3805Q effectively and securely.

-

Can I integrate airSlate SignNow with other business applications?

Absolutely! airSlate SignNow integrates seamlessly with numerous business applications including CRM and bookkeeping software. This means you can streamline your workflow for managing tax forms like the CA Corporation Franchise Tax Form 3805Q alongside other business operations.

-

What are the benefits of using airSlate SignNow for eSigning tax forms?

Using airSlate SignNow for eSigning tax forms such as the CA Corporation Franchise Tax Form 3805Q saves time and ensures compliance with legal requirements. Our platform offers a user-friendly interface, making the signing process quicker and hassle-free.

-

How secure is the airSlate SignNow platform for handling sensitive tax documents?

airSlate SignNow prioritizes the security of your documents with advanced encryption and compliance with industry security standards. When handling sensitive tax documents like the CA Corporation Franchise Tax Form 3805Q, you can trust that your information is protected.

Get more for Ca Corporation Franchise Tax Form 3805q

- New products letter cwk wp modern fan company form

- Memorandum official web site of the city of berkeley form

- Npinventory form last xlsx

- Arizona biofuel annual report form

- Application for a sale health certificate list of ingestible form

- For ada use only form

- Killian l director form

- Biofuel registration form

Find out other Ca Corporation Franchise Tax Form 3805q

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast